Why Are We Using The Stars to Navigate?

With the college football season kicking off this week, I thought I would use this as an opportunity to explain the connection between Penn State and inflation. No, it’s not that they are both overrated.

Penn State’s perfect 1994-95 season coincided with my senior year in high school. Unlike the traditional Nittany Lion squads that specialized in defense (1987 Fiesta Bowl 14-10 anyone?), this team was an offensive powerhouse. They averaged 47 points and 500 yards per game before that was a thing. Three top 10 picks in the NFL draft from the offensive side of the ball (which might be more than every year since combined).

Week 2 was a 38-14 destruction of #14 USC. In back to back games in the middle of the season, we beat #5 Michigan at their house and then issued a 63-14 drubbing of #14 OSU at home. This moved us into the #1 spot in the polls…which we held for just one week.

This was before the internet, so voters literally based their rankings off of reading the scores in the newspaper on a Sunday morning. JoePa had a history of not running up the score. He didn’t believe in style points (contrasted with Jimmy Johnson who quickly realized optics mattered). You could slide in the rankings by giving up points in garbage time, resulting in a game that appeared closer than it really was if all you were doing was looking at a score in the sports section.

Which is exactly what happened the following week against Indiana. With a 35-14 lead on the road heading into the 4th quarter, the 2nd and 3rd stringers came in. Indiana scored two touchdowns late, including one in the final minute. There was never moment when the game was in doubt, but a 35-29 final score caused PSU to slide to #2 in the poll and led to a Rose Bowl matchup against the Oregon Ducks instead of an Orange Bowl showdown for the national title.

The contest was initially tighter than expected, with PSU up 14-7 at half before pulling away 38-20 for the W. I still consider PSU the national champs of the 1994-95 season. Out of frustration, I created an “Alternative AP Top 25”, which might be the only way PSU wins another title. Also, I am the only voter.

What does this have to do with anything?

“Using a box score to rank a team is like navigating by the stars under cloudy skies.”

That’s how Powell described the current challenges of monetary policy. I think it’s a great analogy, but I think it leaves out a key piece of information. Unlike 1995 sports writers, Powell has more modern tools at his disposal. Even though traditional monetary navigational tools might be the equivalent of the crumpled map in the glove box, Powell could be using more modern tools like GPS.

In what will likely go down as the longest segue in newsletter history, I’d like to think that 1995 season helped Penn State lure rising academic star Dr. Brent Ambrose to its business faculty the following year. Dr. Ambrose is relevant here for three reasons:

- I interviewed him for a newsletter once and quickly realized professors are much smarter than me and dissuaded me from ever wanting to pursue a grad degree

- I was only able to land an interview with him because he was my brother’s PhD advisor at Penn State

- In 2016, frustrated by the lack of attention being paid to the terrible lag in the shelter component of inflation, he created a new inflation index

While I would have called the index “GPS CPI”, he went with the “Penn State Alternative Inflation Index”. Seems as though I’m not the only one with an alternative Penn State index…

Since Jackson Hole was largely a non-event, and since college football finally kicks off this week, I thought we’d spend a little time talking about that paper and the resulting takeaways.

Punchline first – during economic expansion, inflation is understated.

But during economic slowdowns, inflation is overstated.

Guess which one we’re in now?

Last Week This Morning

- 10 Year Treasury at 4.24%

- German bund at 2.56%

- 2 Year Treasury at 5.08%

- SOFR at 5.30%

- Term SOFR at 5.33%

- Durable Goods came in at -5.2% vs. 4% expected

- Initial Jobless Claims came in at 230K vs. 240k expected

- The BLS revised lower the prior year’s job gains by more than 300k, or about 25k per month

- And the award for “Least Surprising Event of the Year” posthumously goes to Yevgeny Prigozhin

Penn State Alternative Inflation Index

First things first – this stuff is intense and above my paygrade. I haven’t spoken with Dr. Ambrose or his co-authors. If I was a legitimate source of news, this is where I would insert something like, “We reached out for comment but did not receive a response by the time of publication,” but I decided two hours ago to write about this. What do want from me? The newsletter’s free – you get what you pay for. But since I could be misinterpreting their work, blame me, not them.

