Why Are Swaps Cheaper Than Treasurys?

In 2015, and again in 2020, I wrote about one of the most confusing anomalies in finance: negative swap

spreads.

Those notes became some of the most-read emails I’ve ever sent. Why? Because negative swap spreads

shouldn't exist. In a rational world, the US Government is risk-free, and banks are not. Therefore, a bank

attempting to swap a floating rate for a fixed rate should pay a premium over Treasurys. Even if the US

Government isn’t entirely risk free, it’s hard to argue the people with the printing press are riskier than the

banks they’ve bailed out. Banks should trade at a premium to the government.

But for the last decade, that explanation broke down.

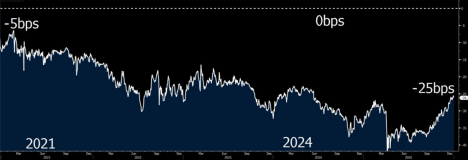

In 2025, 5-year swap spreads got as low as -45bps in April. As we kick off 2026, they are sitting around -

25bps.

Why does this matter to you?

If you are a borrower, this is money in your pocket. Because swap rates are trading inside (lower than) Treasury yields, a Bank Loan + Swap is currently beating traditional fixed-rate financings like CMBS or LifeCo, which typically price over Treasurys.

If you are pricing a deal right now, you are likely seeing all-in swap rates that are noticeably tighter than bond-equivalent yields.

This is especially true now that banks have gotten aggressive again following years of holding back on lending.

Why Is This Happening? (The 2026 Update)

The persistence of negative spreads comes down to three main pressure points:

1. The Supply Flood (Uncle Sam needs money) The US Treasury is issuing debt at a firehose pace. The CBO projects primary budget deficits of ~1.8% for the next decade, and more than 6% including interest. To buy all that debt, dealers (banks) need space on their balance sheets. When the system is flooded with Treasurys, dealers charge more to hold them, pushing Treasury yields up relative to swaps.

2. Regulation (The balance sheet penalty) This is the biggest driver. Post-2008 regulations (Basel III, etc.) made it expensive for banks to hold assets like Treasurys on their balance sheet.

The Nuance: We are seeing some relief. The eSLR (supplementary leverage ratio) rules are being tweaked to reduce the capital required to be held against Treasurys.

The Catch: While helpful, it’s not a silver bullet. Regulators are leaning toward a "capital neutral" approach. So, while holding Treasurys might get slightly cheaper for banks, other activities (like cross-border derivatives) might get more expensive due to updated GSIB scores.

3. Demand for Fixed Rates Borrowers want fixed rates. When you swap a floating rate loan to fixed, you are effectively selling a fixed-rate instrument. This massive selling pressure on the swap rate pushes it down, further widening the inversion between swaps and Treasurys.

What could cause spreads to get more negative? Or less negative?

Since we are sitting at -25bps, the natural question is: "Where do we go from here?" Here is the cheat sheet on what drives these spreads further into the negative or back toward zero.

What could make spreads MORE negative (wider inversion)?

Basically, anything that clogs up bank balance sheets or creates a glut of Treasurys.

- More Treasury Issuance (supply glut): If the government issues more debt than expected (and the CBO is already projecting massive deficits), dealers get choked with inventory. To hold that inventory, they demand higher yields on Treasurys relative to swaps.

- Disappointing Regulatory Relief: Markets are currently pricing in some relief from the Fed on capital rules (eSLR). If the final rules are "capital neutral"—meaning they give with one hand and take with the other—banks won't have the new capacity the market is hoping for.

- Aggressive Hedging (Borrower Demand): If every borrower rushes to fix rates at the same time using swaps, the massive demand to "receive fixed" pushes swap rates down further relative to Treasurys.

What makes spreads LESS negative (normalization)?

Basically, anything that frees up balance sheet space or reduces the pile of Treasurys.

- The End of QT (already happening): When the Fed stops rolling assets off its balance sheet, it stops adding to the supply of Treasurys the private market has to absorb. Less supply pressure = tighter spreads.

- Regulatory "wins": eSLR Changes: If regulators allow banks to hold Treasurys with less capital penalty.

- Quarterly Averaging: Moving GSIB calculations to an average rather than a single day snapshot would stop banks from "risk dieting" (dumping assets) at quarter-end, smoothing out the volatility.

- Fiscal Discipline (lol): If the US government suddenly decided to stop spending money and reduced debt issuance, the scarcity of Treasurys would drive their yields down and spreads would normalize.

Bank swaps vs Market convention swaps

I’ve been banging this drum for a while, so hopefully this isn’t news to you. But real estate bank swaps have different conventions than the typical generic swap rate you’ll see quoted on websites. We provide both on our website. Today, your bank swap is 7bps lower than a market standard swap.

Your bank loan swap

The difference today isn’t nearly as much as it was a few years ago, but it’s still 7bps on a 5 year swap. On a $50mm swap, that’s more than $160k in upfront swap profit the bank recognizes, which you are paying for.

Using our website still isn’t enough because we assume interest only, whereas most swaps you execute have amortization or draws, which further influence the rate.

“I would have called you but the lender wanted me to use their swap desk…”

If I had a nickel for every time I’ve heard a customer say this to us, I’d probably be a partial owner of the Eagles by now.

Unlike caps, we don’t auction off swaps. About 99% of swaps are done with the lender because the swap creates credit exposure. The lender can use the real estate that secures the loan to also secure the swap, whereas another swap provider will want cash as collateral. You won’t want to do that, so you will go right back to the lender for the swap.

That means nearly every swap we’ve ever worked on has been done with the lender. We negotiate the spread, the ISDA documents, and use the same live trading systems the banks use when you actually lock your swap. Plus, we have fun helping you figure out the most ideal structure given the particular project and objectives. When you have to use a certain provider, isn’t that when you need help the most?

If your lender is a regional bank, there’s a good chance they don’t have their own swap desk. They use one of our competitors as their advisor + a major bank like Wells, PNC, or US Bank to offer you the swap. That’s more hands in the cookie jar, and when you ask your lender what the swap spread is they might quote you their portion rather than the total cost to you.

Fully capturing all these market eccentricities is tricky, so the bank should be fine with you using a third party expert. They don’t balk when you hire an attorney, right?

If they push back like they did to one of our first clients ever, just ask them what he asked them. “If I’m the one paying them, what do you care?”

The Bottom Line

As long as bank loans are aggressively priced, swaps will provide an attractive alternative to traditional Treasury based financings. Negative swap spreads are likely to persist and differences in conventions means real estate bank swaps will always be lower than generic published rates.

The negative spread anomaly is essentially a balance sheet rental fee. The market is charging a premium to park US Treasurys on bank balance sheets. Spreads got less negative in late 2025 as the Fed slowed QT and the market began pricing in eSLR relief, but swaps are still 25bps inside of Treasurys.

If you’re looking at a deal and want to run the numbers on a swap vs. a Treasury-based execution, give us a shout.