The Fed Might Not Cut At All in 2026

The most shocking part of the NBA betting scandal is that it involved Chauncey Billups. Really? He was the draw for whales? Can you imagine some shady character whispering to you “Hey man, you want a seat at a private game? Chauncey Billups will be there.” And you’re like, “Well I can’t pass that up…”

The second most shocking part is that Terry Rozier was drawing that much interest in prop bets! “On March 23, 2023, U.S. Integrity, a firm that monitors betting markets for suspicious activity, notified sportsbooks and the NBA that an unusual influx of wagers involving Rozier were coming in ahead of the Hornets' game vs. the Pelicans – bets that involved the then-Charlotte guard hitting the under on certain stat totals, like points or rebounds. Some sportsbooks reportedly stopped accepting bets on Rozier as a result.” (1)

At that moment, a professional gambler would say, “Rozier is in on it. I need to avoid Rozier wagers or figure out who is involved so I can pile on.”

Adam Silver promptly, seriously, thoroughly, methodically, and deeply investigated the Rozier wagers and declared them nothing to worry about!

“In March 2023, the NBA was alerted to unusual betting activity related to Terry Rozier’s performance in a game between Charlotte and New Orleans,” NBA spokesman Mike Bass said in a statement. “The league conducted an investigation and did not find a violation of NBA rules.”

The third most shocking part is that Terry Rozier has made $160mm!??!!?? (2)

The fourth most shocking part is that of course it was well known among professional gamblers. I always tell my teammates, “If you want to know how serious someone is about their opinion, put money on it.” Gamblers didn’t need an NBA investigation, they were getting smoked by amateurs and just knew it was rigged. Nate Silver wrote an excellent piece (here) if you want to read more.

I look forward to the NBA’s incredibly thorough investigation into the Dallas Mavs landing Flagg just months after trading Luka to the Lakers.

Last Week This Morning

- 10T: 4.00%

- 2T: 3.48%

- SOFR: 4.24%

- Term SOFR: 3.99%

- CPI Inflation Data

- A little bit cooler than expected, as firms are passing through just 26% of tariffs.

- A little bit cooler than expected, as firms are passing through just 26% of tariffs.

Fed Meeting – Wednesday

They will cut 25bps on Wednesday. If Mark in Hermosa bets me on 50bps again and they cut 50bps, then I know Terry Rozier has gotten involved in FF futures.

They will also signal another cut is likely in December, pushing floating rates down to 3.5%-ish.

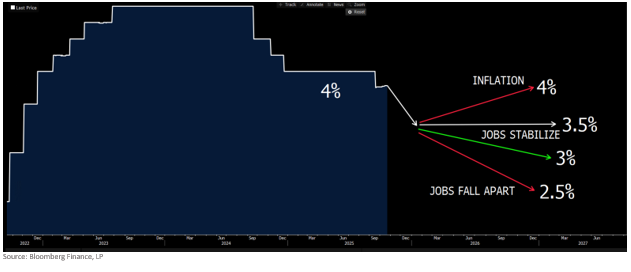

But I can’t shake the feeling that the Fed might not cut at all next year. The market has FF below 3% by year end 2026, but I think the market is counting on continued weakness. If that weakness fails to materialize, the market may need to back out some cuts.

Here’s my overly simplistic view.

Remember, my argument for cuts over the last 12+ months has been that the Fed is easing off the brakes, not pressing on the gas pedal. As they approach neutral, they risk accidentally pressing on the gas pedal. They will become increasingly cautious as they approach the unobservable mythological unicorn “neutral.”

Neutral really has two parts:

- The “natural” rate, aka r*

- Inflation

The best estimates we have on the natural rate put it currently around 0.75%.

Inflation is running at 3%.

0.75% + 3.00% = 3.75%

So why is the Fed cutting to 3.5%? Because they (and I) believe 3% is NOT the new normal. We were at 2.5% before tariffs started impacting the data.

0.75% + 2.50% = 3.25%

That means a reasonable range for Fed Funds is 3.25% - 3.75%. I’m just a dumb state schooler, but I think the middle of that range is about 3.5%.

As 2026 plays out, here’s how the Fed will respond.

Level Off at 3.5%

- Jobs stabilize, unemployment rate stays about the same.

- Inflation is elevated, but not surging.

Cut to 3%

- Job losses, but not in a freefall. UR is climbing.

- Inflation starts falling.

Cut Below 3%

- Job losses accelerate, UR through 5%.

- Inflation starts falling.

Hike Back to 4%+

- Job gains, UR back to 4% or lower.

- Inflation surges.

Trump will load up as many dovish Fed members as possible, so the Fed will have a bias to cut. But he won’t have a majority.

I think 2026 could be a weird year.

- The inflation story has been more muted than expected, but dragging on longer than expected.

- Tariff inflation is clearly going to carry into 2026.

- GDP may accelerate with fiscal tailwinds and increased productivity from AI.

- Unemployment will likely tick higher, even if firms don’t fire aggressively.

- Fiscal responsibility should keep a lid on Treasurys.

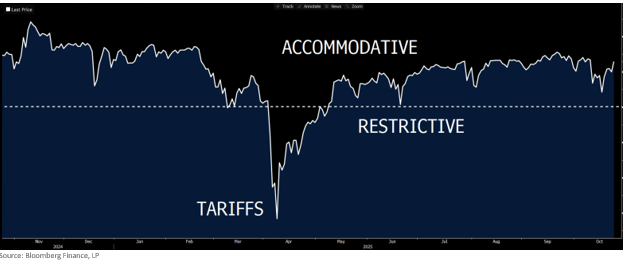

And don’t forget that financial conditions are already accommodative. Lower FF will only contribute further to that.

Treasurys and Hedging

What does all this mean for managing interest rate risk?

If the Fed doesn’t cut in 2026, it means fixed rates are unlikely to push significantly below 4% and could even rebound. If you are focused on fixed rates (bank swaps, CMBS, Life Co, etc), there would be value in locking in today’s curve before the market backs those cuts out.

(Also, as an aside…if I had a dime for every time a customer said, “The bank wants us to use their swap desk” I could retire. Yeah, every swap we work on is a direct negotiation with the bank. Does a bank loan mean you don’t use a lawyer for closing? I’m looking at you, Ken in Chicago. Erin - get your team in check! For the rest of you - if you are doing a swap, call us! But I digress…)

Even if I am right, the same logic does not apply as strongly for caps. Buying forward starting caps dramatically increases the cost in a way that doesn’t occur with swaps. You are still likely better off waiting and buying that replacement cap in six months.

But it could make sense to buy a lower strike or longer-term cap than you would otherwise buy. For example, if you have a cap purchase before year end anyway, you may want to consider a 2-3 year cap instead of a one year cap. This is particularly true of agency caps if you get the added benefit of hedging through maturity and unlocking those escrow balances (read me).

If the wheels fall off the job market (100k+ losses per month), the Fed will cut below 3%, but I just don’t think that’s going to happen in 2026. I think it’s far more likely that we bounce around 0 for a while as firms put AI to work and make their existing teams more productive.

The Week Ahead

Fed meeting Wednesday and then several speeches late in the week to massage the message. Talk to you guys after the meeting.

This is the most attention the Hornets have gotten since Grandmama!