What’s the Game Plan Here?

Last Week This Morning

- 10 Year Treasury down to 2.92%

- German bund down to 0.95%

- 2 Year Treasury down to 2.58%

- LIBOR at 0.89%

- SOFR at 0.79%

- Term SOFR at 0.80%

- China’s Zero Covid policy is working so well its economy just experienced the second biggest monthly credit contraction on record…right behind Feb 2020

- China will likely be easing monetary policy in the coming weeks

- Europe is either in a recession or about to enter a recession

- This makes discussions around banning Russian oil trickier

- US odds of a recession now exceed 30%

- CPI (YoY) came in at 8.3% vs 8.1% expected

- Core CPI (YoY) came in at 6.2% as expected

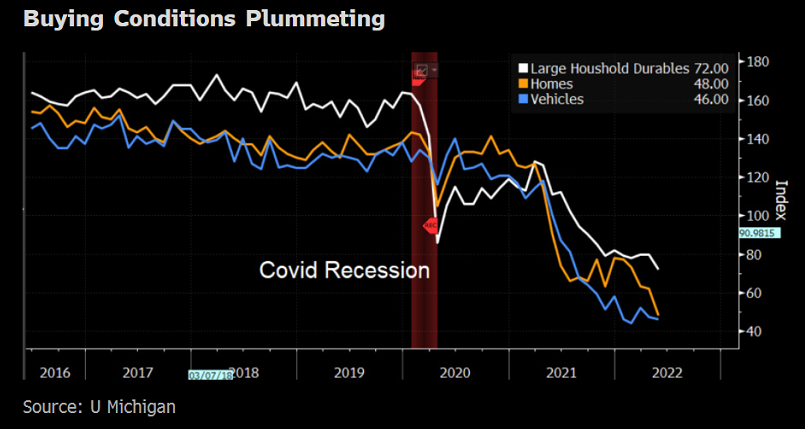

- UMich Consumer Sentiment Index hit a 10 year low (yes, lower than during covid)

- This suggests lower consumer spending ahead

- Consumer spending is 2/3rds of GDP

- You can connect the dots from there

- Consumer spending is 2/3rds of GDP

- This suggests lower consumer spending ahead

- UMich 5 year inflation expectations:

- 1 year ahead: 5.4%

- 5-10yrs ahead: 3.0%

- Powell was officially confirmed by the Senate for his second term

- Turns out Democrats do know how to reduce regulations, it just takes a baby formula shortage

Passing the Baton

One of the Fed’s biggest challenges is using demand side policies to affect supply chain dislocations. I’ve quipped that hiking rates won’t suddenly open up the ports in LA, but if you’re a Fed official, you’re probably thinking, “When all you have is a hammer…”.

The Fed’s actions will impact demand. Over time, Supply Side will pass the baton to the Demand Side of the equation.

As the supply chain dislocations resolve themselves, the Fed will be confronted with a slowing economy. An elusive soft landing will reside somewhere in that passing of the baton.

Speaking of those pesky LA ports, Eugene Seroka, Executive Director of the Los Angeles port, said 39 ships were waiting to anchor outside Los Angeles and Long Beach, compared with more than 100 earlier in the year.

