Why Isn’t LIBOR at 0%?

Since I’m a silver lining kind of guy, here are some of the things that coronavirus has helped me really appreciate that I may not have otherwise realized.

- My kids’ ability to walk into any room and launch into a discussion without any regard for what might be going on and just assume I was sitting there waiting for them

- How great our dogs do of warding off terrorizing invaders like Amazon deliveries or strolling neighbors by barking like crazy

- My wife’s ability to shave a deep groove into the side of my head while cutting my hair

- How much clutter our living spaces can accommodate

- How effective our garbage disposal is at letting me know it’s working, particularly during conference calls

- How committed our kids are to getting those 12-14 hours of sleep they need to keep growing

- Eating frozen pizza twice a week never ever ever ever gets old

- How publicly traded companies like Ruth’s Chris successfully manage to snag an outsized portion of loans at the expense of other companies while the SBA program runs out of money

- The high-quality manufacturing of our neighbor’s leaf blow that allows him to run it uninterrupted for two consecutive hours at a time

- How much every company is sure that they understand what we are going through, they are here for us, their product can help us get through, and no payments for 3 to 6 months

Last Week This Morning

- 10 Year Treasury pushed lower to 0.64%

- German bund down 12bps to -0.47%

- Japan 10yr hovering around 0%

- 2 Year Treasury down a touch to 0.20%

- LIBOR continues to drop, down to 0.67%, with a couple of resets this year negative

- SOFR is .03%

- Earnings are getting slashed but stocks are up, thank you Fed

- Moody’s indicated it may cut ratings on 20% of all CLO’s they rate, more than $22B

- “The share of companies carrying B3 ratings is much higher than at the start of 2009, providing tinder to fuel future downgrades. These companies will find it difficult to refinance debt in deteriorating economic conditions and, once downgraded, could ultimately face a default if markets remain shut to lower-rated issuers.”

- Over 5mm Americans lost their job last week, totaling more than 22mm in the last four weeks

- China GDP had its worst quarter since 1992

- Retail Sales had worst month ever

- Empire State Manufacturing Index had its worst month ever

- Leading Economic Indicator Index had its worst month ever

- With all those rosy headlines, it’s probably a total coincidence that protests are starting to break out

Why Isn’t LIBOR at 0%?

