Cap Provider Rating Requirements – Update

Intro

For lenders who require interest rate caps the topic of cap provider ratings has undoubtedly come up. Not much has changed over the past few years, but we thought it was a good time to revisit.

As you may recall from our resource, Rating Requirement Impact on Caps, requirements consist of Required Ratings and Downgrade Triggers.

Required Ratings

Dictate a minimum threshold a bank must meet to participate in a cap auction. Often called the initial ratings, these are typically set at A+/A1, A/A2, or A-/A3 (by S&P and Moody’s respectively).

Downgrade Triggers

Are the minimum level the cap provider can be rated before they cease to be an Acceptable Counterparty. The triggers are also set at A+/A1, A/A2, or A-/A3, but A-/A3 is the market standard.

Remedies to Downgrade

If a cap provider is downgraded below one or more of the triggers, then they typically have to replace themselves with another provider who meets the required ratings, obtain a guaranty from another provider, or post cash collateral.

While posting collateral is more favorable to the cap provider and borrower, many loan docs only allow for the provider to remedy through replacement.

How Do Ratings Impact the Cost?

The higher the Downgrade Triggers are set, the greater the probability a provider will be downgraded at some point in the future, requiring them to meet a remedy on their own dime. The banks charge a premium for this risk.

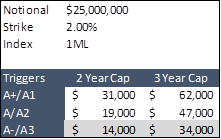

Setting the Downgrade Triggers above A-/A3 narrows the pool of potential cap providers, many times to just one or two banks, and increases the cost of the cap due to increased risk and less competition. Below we’ve outlined some generic cap pricing at a few different rating levels to give an order of magnitude.

A common misconception is that Required Ratings impact the cost, but they currently do not.

Fitch Ratings

Some of the common cap providers are not rated by Fitch and require “if rated” language in order to be eligible to participate.

While it’s possible to buy caps with Fitch ratings, doing so is uncommon and typically adds a premium to the cost.

Takeaway

If you’re a lender reentering the space or starting up a new program, we would urge you to keep the following points in mind:

- Market standard Downgrade Triggers are A- by S&P and A3 by Moody’s. This level achieves the most efficient pricing and broadens the pool of potential providers.

- Required Ratings don’t impact the cost so long as they’re no higher than A+/A1.

- A replacement only remedy to downgrade is the most stringent. In some cases, the inclusion of collateral posting can help improve the cost or get more banks interested in participating.

If you have any questions or would like to discuss the cap market, feel free to reach out. We’re here to help.