Unlocking Cap Escrows

As rate expectations have trended lower, many borrowers with Agency floaters have found themselves over escrowed by a meaningful amount. On 7 and 10 year ARMs approaching maturity, this presents an opportunity to hedge through maturity and unlock the remaining reserves.

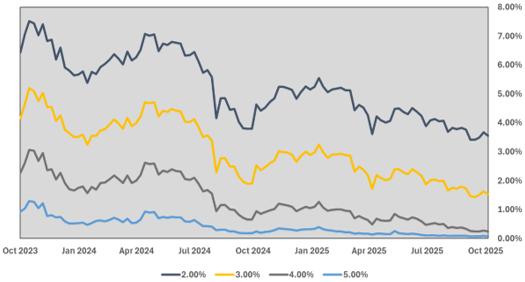

The following graph illustrates the changes in Agency cap escrow requirements. Note, costs are shown in bps of notional.

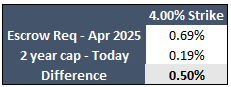

Assume a borrower’s cap escrow was re-calculated six months ago and the cap needs to be extended today. The following table outlines the cost of a 2 year 4.00% strike grossed up 125% in April 2025, the cost of a 2 year cap today, and the difference.

If just 2 years remain on the loan, the borrower could simply hedge through maturity and unlock the excess escrows. In our example, the 4.00% cap unlocks almost 0.50% of the loan amount, but we’ve seen some actual scenarios with significantly higher sums.

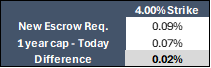

Alternatively, the borrower could forego the longer term and buy another 1 year cap today. Given the amount in escrow, it’s possible they wouldn’t need to reserve anything else unless cap costs increase at the next (final) escrow re-calc.

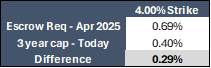

What if your loan has 3 years remaining? If you’ve already stopped escrowing, there might still be excess cash, even if you buy a 3 year cap.

The strategy can work for caps that have future maturities too. As rate expectations have fallen, forward starting cap costs have decreased meaningfully.

These are overly simplistic examples so your mileage may vary. The timing of your last cap purchase, when the escrow was last recalculated, how much proceeds are in the account, the strike, and the current cost of your cap all play into the outcome.

Waiting to buy replacement caps in the future and/or shorter terms are still projected to result in savings if rates follow current expectations. However, if your loan is nearing maturity and the desire is to unlock excess escrows, hedging through maturity is something to consider.

If you’d like help running scenarios for your assets, give us a call at 704-887-9880, email us at pensfordteam@pensford.com, or respond directly to this.