Speak Loudly and Carry a Little Stick

Last Week This Morning

- 10 Year Treasury at 3.95%

- German bund at 2.53%

- 2 Year Treasury at 4.82%

- LIBOR at 4.63%

- SOFR at 4.55%

- Term SOFR at 4.62%

- PCE MoM came in at 0.6% vs expected 0.5%

- Core PCE MoM came in at 0.6% vs expected 0.4%

- PCE YoY came in at 5.4% vs expected 5.0%

- Core PCE YoY came in at 4.7% vs expected 4.3%

- GDP revision (Q4) 2.7% vs expected 2.9%

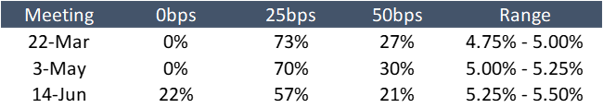

Friday’s Inflation Impact on Rate Hikes

Following Friday’s Core PCE report, rate hike odds surged, but not as dramatically as they would have in the middle of last year. It was a little surprising.

I think there’s a growing sense that time, more so than peak level, will be the focus moving forward. Also, 50bps hikes are not on the table. Here are current odds of hikes at the next three meetings.

Last Week This Morning

- 10 Year Treasury up to 3.82% from 3.70% to start the week

- German bund at 2.43%

- 2 Year Treasury at 4.62%

- LIBOR at 4.59%

- SOFR at 4.55%

- Term SOFR at 4.56%

- Tons of inflation data came in as expected or a little higher than expected

- Empire state manufacturing index came in at -5.8 vs expected -18.0

- Philadelphia Fed manufacturing index came in at -24.3 vs expected -7.5

The odds of Fed Funds finishing the year at 5% or higher are now at 91%. That is the takeaway from Friday’s inflation report. Friday may increase the peak a bit, it may delay the pause by a month, but it really hammered home the point that the Fed won’t be cutting this year.

This makes sense to me. After hiking 5% in a year, does one extra hike really have that big of an impact? Pausing at 5.25% will allow inflation to run rampant, but 5.50% will win the war? C’mon.

If the Fed keeps hiking at 25bps per meeting, it may be primarily for the optics. Powell wants to shift into evaluation mode and to give rate hikes time to do their thing, but he can’t stop altogether while inflation isn’t falling. The optics would be terrible and the Fed would lose credibility. Instead, they thread the needle by hiking 25bps a pop and focusing on the messaging that they need time to evaluate the impact of the hikes.

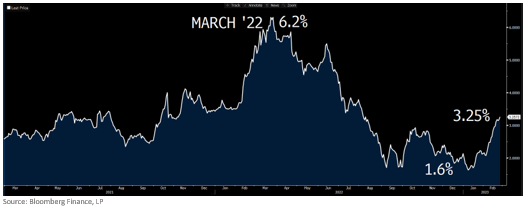

More importantly, he can’t stop hiking if inflation expectations are on the rise again. This is a much bigger reason to keep talking about rate hikes than Friday’s report, which was the result of conditions set into motion a year ago. This graph is Exhibit A for why Fed-speak will keep driving home “higher for longer”, even if behind closed doors they really want to pause.

I wouldn’t be surprised to see lots of tough talk out of the Fed in the coming months while they limp along with 25bps hikes, hoping inflation cooperates before they overtighten.

Speak loudly and carry a little stick.

Caps

Cap prices are back up, however, matching or exceeding the peak we saw in Nov/Dec. Remember, cap prices fall once the Fed pauses and Friday’s number pushed the pause out from March to May.

Volatility is up, but not as dramatically as you might think based on the recent inflation reports. Again, I think this is the result of the market believing the Fed is done with 50bps or 75bps hikes.

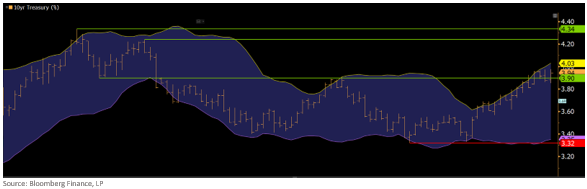

10 Year Treasury

First the CPI, then PCE, have caused the 10T to test the high end of the range at 3.90%. I suspect it will hold because the market really expects the tightening of 2022 to begin to take effect in the months ahead.

- if 3.90% fails to hold, there’s not much between it and the 2022 high of 4.34%

- the low end of the range is 3.40%, so we have lots of room lower on 10yr rates if eco data softens

Week Ahead

Far less data this week but lots of Fed-speak to test out my theory.