Borrowers Could Float Lower, But You Don't Have To

With markets projecting the Fed to begin cutting rates in 2024, interest payments on floating debt are expected to fall by over 2% in the next couple years. However, if history tells us anything, it’s that markets tend to underestimate how far floating rates will fall once the Fed starts cutting.

Holders of floating rate notes could face material compression in interest revenue over the next few years, especially on investments with low (or no) index floors.

There are options that can be utilized to “lock-in” yields, but the time to hedge is before the Fed starts cutting.

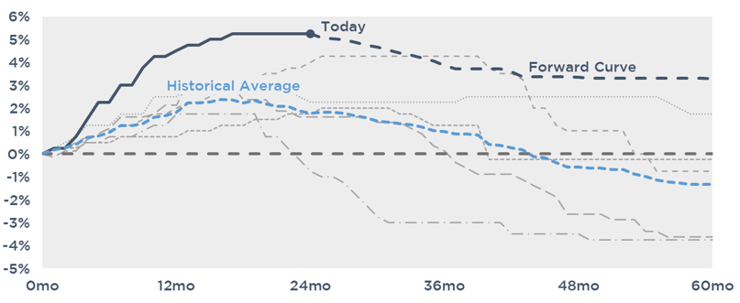

Rate Expectations

The following graph compares the path of floating rates this cycle compared to the previous five. With the exception of one case, the Fed cut rates dramatically an average of about nine months after they stopped hiking.

Further, notice how much more quickly rates have climbed compared to previous cycles.

Today’s forward curve suggests that floating rates will fall gradually but level off around 3.50%. But will the Fed actually be able to avoid slashing rates this time around, or will they wind up cutting more dramatically like prior cycles?

As it turns out, the forward curve usually suggests the Fed will gradually cut rates, but that’s historically not what tends to play out.

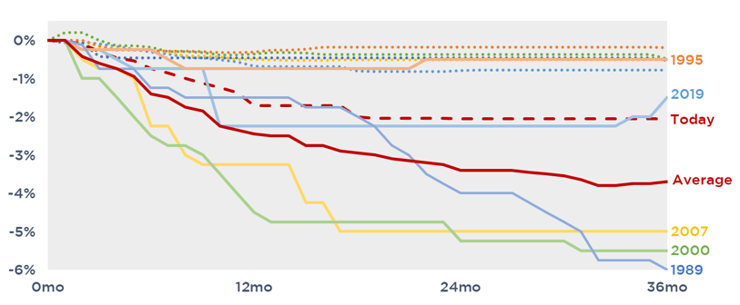

In the chart below, the dotted lines represent what markets were expecting floating rates to do just before the first rate cut in the past five Fed cycles. The solid lines are where the Fed actually took rates.

With the exception of the 1995 cycle, the market has underestimated the magnitude of rate cuts. If this tightening cycle behaves like any of the others, we could be in a materially lower rate environment over the next couple years.

Hedging Floating Rates with Floors

Lenders can “lock-in” their returns on floating debt by purchasing a derivative contract, specifically a floor, that pays them back in the event rates fall below a pre-determined strike.

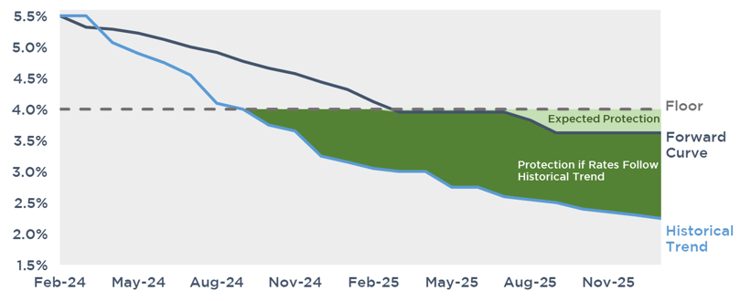

For example, if you want to hedge against SOFR falling below 4.00%, you would purchase a floor contract with a strike at that rate. The floor pays you the difference between SOFR and 4.00% for any period that SOFR resets below 4.00%. This works just like an interest rate cap, just in the opposite direction.

If SOFR resets at, say, 3.50%, your payout would be 4.00% strike – 3.50% SOFR = 0.50% payout. That 0.50% payout offsets decreased interest revenue under the floating rate note, ensuring a minimum return of 4.00%. Here’s a graphical representation of how that floor would behave if rates either (a) followed expectations or (b) fell in line with historical trend.

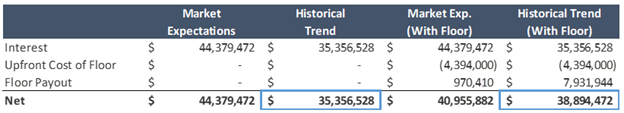

Now, here’s a comparison of those scenarios assuming $500mm floor is purchased. If rates follow a path inline with historical trend, the floor makes up for more than $3mm in lost interest revenue on a net basis.

Cost of Floors

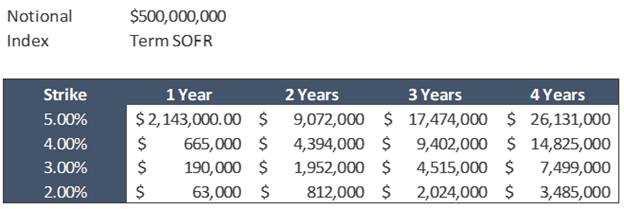

The cost of buying a floor will vary depending on the specific terms and the amount hedged, but for illustrative purposes, the below table outlines the cost to place a generic hedge on $500mm.

If the upfront cost is prohibitive, the combination of a floor purchased and floor sold (e.g. buy 4.00%, sell 2.00%) could be used to lower the upfront premium while still providing some protection. This strategy could also be used when the existing notes have imbedded floors that are well below current SOFR, but raising the floor from a fund level is desired.

Finally, if any sort of upfront premium is a deal killer, there are other options to consider such as swaps and short collars. For help determining if buying a floor makes sense for you or if you’d like to discuss alternative strategies, reach out to the experts at PensfordTeam@Pensford.com or (704) 887-9880.

If you need a quick estimate on the cost of a specific floor, check out our floor pricer.