SOFR to 4% by March?

Monday’s newsletter suggested Fed Funds will be at 3.00% at year end, but that was just blown up.

We entered today’s meeting with a 99% probability of at least a 75bps hike following a Fed “leak” Monday suggesting they would not be constrained by previous suggestions of a 50bps hike. Heck, there was a greater probability of a 1.00% hike than a 0.50% hike.

75bps was the decision, the first 0.75% increase in 28 years. “Hold my beer,” – Volcker, who pulled the trigger on a 5.00% increase.

This increase should push floating rates to 1.75%. Powell still believes this is an accommodative level because it’s below the longer run neutral rate of 2.50%. In other words, he doesn’t think he’s applying the brakes yet.

“I do not expect moves of this size to be common.” He continued that he expects the July 27th meeting to be a 50bps or 75bps hike. This suggests the July CPI print could influence that decision, much like it did this month.

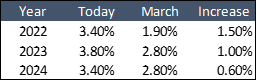

The FOMC raised the year end median projection to 3.40%, which implies 0.50% rate hikes at every remaining meeting this year. Five members see Fed Funds above 4% in 2023.

Take a look at how dramatically the Fed’s own projections have changed since March. Insanity. Plus, look how almost all of the hikes are this year. There is just 0.40% forecasted for next year.

Note the rate cuts in 2024. Furthermore, the lowest dot is 2.0% and highest dot is 4.0%. Within the walls where the decisions are made, there is a 2.0% wide range of outcomes. Imagine being a trader trying to hedge right now.

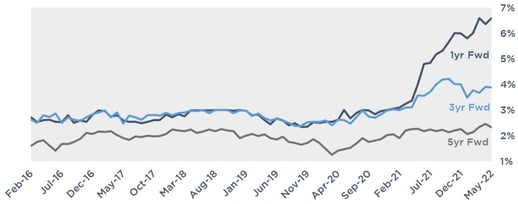

The forward curve puts SOFR at 4.10% in March and north of 3.0% for the next 10 years. That means the T2 could be 4.00% sometime this year, which would further crush cap prices.

Oddly enough, front end rates plunged and the T2 dropped 0.24%. I have to think this is just an exhale that something far more dramatic was taken off the table.

The T10 dropped 0.15% to 3.32%. Remember to keep an eye on 3.25% - will this be enough to push us back through or is 3.25% the new floor?

On External Factors Influencing Inflation

Powell said, “We can’t have much of an effect on commodities and food prices. ” He cited oil, Ukraine, supply chain issues, etc. “It’s increasingly clear many inflation drivers are beyond our control.”

So….hike to 4% just in case?

On QT impacting liquidity

- “We’ve communicated really clearly to the markets and markets seem to be ok with it.”

- “I have no reason to believe it will lead to illiquidity and problems.”

- “Good luck”

Oh wait, that last quote was mine…

On Inflation Expectations

Inflation forecasts were revised to 5.2% this year, GDP was revised lower, and unemployment was raised higher. Plus, Powell said in his Q&A that the longer run neutral rate is “in the mid 2’s”, which is just one more 0.75% hike away. I think the Fed is now admitting it is intentionally putting us into a recession.

On the 75bps hike, it wasn’t just that Friday’s headline CPI sped up to 8.6% from 8.3%. Or that the monthly pace increased from 0.3% to 1.0%.

Inflation expectations, what we have long argued is more important to the Fed than backward looking CPI, hit an all-time high on Friday. Powell committed a decent amount of energy on the topic of inflation expectations.

- “Short term inflation is still very high, but comes down sharply in the coming years”

- “This is very important to us that this remains the case”

- “If we even see a couple of indicators that bring this into question, we take this very seriously”

- “We are absolutely committed to keeping longer run expectations anchored at 2.0%”

- “Inflation can’t come down until it flattens out.”

- “What we want to see is a series of monthly declining readings.”

Warm and Fuzzies

Inflation has never dropped by 2.0% without a recession

Unemployment has never risen by 0.5% without a recession

The yield curve inverted this week, which isn’t that big of a deal except it has a 1.000 batting average

Financial Conditions are just shy of “restrictive” territory for just the third time in 5 years

University of Michigan Consumer Sentiment is at an all-time low (going back to 1978)

- Think about all the bad things, the recessions, wars, terrorist attacks, pandemics, market crashes, currency crisis, financial crisis, hyper-inflation, etc.… the consumer has never been more negative than right this moment

Atlanta Fed GDPNow is projecting Q2 GDP at 0.0%, which would effectively confirm we are already in a recession since Q1 was -1.5%

The ECB is holding an emergency meeting after Eurozone bond yields surged, creating chatter of potential default among the weaker members (cough cough Italy)

Retail sales posted first decline in 5 months, -0.3% vs forecasted 0.1%

Homebuilder sentiment drops to lowest point in two years

Equities are in bear market territory

The Eagles are the sleeper Super Bowl pick

25% of homes listed on the market have cut prices and mortgage demand is half of what it was a year ago

Retailers loaded up on inventory and are about to start slashing prices

The Barclays Capital High Yield 10yr Spread gapped above 5.0%

Oil is at $117/barrel (it started the year at $77) which Biden blames on corporate greed

Takeaway

I think this is a slightly positive step in retaining a shred of credibility with the market because the Fed pivoted in response to Friday’s inflation report.

I know this it tough to envision right now, but the stage has been set for the end of QT and then ultimately the first rate cuts.