Two GOATS One Week

One weekend we saw Lionel Messi play, the next weekend we saw Dave Chappelle. Messi underwhelmed, loafing most of the game. When he actually tried, it was easy to see his brilliance. But I couldn’t get over the walking and standing and malaise. Now, it was the last game of the season, they had missed the playoffs, he was injured a few weeks prior and, most importantly, it was an MLS game. But still. I’ll stick with Pele.

Whatever Messi was, Chappelle was the opposite. He’s my favorite comedian of all time and one of two people I would be star struck by (MJ being the other). And I was. And he was brilliant even when I disagreed with him or got uncomfortable.

Seeing two GOATs in one week got me thinking – I wanna be a GOAT. But of what? Except for my bad boy of pickleball persona, I’m not athletic. I’m not smart. I’m mildly clever from time to time, but I couldn’t do a 5 minute gig on stage without spectators walking out.

So it has to be interest rates, right? But there are literally thousands of people better at rates than me. What if I start narrowing it down so it has to be me? I checked with my wife.

The GOAT of east coast guys that do interest rates named JP!

“Jay Powell?” she asked.

I give up.

Last Week This Morning

- 10 Year Treasury at 4.84%

- German bund at 2.81%

- 2 Year Treasury at 5.01%

- SOFR a 5.32%

- Term SOFR at 5.32%

- S&P Global US Manufacturing PMI 50.0 vs. 49.5 expected

- GDP Growth QoQ 4.9% vs. 4.5% expected

- GDP Price Index 3.5% vs. 2.7% expected

- Durable Goods Orders 4.7% vs. 1.9% expected

- PCE 0.3% vs. 0.4% expected

- Personal Income 0.3% vs. 0.4% expected

- Personal Spending 0.7% vs. 0.5% expected

- UMICH Consumer Sentiment 63.8 vs. 63 expected

- The ECB paused after 10 consecutive rate hikes

GOAT Economy!

Turns out if you throw trillions of dollars at the economy, it can do well for longer than usual. I got dozens of texts late last week that basically amounted to, “The economy grew at 4.9% and inflation was higher than expected, but rates fell? WTF?”

You have to read more than the GDP headline to learn that 1.3% was attributable to inventories and 0.8% was government, two contributions unlikely to repeat. Adjusting for those, GDP was more like 2.8%. Not bad, but not gangbusters, either.

According to Capital Economics, “the acceleration in inventory-building in the third quarter leaves more scope for a reversal in the fourth quarter and beyond. That is a key reason why, despite the strength in the third quarter, we still expect GDP growth to slow to below potential soon with outright declines still a distinct possibility. That weakness, together with further signs of improvement in core inflation is why we expect the Fed to cut rates more aggressively next year than current market pricing assumes.”

Consumer spending was significantly stronger than expected, giving bulls more reason for optimism. Spending was much stronger than expected, but income was lower than expected. Credit and forget it!

The BEA revised estimates of excess savings. We thought they went negative over the summer, but the new estimates suggest consumers might not run out of excess savings until the first half of next year. That would help explain the surprising “resiliency” of the economy.

Even if consumers have more savings than originally believed, they are plowing through it. As savings have been depleted, consumers haven’t changed their spending habits. This false sense of confidence is exacerbated by the belief in a strong labor market. As the labor market slows, the psychology will change. Spending will fall off a cliff.

Credit card debt has topped $1T for the first time in history at the exact same moment most consumers are dealing with interest rates they’ve never experienced in their lifetime. Credit card delinquencies are at the highest level in 10 years. Car loan delinquencies are at the highest level in 30 years. Small business bankruptcies are rising.

According to the Fed’s own measure of financial conditions, we didn’t transition into restrictive territory until June. We are at the most restrictive levels since the financial crisis and more restrictive than any other time period except for 1977-1982. But tell me more about your soft landing, I’m super interested in hearing more.

5% rates are just starting to do their thing…the slowdown is coming.

Inflation – Progress, not Perfection

Core PCE came in at 3.7%, a pretty nice improvement from the 5.5% we were at a year ago. The monthly Core PCE reaccelerated, however, to 0.3%. This will be something to keep an eye on.

Taking the last three monthly Core PCE prints and annualizing them puts us at 2.5%. A year ago it was 5.4%. Progress if not perfection.

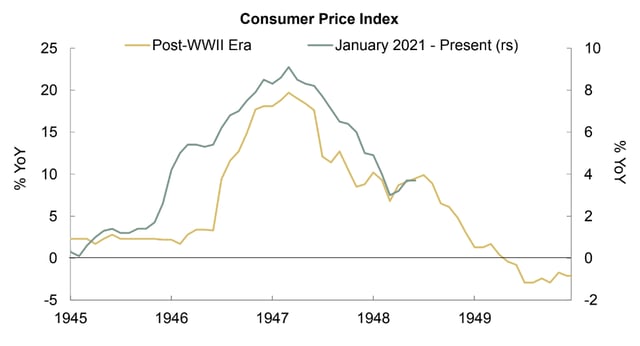

I am in the camp that we are repeating the post-WWII inflationary cycle instead of the 1970s. The 1940s and the pandemic both experienced sharp labor supply contraction and spiking government spending. Here’s a graph from SMBC’s econ team that illustrates the uncanny similarities.

FOMC Primer

The Fed won’t hike this week, which means back to back pauses. They’ll keep talking tough to keep odds of a December hike on the table, but the market has a December hike at just 20%.

