Why Caps Are Suddenly So Expensive (Again)

In November of last year, many floating rate borrowers were shocked to see the cost of their interest rate caps rise dramatically in a matter of just a few days. To help shed some light on the drivers of the unexpected increase, we published a resource called Why Caps Are Suddenly So Expensive.

Well, cap costs have risen dramatically… again. So, in this article, we’ll recap those same three drivers that are attributing to higher cap costs.

- Rising Swap Rates

Rate expectations are the primary driver of a cap’s premium, which can be expressed through swap rates. Below is a graph of how the 2yr swap rate, which is simply what markets expect SOFR to average over that period, has behaved in recent months.

To provide an order of magnitude of the impact on cap costs, the quotes shown in green are the estimated premium for a generic $25mm 2.00% cap.

Now, here’s that same graph but on 3yr swap rates.

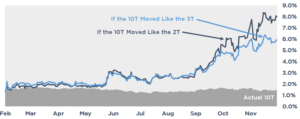

To put the recent rise in 2yr and 3yr rates into perspective, below is a graph of what the 10yr Treasury yield would look like if it moved proportionately the same amount as short-term rates over the past year. What would the market’s response have been if the 10T climbed to 8% in the past month?

- Term Premium

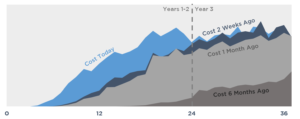

In general, caps become exponentially more expensive as term is added. As a trader looks further out, they become increasingly less certain of the path of rates and charge accordingly.

Below is a graph illustrating how a cap’s total premium is distributed across its term and how it’s changed recently. As expectations for rate hikes have been brought forward in time, the earlier years of the cap have become much more expensive, but the third year is still worth roughly as much as the first two.

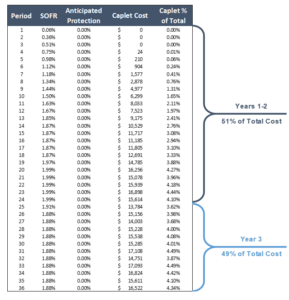

Here’s that same 3yr cap cost today broken down by it’s per-period cost, otherwise known as “caplets.”

- Volatility

Last but certainly not least, the wild swing in rates, hawkish Fed commentary, and geopolitical unrest in recent weeks has sent volatility exponentially higher. As volatility increases, traders’ cost to hedge climbs, which leads to increased premiums. Below is a graph of how volatility has risen in the past year.

Conclusion

Borrowers planning to purchase an interest rate cap have unfortunately been impacted by the beginning of a Fed tightening cycle and recent events driving heightened uncertainty in the market. As a part of our involvement in placing a cap, Pensford will help keep track of your cap cost and monitor market events that could lead to shifts in pricing.

For a quick estimate, download our cap pricer. For a more precise quote, feel free to reach out to the Pensford team at capteam@pensford.com or call (704) 887-9880.