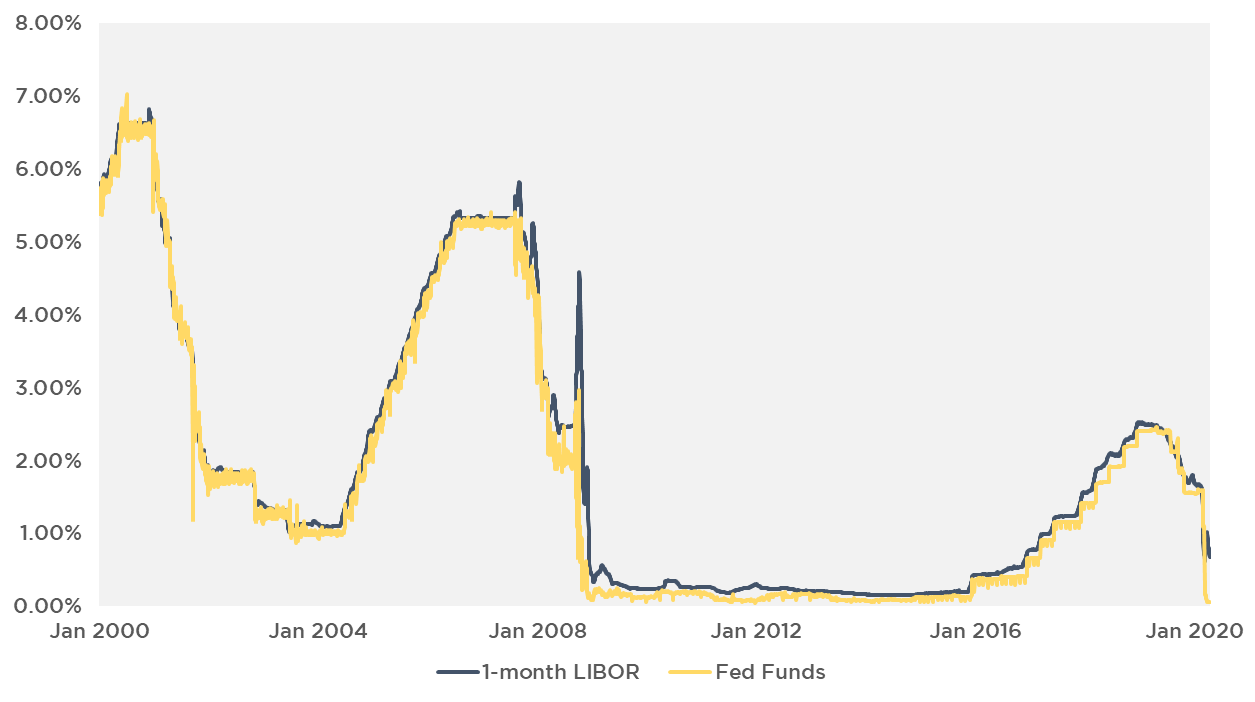

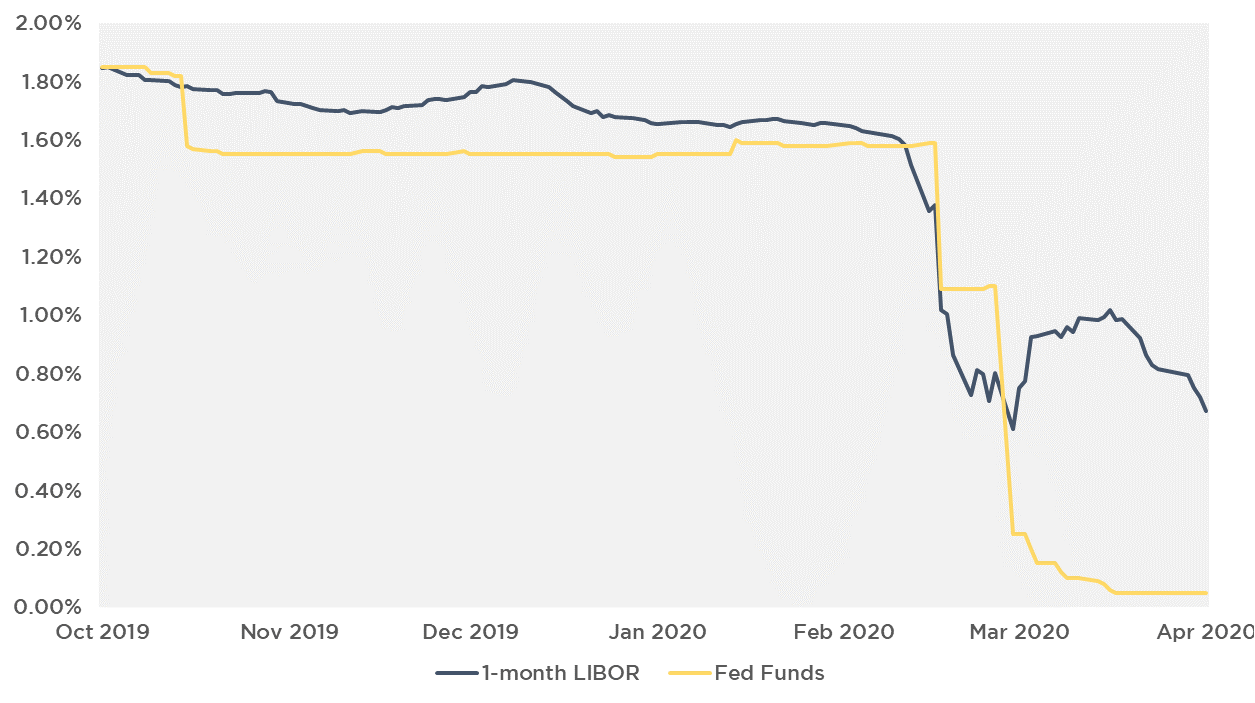

The Fed cut rates to 0% a month ago, but LIBOR hasn’t followed suit. Why? Remember, LIBOR represents an unsecured borrowing rate between banks. It typically resets about 0.15% over Fed Funds.

During periods of financial stress or when bank creditworthiness is in question, LIBOR tends to disconnect from Fed Funds. LIBOR has remained elevated since mid-March even though Fed Funds has been cut to 0%.