There are two main pieces you care about:

1. The research paper itself: Housing Rents and Inflation Rates

2. The indices they created as a result of the research: Penn State/ACY CPI Index

The paper largely focuses on how badly the lag from housing impacts CPI/PCE readings. By now, we are all well aware of this - but they’ve been talking about it since 2016. In fact, they were talking about it at that time because they believed inflation was understated (cough cough Jon M. in Charlotte).

The puzzle is that “official” inflation rates did not respond to monetary policy as many policymakers expected despite its unprecedented scale. However, we show that inflation rates based on the alternative housing rent measure did exhibit the expected response to the change in monetary policy. In particular, the modified core PCE inflation rate exceeded the 2% threshold in 2011 and has been consistently higher since then.

“In addition, due to a very rapid and constant increase in housing rent since 2010, the modified inflation rates were significantly higher than the traditional rates. In fact, the NRI-core CPI indicates that annual inflation rates were constantly higher than 5%.”

But no one cared until the Fed had its first real inflation battle in 40 years.

“(V)ariations in housing rent measurement causes differences in both directions depending on the business cycle. Therefore, the major issues are underestimated volatility and significant lags in the official rent measure.”

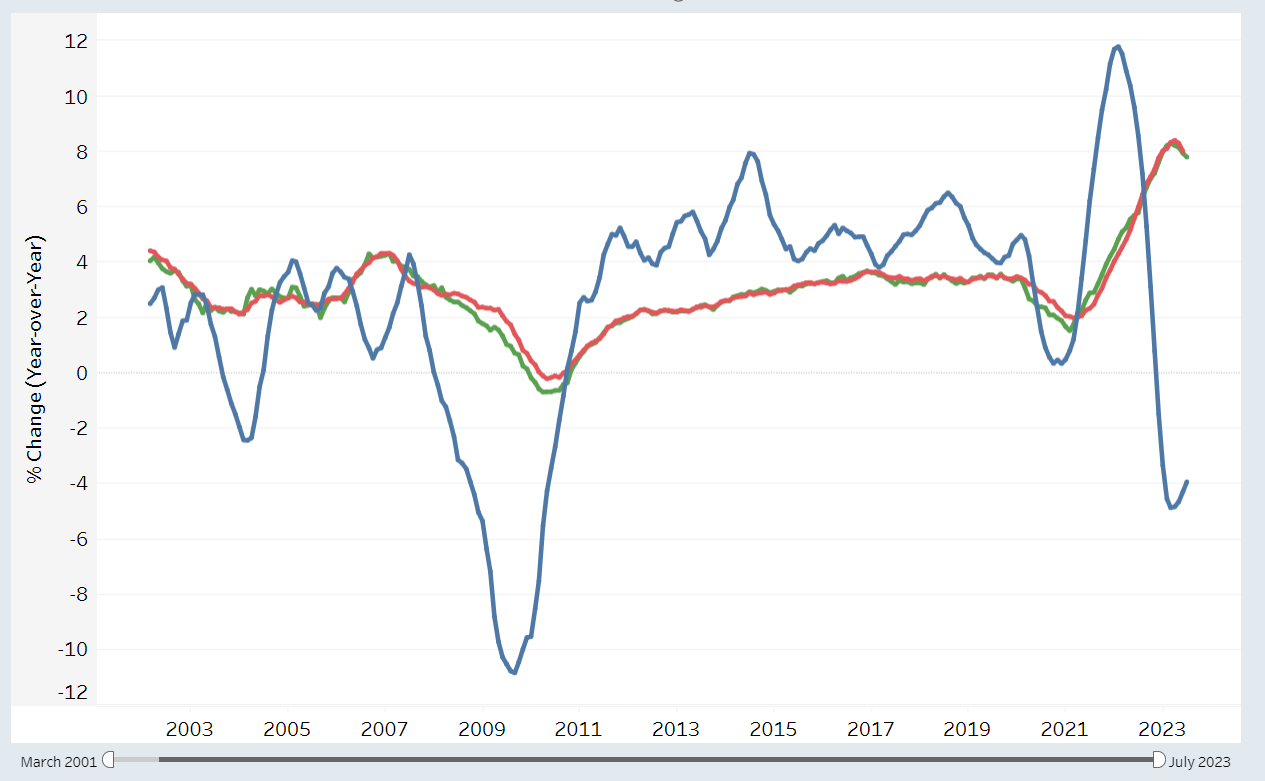

In general, during economic expansion, inflation is understated. And during economic slowdowns, inflation is overstated. This is the graph from the second link above.

