T10 to 4%?

Big webinar this week, so keeping it short and sweet today. Register here to hear my thoughts on how much the Fed will cut rates next year, why Michigan is the George Santos of college football, and compare the Dallas Cowboys to…themselves.

Last Week This Morning

- 10 Year Treasury at 4.20%, its lowest point in 3 months

- German bund at 2.36%

- 2 Year Treasury at 4.54%

- SOFR at 5.33%

- Term SOFR at 5.35%

- Fed’s Waller's said he is "increasingly confident" current Fed policy is sufficient to bring inflation back to 2% and discussed the possibility of rate cuts next year

- Powell’s speech stating officials are still prepared to tighten policy further if needed.

- Atlanta Fed GDPNow Q4 forecast was revised down from 2.1% to 1.2%

- I would pick UGA over Texas for the CFP because to be the champ you gotta beat the champ and Texas plays in a division that believes “defense” is a four letter word

Inflation

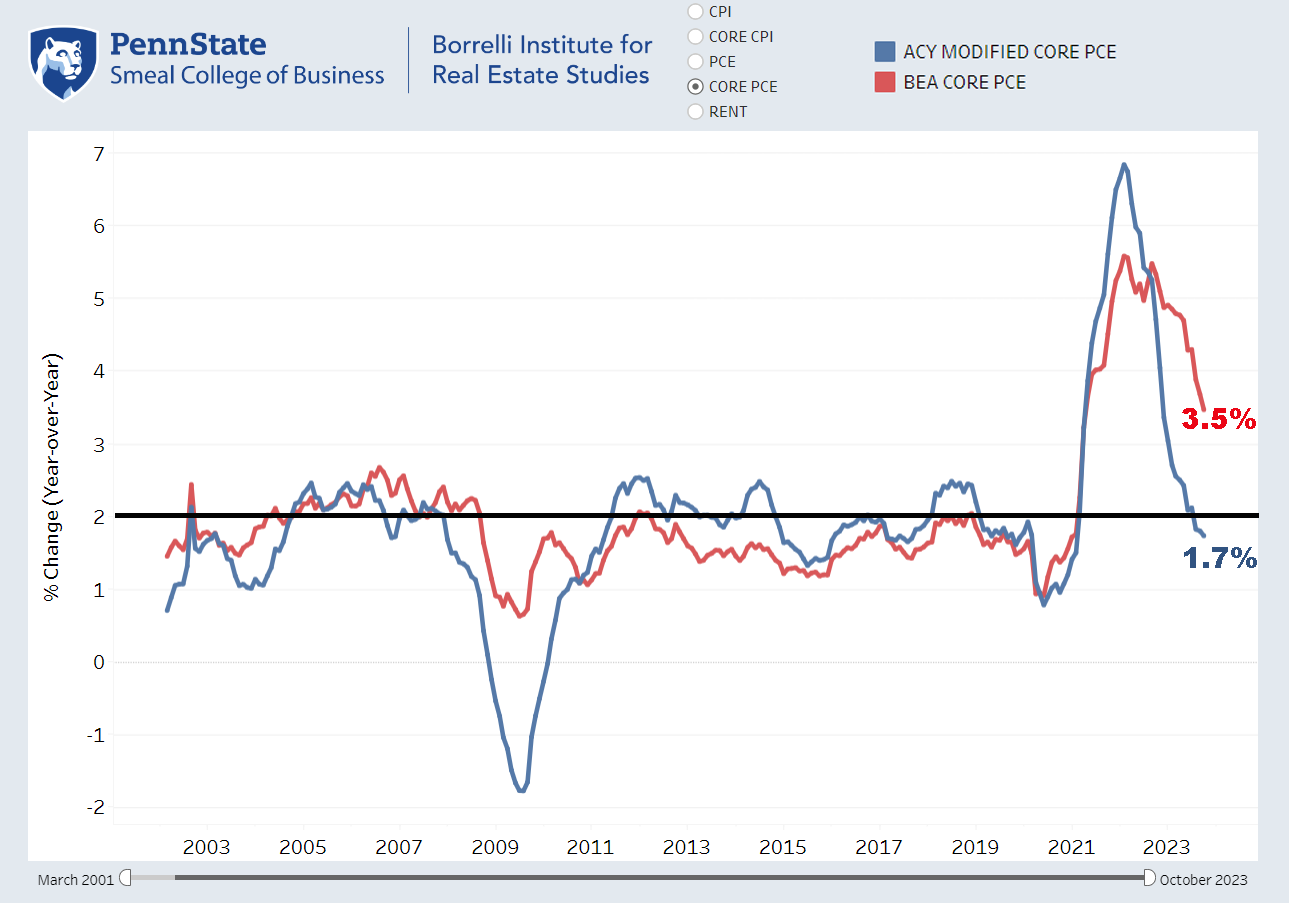

Anyone talking about how we still have a lot of work to do on inflation isn’t paying attention.

Core PCE came in at 3.5%. A year ago, it was 5.5%. This progress has been made without a recession or unemployment surging through 4%. Imagine how much inflation will drop once these come into play.

If you take the last three monthly Core PCE numbers and annualize them, Core PCE is just 2.4%.

If you look at alternative measures of inflation that attempt to account for the huge lag in the official government statistics, we’re below 2%. Penn State’s alternative measure of inflation has Core PCE at 1.7%.

This is not being stressed enough right now – all of this progress has come without a recession or surging unemployment. If when those happen, inflation will blow through 2%.

The Fed has been overestimating inflation levels all year. Here’s how good the Fed is at projecting inflation and why we should absolutely positively believe them that they might still hike.

- In June, the Fed projected Core PCE would finish the year at 3.9%

- In September, the Fed projected Core PCE would finish the year at 3.7%

- On Thursday, Core PCE came in at 3.5%

- At the end of this month, it’s projected to come in at 3.3%

With six months to go in the year, the Fed was likely wrong on inflation by more than 0.5%. Just six months! Furthermore, it has been forecasting inflation to finish 2024 at 2.6% - how much might it be off by with a year to go?

The Fed will be forced to revise its 2023 inflation forecast lower. Does it also revise 2024 lower or does it keep those forecasts at 2.6% to perpetuate the myth of higher for longer?

Rates and Stuff

Last week we said 4.50% was the new ceiling and 4.25% was the next resistance level lower. In short order we had blown through 4.25% and need to closely watch to see if 4.19% was a temporary move or is 4.25% the new ceiling? If so, there’s a psychological level of 4% but a technical level of 3.90%.

While a falling 10T feels good to those of us in the real estate business, it is counterproductive to the Fed’s goal of applying the brakes. Lower rates loosen financial conditions, forcing the Fed to talk tougher to offset that drop in rates.

But with an FOMC meeting next week, the Fed will go dark this week. That could give the market some momentum to push the T10 towards 4% in a Fed-speak vacuum.

Week Ahead

Turns out the Fed isn’t just bad at forecasting inflation. In September, the Fed’s year end projections had unemployment at 3.8%. We hit 3.9% last month. We get the next jobs report Friday and I think the unemployment rate will hit 4%. How will this impact the Fed’s meeting next week? Inflation 0.5% lower than the Fed thought in June. Unemployment 0.5% higher than the Fed thought in September. They aren’t any better at this than the rest of us.