Keep Defeasance Costs Low with Swaptions

Since the start of the year, borrowers on new financings have felt the pain of yields rising dramatically, sometimes sending hedging costs or fixed rates multiples higher than what was budgeted for. On the flipside, borrowers originally facing steep defeasance premiums on a refinance or sale have seen substantial relief as rising rates continue to eat away at the cost to exit the financing.

If you’ve got a defeasance (or anything else falling in the prepayment bucket) upcoming and are worried about a sudden drop in rates impacting your exit costs between now and closing, a swaption could be an effective way to hedge against a higher penalty. Especially after the recent yield curve inversion.

How it Works

A swaption is essentially a call option on swap rates. Typically, you’d purchase a swaption to hedge against a rise in rates between now and the time you lock. For example, let’s say you’ve got an upcoming CMBS loan closing and today the rate is at an attractive 3.00%. However, your loan closing isn’t for another two months, and you’re worried about that rate climbing above 3.50% by the time you lock. To hedge against that risk, you’d purchase a swaption struck at 3.50%, which would cover you for any rate movement beyond that strike.

Now, let’s flip that upside down. Swaptions can also be used to hedge against falling rates. For example, if you’ve got a loan with two years remaining and a defeasance with a 2.55% replacement rate, and you’re worried about a dip in two year rates blowing up your costs at closing, you could protect against that scenario with a swaption.

Let’s assume on June 1st you’re closing on the sale of a property and the underlying loan has $50mm outstanding with two years remaining before maturity. The 2-year Treasury yield is currently at 2.55%, and for every 10bps that yield falls, your prepayment penalty rises about $100k. So, you buy a 2.55% swaption today with a June 1st expiry to essentially lock in your current defeasance premium. On June 1st, this plays out one of two ways:

1. The 2-year rate remains at or above its current yield and the option expires worthless

2. The 2-year rate falls below 2.55% and your hedge provider reimburses you the present value difference between that strike and the current 2-year rate

If rates remain above the strike, you’re out the cost of the hedge. But if rates fall and the hedge pays out, you can use that payout to offset the rise in your defeasance penalty, making it feel like your costs are as low as they were a month ago.

What's it Cost?

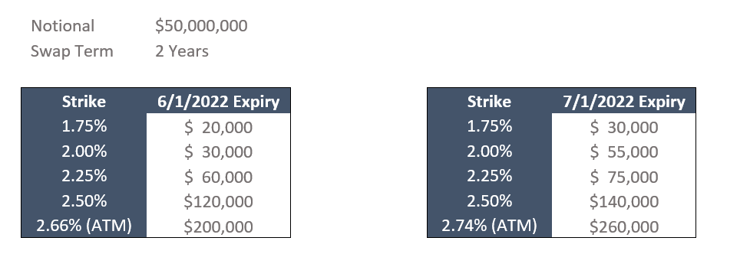

Below, we’ve outlined the estimated premium for a swaption to hedge against rising defeasance costs across a few different strike rates. We’ve included expiries for a closing both one month or two months out. Remember, buying a swaption at the at-the-money strike (ATM) essentially hedges against your defeasance penalty rising above what it is today.

As illustrated, these instruments grow more expensive as you push out the expiry or raise the strike.

Don’t forget, swaptions can be used to hedge not just defeasance but prepayments in general including yield maintenance, make whole, swap breakages, etc. And, although swaptions are highly effective at hedging prepayment penalties, they’re not perfect (but pretty dang close).

If you’ve got an upcoming defeasance (or prepayment) and are worried about falling rates impacting your deal, don’t hesitate to reach out to pensfordteam@pensford.com or (704) 280-9702 to see if a swaption might make sense.

For a more in-depth explanation of swaption mechanics, check out our Swaptions 101 resource.