Jobs Report Recap

Mercifully short newsletter this week as I try to squeeze this in between graduation activities. Three down, two to go – we’re over the hump!

I will say, it felt much more normal than I expected. The ceremony was held at the high school football stadium instead of a local college auditorium, which we loved. Shorter drive, easier parking, hopefully they keep this post-pandemic. The bleachers were full with no social distancing, while the graduates sat on the field in chairs six feet apart (don’t ask me why).

I felt totally comfortable during the ceremony. Although we were shoulder to shoulder with thousands of other family members, we were outside and everyone in my family has been vaccinated. The only time that felt a little weird was during the exit, when we were all pushed out a single gate. I didn’t feel unsafe, just weird.

I have worried that we would be forced to cling to precautions beyond their usefulness. For example, I still need a mask to fly even though I’m fully vaccinated. But for the most part, I have been surprised how quickly things are returning to normal. Stores and restaurants are no longer requiring masks and we seem to be settling in nicely. But what will etiquette be for handshakes? Hugs?

This gives me hope that our three college kids will actually be on campus and in-classroom this fall…and most importantly, out of the house!

Last Week This Morning

- 10 Year Treasury down to 1.55%

- German bund down a few bps to -0.21%

- 2 Year Treasury down 1bp to 0.14%

- LIBOR at 0.08%

- SOFR at 0.01%

- The economy added 599k jobs vs the forecasted 671k

- Unemployment down to 5.8%

- Average hourly earnings y/y (re: inflation) at 2.0%

- Biden and the GOP continue to haggle over the $1.7T infrastructure bill, with the latest development involving a removal of the corporate tax hike and a reduction in the total spend to “just” $1T

- Crude oil hit a two-year high

- Yanking Rahm out on day 4 feels like the illusion of safety to me

Jobs – Substantial Further Progress?

The economy added 559k jobs last month, well below the 1mm whisper outlier some expected. The unemployment rate dropped to 5.8%. Long-term unemployment (six months) dropped by 431k, suggesting some of those first impacted are finally landing jobs again.

The labor force participation rate is 1.7% below Feb 2020 levels, and we are still down 7.5 million jobs over that timeframe.

Restaurants and hospitality benefited the most, seeing a gain of 186k jobs. Nonetheless, we were turned away from a restaurant this weekend because of a shortage of servers.

I read several stories this week about how some of those currently unemployed are looking at their old jobs and saying, “No thanks.” Ummm, ok, agreed, but what are you going to do about it? Isn’t the beauty of our system that you change your situation? Don’t like your old job – go get a better one. Better yourself. Put in the work. But I guess when you are getting paid to sit at home, it’s a bit easier to sit at home and not go back. It’s no wonder we are experiencing wage pressure – private employers are competing with Uncle Sam.

Yesterday marked the 77th anniversary of D-Day. Last weekend was Memorial Day. I’m not sure this generation, comfortable sitting on the couch collecting enhanced unemployment, appreciates what real sacrifice looks like.

CIBC economist Katherine Judge wrote, “Our research suggests that generous unemployment benefit supplements have been the main factor holding employment gains back amidst record levels of job openings, but with many states moving to end the supplements in June, we expect millions of jobs to be added over the summer months.”

The Fed has indicated it will remain in an extremely accommodative stance until the labor market experiences “substantial further progress.” This report, while reasonably strong, is unlikely to meet that threshold.

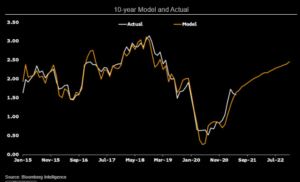

10 Year Treasury

While Friday’s labor report likely keeps a lid on yields in the near term, this might be a situation of delayed gratification. We expected the job gains to be hitting headlines already, but it’s taking longer than expected. If we start seeing a spike as enhanced unemployment expires or kids return to school, don’t be surprised to see upward pressure on Treasury yields.

The 10T is likely to be rangebound absent some catalyst, like an outlier inflation report or taper talk.

Low end 1.47%-ish

High end 1.77%-ish

Bloomberg’s rate model is still projecting a move to 2.50% over the next year, including 2.0% by year-end.

Week Ahead

Tons of inflation data this week, including CPI and UM Inflation Expectations.

And no more year-end participation trophy school activities!