We Just Need to Know What Rules to Play By

I was on the phone with a good friend Friday discussing college football, our favorite topic. He’s a Notre Dame alum and diehard fan. He was happy with their showing against Ohio State and said, “So tomorrow we’ll get back on track against a cupcake…no offense to Marshall but…”

I cut him off. “How could Marshall not be offended by that?”

He chuckled, “I hope I’m not eating those words tomorrow…” He still hasn’t responded to my email as soon as the game was over.

A&M got shelled by NC-based and perennially scrappy App State. Wisconsin lost at home. Iowa lost and proved again Iowa City is where offenses go to die. It was a glorious Saturday. But those summabitches from Tuscaloosa somehow managed to dodge the bullet. Texas lost its starting QB in the first half and still went the distance. Longhorns….YOU HAD THEM! The entire country was rooting for you. Ugh, that one is going to sting for a bit.

Now I turn my attention to the NFL, where the Eagles begin their march to play the Bills in the Super Bowl.

Last Week This Morning

- 10 Year Treasury up to 3.30%...do not sleep on that 3.25% threshold

- German bund up to 1.69%

- 2 Year Treasury at 3.56%

- LIBOR at 2.77%

- SOFR at 2.29%

- Term SOFR at 2.78%

- The ECB delivered a 75bps hike

- Don’t look now, but Russia is starting to pull back from Ukraine

- How was 9/11 twenty one years ago? Our analysts have no memory of that day. I still can’t wrap my brain around that.

When Will Lending Return to Normal?

In August 2012, Pensford’s volume fell off a cliff. September was dead. October was a ghost town. I happened to be having lunch with one of my favorite clients, a Raleigh-based developer. He told me not to worry.

“Real estate pros can do deals in any environment – they just need to know what rules to play by. Higher interest rates, tax policies, regulatory challenges, Republican vs Democrat, etc. None of it matters that much even though we will cry and moan about it like it does.” He had my attention.

“We just need to know what rules to play by, and a presidential election is a threat to those rules changing. It won’t matter who wins next month, I think your volume will pick back up as soon as the election is behind us.”

Sure enough, our volume took off in December and didn’t slow down for two years.

I think this Fed tightening cycle is having a similar effect. Without clarity around whether the Fed is going to 3% or 4% or 5% or much higher, it’s tough to underwrite a deal.

The unknown landing spot for floating rates is a threat to the rules. The rules are different at 5% than at 4%.

Lending (and deal making in general) won’t return to normalcy until we have better insight into this leveling off point.

If December gets us to 4% and a message of “we’re going to pause here and monitor”, I think lending returns to more normal levels in 2023.

If, however, the Fed is still talking up hikes into 2023, it will delay that return.

Inflation Data This Week

“History cautions strongly against prematurely loosening policy,” Powell said at a Q&A presented by the Cato Institute. “I can assure you that my colleagues and I are strongly committed to this project, and we will keep at it until the job is done.”

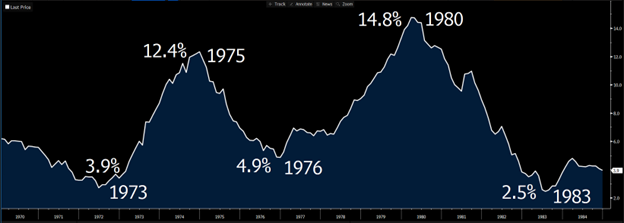

Last week we tackled the question about whether we were set to repeat the 1970s (Is This the 1970s All Over Again?). I concluded no, but that the ‘70s are certainly informing Powell’s approach. The graph below is CPI in the 1970s and Powell wants to avoid the mistakes made that allowed inflation to both surge and persist. It took Volcker to finally break the back of inflation and Powell is using that playbook now before it gets away from him.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

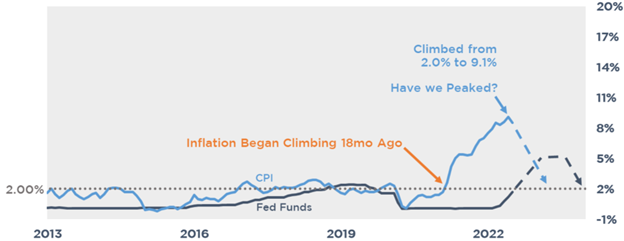

Tuesday brings the next batch of CPI data. Headline CPI peaked (for now) at 9.1% in June and dropped to 8.5% in July. August’s data (released this Tuesday) is forecasted to at 8.0%. I’m going to put on my rosy colored glasses and pretend it keeps trending lower. Keeping a consistent pace of a decline of 0.5% per month puts us at 6% at year end.

