Inflation Ghost Stories

Last Week This Morning

- 10 Year Treasury up 3bps to close out at 0.69%

- German bund down 6bps to -0.49%

- 2 Year Treasury basically unch at 0.14%

- LIBOR at 0.155%

- SOFR is 0.10%

- Retail sales missed forecast

- Empire State Manufacturing came in 4x greater than expectations

- Consumer sentiment came in higher than expectations

- In China, retail sales and industrial production are climbing

- The Bank of England is officially considering negative interest rates

- We are as busy as we have ever been and I have to wonder how much of that is driven by fear of tax changes in 2021

- Trump apparently gets one Supreme Court appointment per million votes he lost by

- The Philadelphia Eagles made me realize that I wasn’t missing sports as much as I thought I was

- There is a less than 0% chance that Mitch McConnell cares about being accused of hypocrisy (and neither would Schumer if the roles were reversed)

- Every time I wonder how Trump, of all people, secured the evangelical vote, I have to remind myself it’s all about the Supreme Court

- Speaking of hypocrisy, the Big 10 suddenly decided it is safe to play football. Of course, it is citing shocking improvements to testing in just the last month and in no way is influenced by the loss of revenue, threat of litigation, or transferring of players to other conferences. It’s all about free labor and billions in revenue student-athlete safety…

FOMC Rate Decision

The Fed now projects to be on hold though year end 2023. Specifically, it will not raise rates, “until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2.0% and is on track to moderately exceed 2.0% for some time.”

Pretty benign, but what are the key takeaways?

- Inflation andfull employment will be required before the Fed will consider a hike. Both conditions, not one or the other, must now be met.

- Inflation must actually reach 0% and be expected to sustain that level

- The fact that the Fed specifically cited 2.0% inflation while not citing a specific unemployment rate confirms the abandonment of the Phillips Curve for policy making decisions

- The lack of guidance on quantitative easing suggests they will tackle that at the December meeting

Atlanta Fed President Raphael Bostic also said that the trend will be important. He indicated a 2.3% inflation reading that was expected to remain at 2.3% wouldn’t prompt a hike, while an upward trajectory of 2.2% then 2.4% then 2.6% would be more likely to elicit a Fed response.

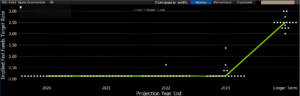

Here’s the updated Fed dot plot, with the individual FOMC member forecast of Fed Funds.

That line is perfectly flat through year end 2023. The market is even more pessimistic, not expecting a hike for five years. Our eldest high schooler will have graduated college before the next hike (hopefully).

The market has LIBOR at just 0.75% in 2030 when our twelve year old is graduating college (also hopefully).

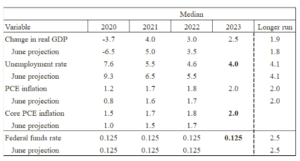

The Fed also raised its forecasts for 2020, while leaving the next few years unchanged for now.

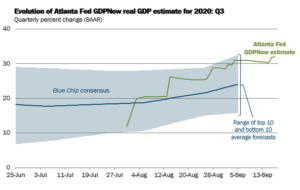

St. Louis Fed President James Bullard was on a panel Friday, saying “This is the biggest growth quarter of all time in the U.S. It looks like 30% at an annual rate. Crazy number, way off the charts compared to anything we’re used to in U.S. post-war macroeconomic history.” Not surprisingly, his projections are far more optimistic, forecasting UR of 6.5% by year end. And the Atlanta Fed’s GDPNow forecast is calling for Q3 GDP to come in at 32%.

Somewhat surprisingly, there were two dissents, albeit for different reasons.

Kashkari – Not Dovish Enough

I’m not sure how the Fed could have been any more dovish, but Minneapolis Fed President Neel Kashkari wanted a more open-ended commitment. He cited the inflation “ghost stories” of the last decade that prompted ill-timed rate hikes. Sounds to me like he might be angling for a Fed Chair nomination.

Kaplan – Too Dovish

Dallas Fed President Robert Kaplan thinks the Fed should keep its options open in case inflation comes back more quickly than expected. I usually align pretty closely with Kaplan, but I disagree with him here. I just can’t envision a scenario where we are concerned about inflation over the next three years, so give the market some runway and start talking about hikes in 24 months.

Inflation Ghost Stories

The statement, as well as all the comments by FOMC members in the subsequent days, centered around inflation rather than unemployment. It’s clear that a very low unemployment rate alone will not prompt a rate hike.

Is it any surprise? Inflation expectations have really struggled to reach 3.0% since the financial crisis. Here’s the University of Michigan’s 1 year inflation expectations index. This is derived from the question, “How much do you expect prices to rise or fall in the coming year?”

But if the Fed targets 2.0%, why am I highlighting 3% in that graph?

Because over the last 20 years, expectations always overestimate actual inflation. I don’t agree with Kashkari on his dissent, but I do think he has a point about inflation ghost stories (ignoring the fact that lumber is up 50% since April…).

Here’s the same graph of inflation expectations, but with actual inflation included.

In fact, actual inflation ends up lagging expectations by about 1.50%. How many of us are reading this right now thinking about how inflation just has to pick up this time? It’s my natural instinct, too. But does it?

If actual inflation tends to undershoot expectations by about 1.50%, that suggests the Fed may be on hold until expectations approach 4.0%. That’s just a back of the envelope guess, but it helps provide some context.

Recall from the first graph that inflation expectations are at just 1.7%…and all of us are thinking about inflation already. Imagine how much more pressing inflation will need to be for expectations to approach 4.0%.

The Bank of America rates team put out a paper that attempts to quantify how long it could take for inflation to hit specific targets under the Fed’s new approach. As a caveat, the starting point matters a lot. Remember, the Fed is now using an average inflation target, meaning the last decade of benign inflation skews the numbers quite a bit…but, if you use 2007 as the starting point and set inflation at 2.1%, it could take 42 years before the Fed’s new goal of 2.0% average inflation is reached.

Admittedly, that’s an extreme example. Let’s instead use 2018 as the starting point and assume inflation jumps to 2.1%. It would still take 1.8 years before inflation would average 2.0% and the Fed would even begin considering a rate hike. That’s why it feels like a near certainty that the Fed is on hold for at least three years.

Obviously, if inflation surprises to the upside, that accelerates the timeline meaningfully. But this thought exercise highlights how impactful this new FOMC strategy could be on floating rates.

There is some non-zero chance that a brand-new analyst out of college this year never experiences 3.00% floating rates in their career.

And maybe they’ll be telling ghost stories about inflation to their kids in 2030…

Week Ahead

Pretty light week for data, so expect most headlines to come from Fed speakers massaging the message.