- Blue line: PSU Marginal Rent Index

- Red line: traditional PCE Rent

- Green line: traditional CPI Rent

The blue line peaked in March 22 at almost 12%. Exactly one year later (March this year), it bottomed out at almost negative 5%. The PSU index leads the traditional measures by 7 months, so rent measures will drop significantly in the second half of the year. This isn’t a forecast – it’s just math. In fact, the alternative measures are already moving back up but we won’t see the traditional measures reflect that until mid-2024.

This addresses the lag effect, but how does that impact overall inflation? Fortunately, they also created an alternative CPI index to more accurately reflect true inflation. From the same site as the graph:

“The new release of the Penn State/ACY CPI Index shows that the US inflation rate for June 2023 declined to -1.137% from the revised May rate of -0.298%. This is the lowest since November of 2009’s revised rate of -1.502%.”

This alternative index concludes CPI is already experiencing deflation.

“But that’s headline CPI! What about Core PCE?! That is still 4.1%!” – guy everyone wishes hadn’t been invited to the party.

“The Penn State/ACY Core PCE Inflation Rate decreased from May to June, from 2.364% to 1.945%.”

This alternative index concludes Core PCE is already below 2%.

But wait, there’s more! The SF Fed (Mary Daly!) has a similar alternative Core PCE index and it’s at 2.15%.

As PSU’s Dr. Ambrose concludes, “(O)ur alternative measurement has an important implication for monetary policy.”

Spoken like a true academic. Fortunately, I am less shackled by academic etiquette, so I will rephrase.

Dear Jay$ - if GPS allows me to fly a plane in cloudy skies, why are we still using the stars to navigate monetary policy?

This is probably why I’ll never get the invite to Jackson Hole.

Labor Market

Once a year, the BLS revises its job numbers. On Wednesday, it revised the March to March job reports down by over 300k.

So…every single month this year we have revised the prior months’ job gains, and now we’re taking another 25k off of that each month? January’s job growth was 472k. The last two months have averaged 186k.

You sure the job market is as resilient as everyone says? If I’ve said it once I’ve said it a thousand times…

Friday brings the next “resilient” report.

Week Ahead

Core PCE and job data will dominate the headlines this week.

Prologue

Indiana the basketball school has somehow played a prominent role of spoiler in other PSU football memories. In the 2013 season, I’ve got tickets to the PSU whiteout game against Michigan on October 12th. We inexplicably lose at Indiana the week prior and I decide we are not wasting the weekend watching them get crushed by Michigan. My wife’s recollection involves me saying repeatedly, “I’m not rewarding that kind of behavior…”

Michigan at PSU goes four overtimes and ends with one of the best catches I’ve ever seen (Allen Robinson!) to the 1 yard. My wife just kept looking at me during the game and I would cut her off, “Don’t say it.” And then in the 2020 covid season, Indiana won the season opener in a horrible OT call. I mean, OSU I get, but Indiana?

Oh, and that ’95 Ducks game? Oregon’s defense was led by a scrappy safety, Chad Cota. He led the team in tackles and caused a fumble – a general thorn in the side of the PSU offense the entire game. He went on to be drafted by the Carolina Panthers in their inaugural season and made the first tackle in Panther history.

Our families became very good friends and our kids grew up together. One of his sons is trying out for the Detroit Lions at WR. The Panthers hosted the Lions Friday night, so we went to the game together and cheered him on. It’s a little surreal cheering for the kid of a guy you used to root against.

Oh, and the Lions WR coach in charge of our friends’ roster spot? Former Indiana star Antwaan Randle El (who, by all accounts, is the best coach he’s ever had an even better dude).

Don’t break my heart again Indiana!