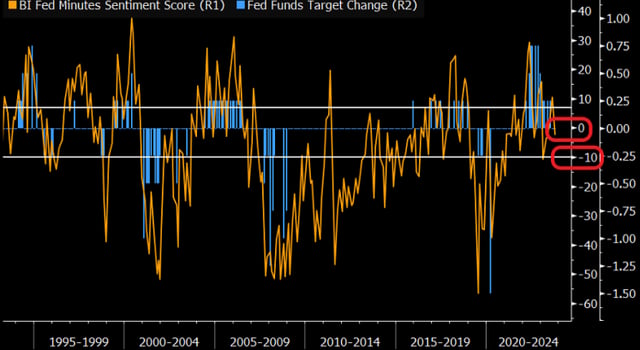

Bloomberg’s Fed Sentiment Index tracks hawkish/dovish sentiment from the FOMC Minutes. We have recently dipped into slightly dovish territory. We need to see more dovish commentary before cuts are on the table, but the first step of moving away from hawkish chatter has been accomplished.

Futures put odds of another hike anytime over the next six months at just 30%, so the market largely believes the Fed is done even if they keep talking up the possibility of more hikes.

I continue to believe the Fed is done hiking and markets are underestimating the number of cuts next year.

Just remember, on a long enough timeline…I am always right.

10 Year Treasury – Rates Aren’t Higher Because of Supply

I think government spending is out of control. If most Americans had the ability to turn on the printing presses and get current on credit cards and car loans, they’d probably do it, too. Government spending is a highly politicized topic, so it’s a favorite go to when assigning blame to higher yields. Too bad it’s not true.

It’s true that the government caught the market offsides two months ago when it unexpectedly announced an additional $250B shortfall that would need to be covered by Treasury supply, but that was only incrementally higher than the known shortfall.

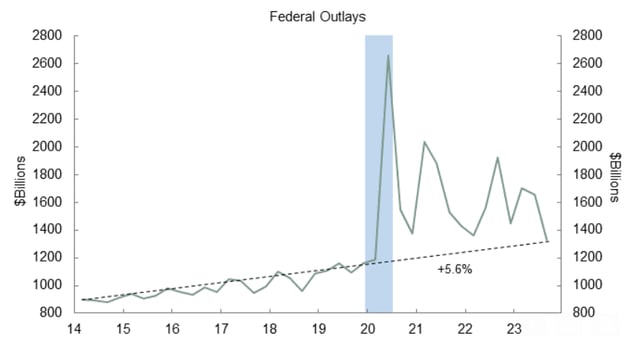

SMBC’s econ team, “The abrogation of the administration’s student debt forgiveness plan lowered the just completed fiscal year 2023 budget deficit by $333 billion, to a still large $1.7 trillion. But as we can see in the chart below, the level of federal spending is now more in line with its pre-pandemic trend of 6%. While unsustainable relative to the economy’s long-run potential, government outlays are less out-of-kilter than they had been. This means that Treasury supply over the next couple of quarters may be more digestible than previously thought.”

If not government spending, what caused the run up in rates?

“Higher for longer”.

Did anyone else feel like one day we woke up and everyone believed in higher for longer? Maybe the Fed just needed a more clever tag line than, “sufficiently restrictive.” Once the marketing team settled on “higher for longer” all the state school kids like me were like “ooooohhh….I get it now.”

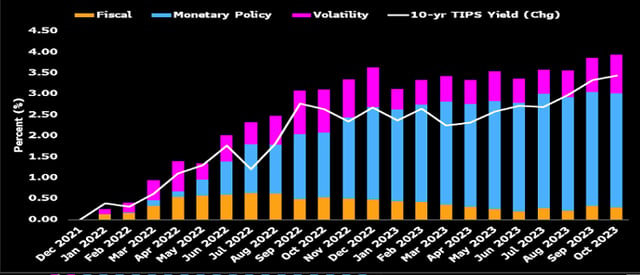

Bloomberg’s rates team put out a research piece that illustrates that monetary policy is far and away the biggest contributing factor to a 5% 10 Year Treasury.

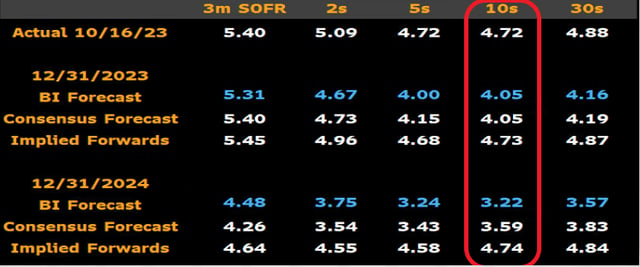

Bloomberg has revised its year end forecast materially higher, but still expects the 10T to finish the year just north of 4% and next year closer to 3%.

Higher for longer. Strong labor market. Strong GDP. Resilient. GOAT Bidenomics.

If the market unwinds all the things we’ve seen over the last few months, the 10T will fall just as quickly as it surged.

Everything is Still Fine

Just remember, everything is fine in the banking sector even though the Fed’s emergency Bank Term Funding Program balance continues to climb.

Nothing to see in the regional banking sector (KBW Regional Banking Index), either.

The Fed’s Term Funding Program is set to expire in March 2024. If that program gets extended, what should our takeaway be?

Week Ahead

Fed meeting is the headliner, but jobs on Friday.

I also saw the Halloween costume GOAT – James Franklin dressed up as a college football head coach!