The Pause™ is Not Data Dependent

The Fed hiked last week, but also signaled The Pause™. Friday’s job report and this week’s inflation data may influence headline chatter about more hikes, but the bar for additional hikes is now high.

Last Week This Morning

- 10 Year Treasury at 3.43%

- German bund at 2.28%

- 2 Year Treasury at 3.91%

- LIBOR at 5.10%

- SOFR at 5.06%

- Term SOFR at 5.05%

- JOLTs Job Openings is down 1.6mm from the start of the year

- Nonfarm Payrolls came in at 253K vs 185K expected

- The last two months were revised down 149k

- Unemployment Rate came in at 3.4% vs 3.6% expected

Jobs

Friday’s report showed a strong headline gain of 253k jobs last month, vs an expected 180k. What went less reported, however, was that the prior two months were revised down by 149k.

Today 222k

Q1 2022 561k

Q1 2021 618k

That darned JOLTS survey keeps dropping, with over 1.6mm fake openings eliminated since the start of the year, matching two-year lows.

The unemployment rate dropped back down to 3.4%, but the participation rate is still 0.7% lower than pre-covid. That might not sound like a lot, but it means we really have about a 4.4% unemployment rate.

The Challenger Job Report (Source) revealed that job cuts are up 322% and plans to hire are down 81% vs this time last year.

Though job cuts fell in April from March, hiring plans have also fallen significantly from 2022. In April, companies announced plans to add 23,310 positions for a total of 93,948 so far this year. This is down 81% from the 486,603 hiring plans announced in the same period last year. It is the lowest number of announced hiring plans through April since 2016, when Challenger tracked 38,455 hiring plans in the first four months of the year.

Heck, even the WSJ is picking up what I’ve been putting down (Source). Indeed.com started charging businesses for applicants that weren’t rejected within 72 hours and guess what happened? Businesses were stunned at the bill they got from the website! One small business owner said, “I don’t have someone who is checking that inbox seven days a week.”

CUE SHOCKED FACE! You mean companies had job postings up but weren’t actively managing applications?

“One doctor’s office said it was charged roughly $2,500 for a month and a week of listings. Another small business was charged $8,000. “This morning after a weekend away, I woke up to a $5,000 bill!” a third small-business owner complained.” One of the companies in the article responded by cutting 90% of their Indeed.com budget.

The JOLTS survey, like the broader labor market, is not as strong as the headlines suggest.

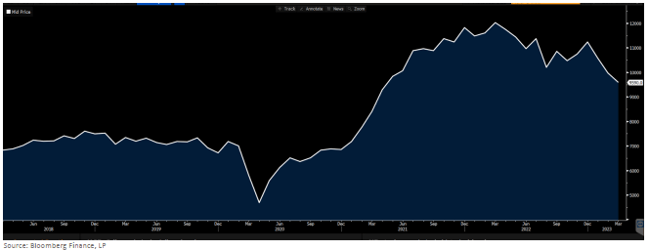

Senior Loan Officer Opinion Survey

At 2pm today, we get the next SLOOS. Look at how tight standards were in January before any regional bank fallout.

The survey was sent out in mid to late March and responses were due at the beginning of April. Today’s report will only reflect the very earliest stages of SVB. That means a big chunk of the tightening since January won’t even reflect the regional bank crisis.

Credit tightening is Exhibit A for why the Fed is done hiking. The tightening will replace the need for the last few hikes.

The Pause™

Here was our knee jerk reaction to Wednesday’s FOMC meeting (The Next Fed Move Will Be a Cut).

Immediately following the meeting, odds of a June hike dropped to 0.0% (not a typo, literally zero). Odds that the Fed wouldn’t cut at least once by year end dropped to 0.2%.

After Friday’s job report, the odds of a June hike increased to just 8.5%. That seems like an awfully small reaction, right? Six months ago, a surprisingly strong job report would have sent Fed Funds futures surging, with talk of a 75bp hike.

Even though Powell said the Fed will continue to monitor data to determine if more rate hikes are needed, I don’t think the Fed is actually data dependent anymore.

Think about how slowly inflation has been coming down. Think about how strong the headline job numbers appear to be. Think about how financial conditions have not surged into restrictive territory.

Powell knew all of this and still strongly suggested a pause.

The Pause™ is not contingent on a sudden improvement in inflation data

The Pause™ is not contingent on a sudden weakening in jobs

The Pause™ is not contingent on a sudden tightening of financial conditions

The bar for additional hikes is very high. Headline CPI this week will show an increase, but that will be attributable to the rebound in oil prices after OPEC restricted supply last month.

Powell knew this last week at his press conference. While the headlines may scream “Fed has more work to do”, Powell won’t react unless core inflation reverses.

The Fed isn’t actually data dependent anymore, unless that data suggests inflation is increasing again.

Week Ahead

Loan officer survey today, inflation data on Wednesday and Thursday, and lots of Fed speakers to massage last week’s message.

Most importantly, another college graduation and one more kid off the payroll!