We're Gonna Cut, Don't Jinx It

As expected, the FOMC held Fed Funds at its current range of 5.25%-5.50%.

The official press release was much more optimistic this time, with the opening line changed from economic activity “actively slowing” to “expanding at a solid pace.” The FOMC believes their risks and goals are moving into “better balance."

Greater Confidence

But they’re not celebrating their victory just yet, or at least not publicly.

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,” a statement Powell repeated numerous times during Q&A.

What does the Fed need to see in order to feel like they have “greater confidence?"

Last SEP projected Core PCE EOY 2023 at 3.2% and EOY 2024 at 2.4%. The December print was 2.9%, already below their expectations. The 3-month moving average of the monthly print is annualizing at 1.6%.

Will two more soft inflation prints before the March meeting be enough to provide the Fed with “greater confidence that inflation is moving sustainably toward 2 percent?"

Powell says it’s not likely, but markets don’t entirely believe it.

Market Reaction

- 10T at 3.94%, down just 3bps from pre-meeting

- 2T at 4.23%, down 2bps

- Market expectations for rate cuts this year pushed out a bit

- 40% chance of one cut in March

- 90% chance of at least one cut by May, 30% chance of two

- Fed Funds at 4.00% EOY

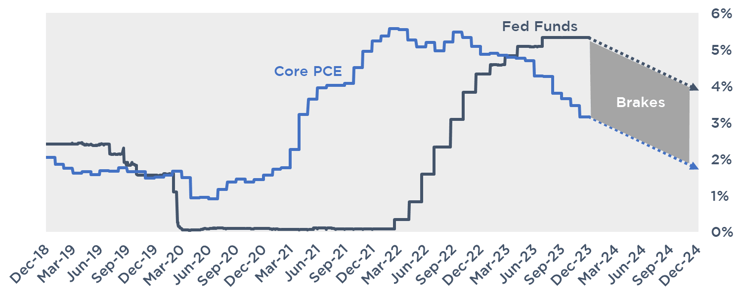

Easing Off the Brakes

Remember, the Fed just has to keep real Fed Funds, not nominal Fed Funds, positive to apply the brakes to the economy.

If inflation falls, real Fed Funds climbs even if the Fed doesn’t hike.

If inflation begins to fall quickly and they don’t cut, they risk slamming on the brakes.

Powell pointed to supply side and labor market recovery post-pandemic as being a material contributor to recent growth. As that recovery levels off, we should start to more heavily feel the impact of tighter policy.

This suggests the Fed sees the factors that led to higher inflation this cycle as a more temporary surge driven by the drop in supply during the pandemic. This puts us in a similar situation to the inflation surge post-WWII and not at risk of facing the unanchored run up in inflation we saw during the ‘70s. Even Powell admitted that he’d be surprised if inflation started moving back up at this point.

On the topic of real rates, Powell cautioned that they “can’t mechanically adjust policy as inflation falls.” However, supply and labor continues to normalize, and waiting too long to cut risks slamming on the economic brakes too hard.

The Fed will likely add a little more braking pressure than they think they need to play it safe.

But if they wait too long to take their foot off the pedal, they risk having to slash rates like they usually do.

The Balance Sheet

Jay Powell: “Nope, different discussion. We’ll start looking at that in March.”

Takeaway

The Fed thinks they’ve done enough to beat inflation but are holding out on cuts for a little longer to be sure they don’t jinx it.

Unless we see inflation materially surprise to the downside, the first cut likely won't happen until after the March meeting.