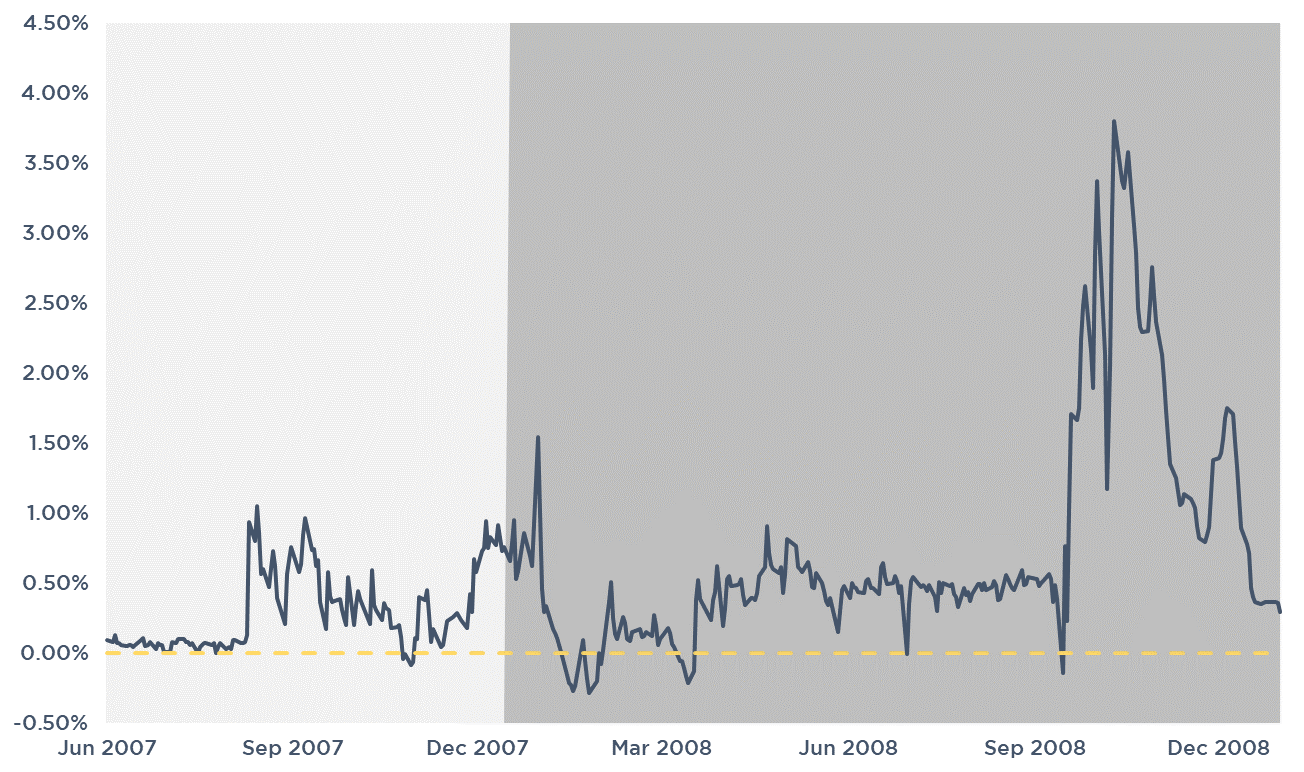

As banks were collapsing in late 2008, LIBOR disconnected from Fed Funds. At peak, it was 3.80% above Fed Funds. But even during that tumultuous time, the dislocation only lasted about three months.

As the Fed has aggressively intervened to provide liquidity, LIBOR has gradually fallen from 1.01% to 0.67%.

We expect LIBOR to continue to fall in the coming weeks and eventually settle around 0.15% – 0.20%.

10 Year Treasury

The Treasury prints them.

The Fed buys them.

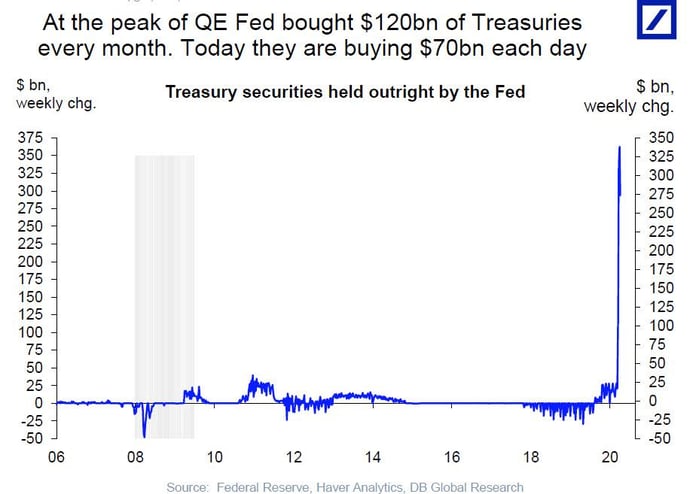

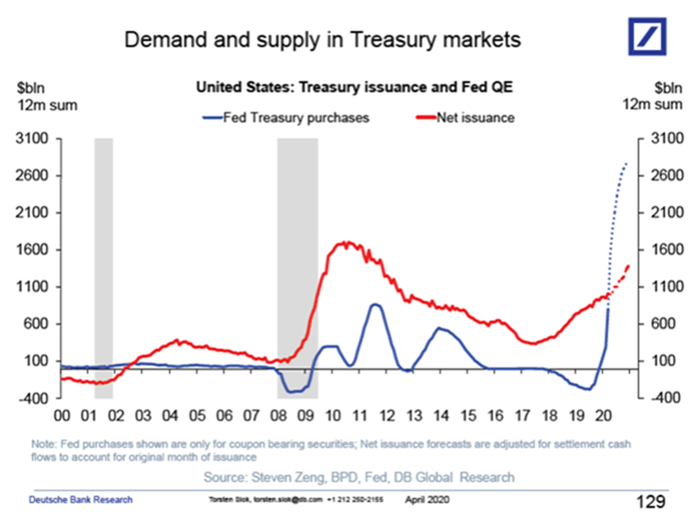

Here’s an interesting graph from DB illustrating the unprecedented Fed intervention.