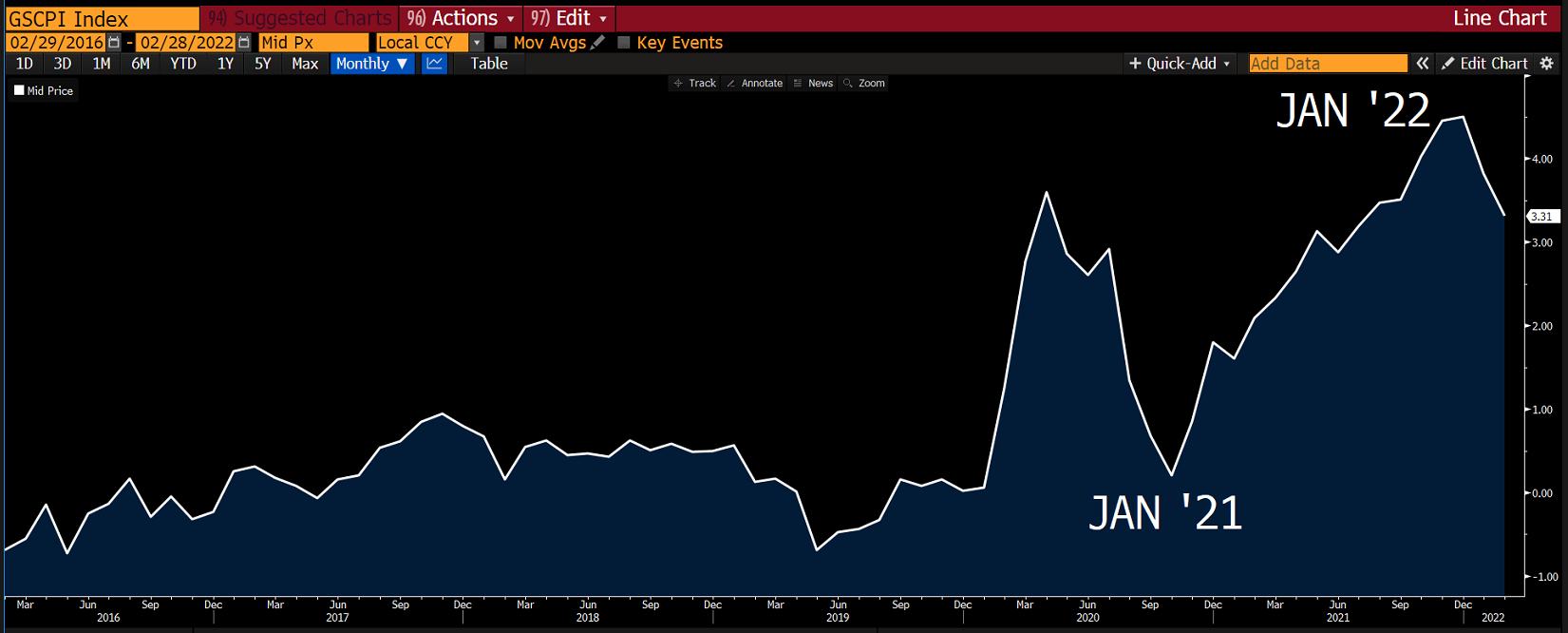

In a related story, the Fed’s Global Supply Chain Index peaked in January, two months before the first hike.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

