To Heck with Your Soft Landing

Last Week This Morning

- 10 Year Treasury at 3.84%

- German bund at 2.45%

- 2 Year Treasury at 4.85%

- SOFR at 5.06%

- Term SOFR at 5.30%

- NY Empire Manufacturing Index came in at 1.1 vs -3.5 expected

- Philadelphia Fed Manufacturing Index came in at -13.5 vs -10 expected

- Retail Sales MoM came in at 0.2% vs 0.5% expected

To Heck with Your Soft Landing

I wanted to call this, “F&ck your soft landing” but the real boss wouldn’t let me, so you get the PG version.

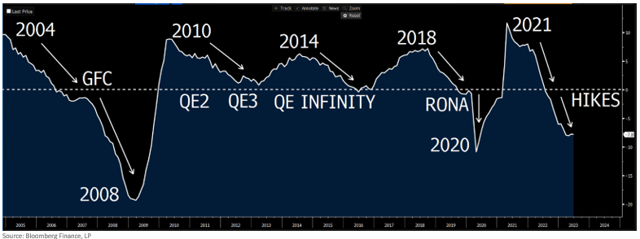

Here’s the Leading Indicator Index, which is far more pessimistic about achieving a soft landing than recent CNBC commentary would suggest.

Even this state schooler can detect a pattern:

- Leading Indicators peak and then start falling towards neutral, hitting that well ahead of a recession

- Approaching neutral creates a fork in the road

- A shock breaks the economy

- Great Financial Crisis

- Covid

- Fastest rate hikes in 40 years

- Fed accommodation puts a floor in the pain and we achieve a soft landing

- QE2

- QE3

- QE Infinity

- A shock breaks the economy

Instead of adding accommodation, the Fed is still hiking and tightening financial conditions. That doesn’t feel like a recipe for a soft landing.

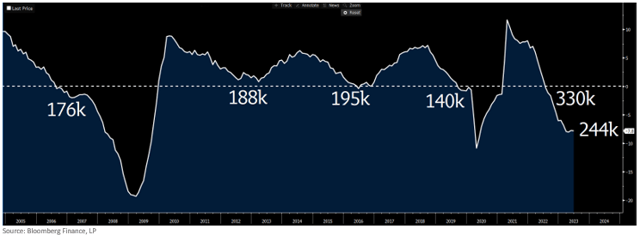

But jobs!

Here’s the same graph, but with the 3 month average jobs report. The job market definitely appears stronger than at other pivotal moments, but it’s not like we’re normally shedding jobs at this point. Just because the pain hasn’t arrived yet doesn’t mean it isn’t coming.

Fed Meeting Wednesday

A hike is a done deal. Markets have a 99.2% probability of a 25bps hike this week. This will put the upper band at 5.50%, the highest in over twenty years.

The only unknown at this point is what sort of tone accompanies the decision. Bloomberg’s Fed Sentiment Index tracks the Fed rhetoric and it’s already softened substantially this year. Those expecting a sharp change in tone will probably be disappointed.

CPI data from last week takes the pressure off ramping up the rhetoric, but don’t expect them to go full dove. I expect lots of talk about still having work to do and commitment.

The odds of a hike at the September 20th meeting are 16%, while odds of a hike anytime before year end are 30%.

Odds of a cut this year are just 9%.

The first time the odds of a cut exceed 50% isn’t until March ’24.

How Low Will the Fed Cut?

Like a well-run Cowboys team or a relevant Longhorns team, the equilibrium rate is a unicorn (just checking to see if my friends in Texas are still reading!). It’s the rate that neither encourages nor restricts growth. It’s the impossible goal of all monetary policy decisions. It’s also a moving target. It changes over time, making the impossible even impossibler. Mission Impossible 13 – R*. Pan to Ethan Hunt sprinting through the halls of the Fed.

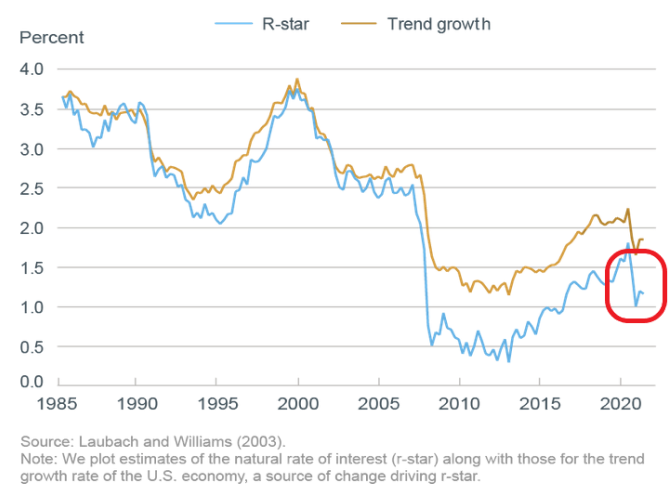

Whenever the Fed cuts, will rates go back to 0%? Or is a 4% Fed Funds the new normal? The Fed’s perception of the neutral rate is probably a good guidepost. Anything above that rate is considered restrictive, while anything below that rate is considered accommodative.

The NY Fed publishes an estimate of R* and while it has risen substantially off the lows of 2010-2020, it’s still somewhere between 1.0%-1.50%.

While a return to 0% would probably require a shock to the system, stopping at 4% seems unlikely, too.

Week Ahead

This is a gigantic week. Not only do we have the Fed meeting, but then GDP and inflation.