June 9.1%

July 8.5%

Aug 8.0%

Sept 7.5%

Oct 7.0%

Nov 6.5%

Dec 6.0%

It could fall faster than that, but I don’t think by much. In the six months from September 1981 to March 1982, it fell from 11.0% to 6.8%. A similar 40% drop from June’s peak would still put us at 5.4% at year end. It also means we don’t hit 2% until August 2023.

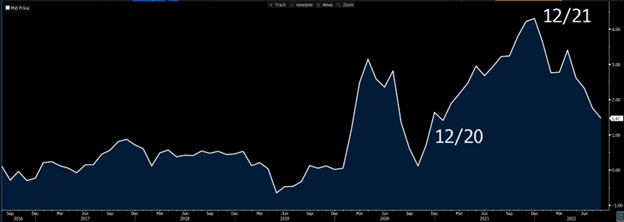

Perhaps the biggest reason inflation might fall faster than in the early ‘80’s is that inflation isn’t solely the result of excess demand. Supply chain pressures are easing and excess inventories could depress prices faster. Here’s the Supply Chain Stress Index, which is back to 2020 levels after peaking last December.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

While headline CPI is what we’ll read in the WSJ, the Fed is more focused on the monthly data. Is inflation accelerating or decelerating month to month?

Last month, CPI m/m fell from 1.3% to 0%, largely on the back of plunging oil prices. It is forecasted to fall further, to -0.1% this week.

Stripping out oil/food, Core CPI m/m feel from 0.7% to 0.3% last month. It is forecasted to remain at 0.3% this week.

Progress, but slow progress.

Powell is going to need to see at least three consecutive months of falling inflation before he will even acknowledge inflation is falling. Otherwise it might end up being a pump fake. But even if inflation is at 6% at year end, do you really think he’s going to declare victory?

This cannot be understated – Powell, like Volcker, is obsessed with messaging right now. He has to convince everyone that the Fed will not blink in its battle with inflation, even if their decisions cause “some pain.” Behind closed doors, he may even start making plans for an eventual Fed pivot, but he will not say that publicly any time soon.

If inflation trends lower like outlined above, I don’t expect the Fed to declare outright victory. Instead, I would expect a shift in messaging. We will start hearing a lot more about the lag effect and the fact that the Fed needs to slow the pace of hikes or level off and then wait for the effects to catch up.

What happens this week could influence the Fed decision next week, but only if it’s an outlier print. I think 75bps is the base case scenario, but a surprisingly large drop in inflation could open the door to 50bps.

SOFR will probably be north of 3.00% in 10 days and about 4.0% at year end.

The real question is whether Powell can tweak the messaging to say, “We need to level off and wait for the effects of our rate hikes this year to catch up.” Basically, Fed Funds will be around 4% for a while we wait to see if inflation keeps coming down.

It will be a tricky position to take because he doesn’t want to appear to be backing off too soon but also doesn’t want to send unemployment surging.

10 Year Treasury

Two beliefs are primarily responsible for keeping a lid on 10 year rates right now.

- The Fed is hiking us into a recession

- Inflation is a near term problem

Of these, everyone is laser focused on inflation.

The one that might sneak up on us is the first one. If data comes out consistently stronger than expected, there will be at least some whispers that maybe we will avoid a deep recession.

That, in turn, could apply upward pressure on the 10T. We have tested the critical 3.25% level multiple times now and it’s not inconceivable that it finally breaks and the 10T moves up 50bps in short order.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

Week Ahead

Relatively light week outside of the inflation data. The Fed will be quiet ahead of next week’s meeting.