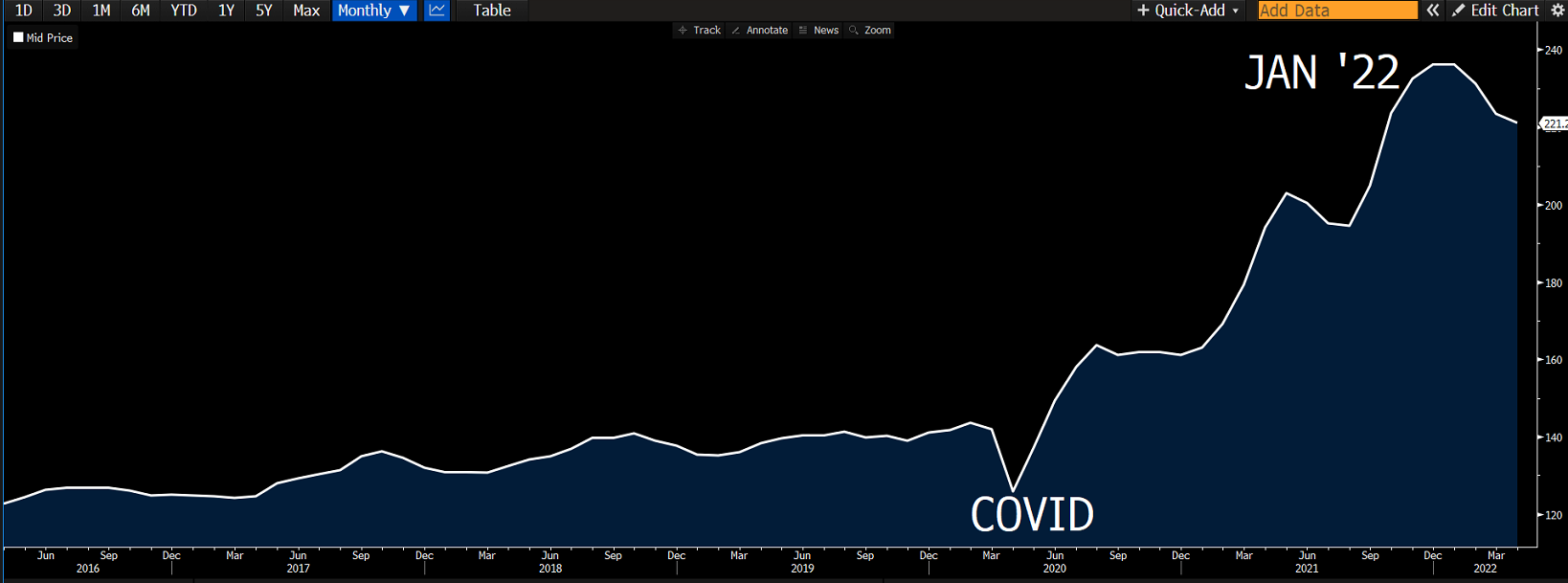

The Manheim Used Vehicle Index peaked the same month…also two months before the first hike.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

Buying conditions have been on a downward trend for some time. This is bad juju for consumer spending and GDP.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

Sure, higher rates might cause stocks to plunge quickly, but it can’t impact the overall economy that quickly. Housing might experience a quick cooling off, but what about things like clothing that aren’t directly impacted by low interest rates?

Omair Sharif of Inflation Insights predicts inflation will fall to 5.3% by December. He also computed scenarios high and low scenarios of 7.1%, and 4%, respectively. But that’s an annualized number – his baseline report for the month of December is “just” 2.5%.

Remember, Powell himself believes the current Fed actions won’t impact inflation readings until Q1 of 2023, so these forecasts are likely to materialize regardless of Fed policy decisions today.

What’s the Game Plan?

Look how quickly Financial Conditions have tightened in six months. We are barreling towards restrictive territory and have only just begun hikes and QT.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

How long before we are in restrictive territory? Glad you asked.

If conditions continue to tighten at the same pace, we will

- Be in restrictive territory by June 7th

- Hit the recession threshold in October…of this year

Furthermore, take a look at how the Fed has handled restrictive territory since the financial crisis.

- 2010 – start QE 2.0

- 2011 – start QE 3.0

- 2016 – Yellen had hiked once in December 2015 and then paused for a year

- 2019 – the last hike of the tightening cycle was December 2018, even though the blue dots suggested 50bps of tightening in 2019. By summer 2019, the Fed was instead cutting.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

What’s the game plan here if we cross the threshold before the June 15th meeting?

Powell and others have pretty much confirmed that the Fed will hike 50bps at each of the next two meetings. That would put Fed Funds at 2.0% by the end of July.

I’ve described rate hikes as the Fed applying the brakes. But what if the Fed doesn’t believe it is yet applying the brakes? What if the Fed believes it is simply easing off the gas pedal because financial conditions are still accommodative? What if the Fed believes it is simply easing off the gas pedal because Fed Funds is below neutral? Doesn’t that suggest an over-hiking is on the table?

The Fed has set us on a path towards a demand side recession while speculating on the timeline of supply chain pressures easing. What an impossible task. Throw in a Russian invasion of Ukraine and a likely European recession and the odds of a misstep appear to be climbing.

And if political pressure was applied to Powell at year end to hike quickly because inflation was eroding approval ratings purchasing power of everyday Americans, what could that political pressure look like in 6 months with rising unemployment?

I believe the Fed will either change its tune or will hike us into a recession quickly. Both scenarios result in a lower-than-expected Fed Funds, either from a leveling off or a retracement. Each hike above 2.0% will be incrementally harder to pull off and to sustain.

Week Ahead

Light week regarding economic data. Retail Sales on Tuesday could provide a glimpse into spending habits, which leads to GDP.