Notice how the Federal Reserve is projected to soak up a vast majority of Treasury securities this year.

On day 1, the Fed was buying $75B in Treasurys every day. That has stepped down to $30B and this week is projected to be $15B. But that’s still $300B a month, more than double the net issuance. The Fed will likely buy about 75% of the Treasury issuance this year.

The Fed is also buying investment grade bonds. How long before they start buying junk bonds to prop up the CLO market?

How long before they start buying stocks?

If the Fed couldn’t extricate itself from its accommodative policies post-financial crisis, how will they extricate themselves from today’s measures?

To be clear, Fed intervention is necessary right now. I applaud Powell going all in. But there will be consequences at some point. But I guess we’ll cross that bridge when we get there.

Long Lasting Effects

Despite 22mm jobs lost in the last month, I don’t think the new economic reality has set in for most of us. The downturn has been so acute that we really haven’t experienced the economic fallout. Yet.

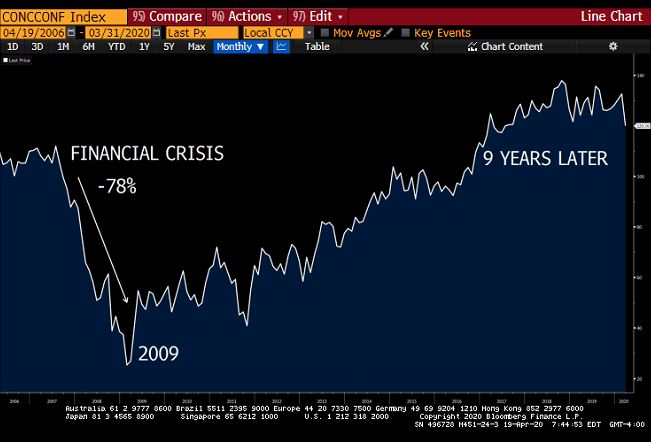

Consumer spending is 2/3rds of GDP. And spending is driven by confidence. How many of us would run out and spend a lot of money tomorrow if stay at home orders were lifted? It’s not the quarantine that is preventing us from spending money, it’s the uncertainty. Following the financial crisis, it took 9 years for consumer confidence to rebound to pre-crisis levels.

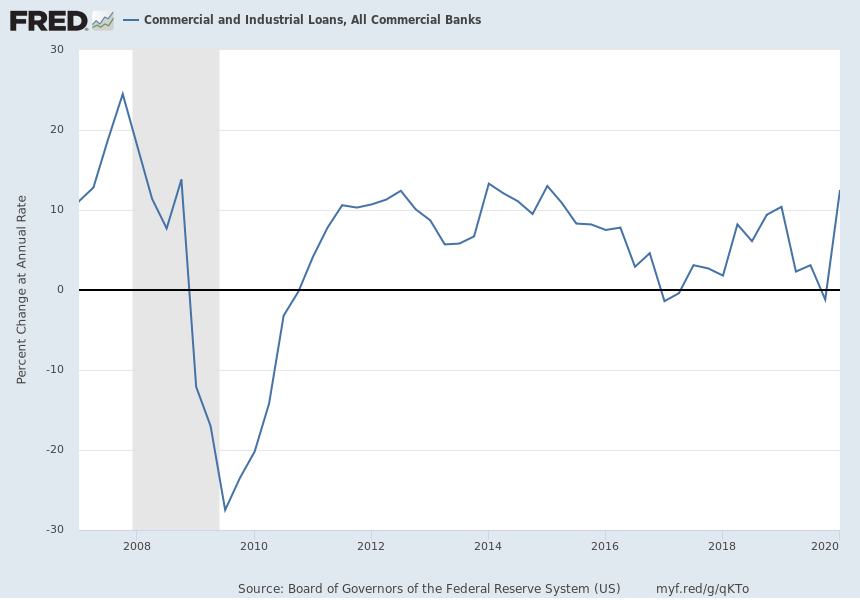

Here’s a look at loan volume during the financial crisis. While GDP contracted for one year, loan growth contracted for three years.

But that’s all loans. We’re in real estate, so it’s probably totally different. We’re special, right? Unfortunately, real estate balances didn’t exceed previous levels until November 2016.

Maybe we’ll have a vaccine in a few months. Or ample testing that allows us to resume at mostly normal. Or maybe football season starts and Americans decide we’ve just had enough and throw caution into the wind.

But we will probably be dealing with the economic consequences for several years before we really return to an economic normal.