Floating Rates & How Capping Below the Floor Is Costing More

Despite the recent increase in cap costs, many of our clients are still exploring whether purchasing a cap in a lower strike range makes sense for their deal. After all, buying an in-the-money cap means spending less on volatility premium and is arguably a more efficient use of funds.

But as floating rates rise, lenders increase floors to keep pace. No problem! Buying a cap below the floor lowers the effective rate, right?... Right?

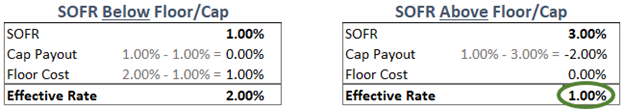

Unfortunately, the math doesn’t work out quite that simply. Let’s assume you’re closing on a loan with a 2.00% floor and are purchasing a cap with a 1.00% strike at closing. Take a look at the following scenarios.

When SOFR is below the cap strike, the hedge isn’t providing protection and won’t offset any of your interest expense. Meanwhile, the floor is pulling the rate up, increasing your effective interest.

On the flipside, when SOFR is above the cap and floor, the cap kicks in and begins paying out, thereby lowering your interest expense. In this scenario, the floor is out of play and is no longer driving the rate upward.

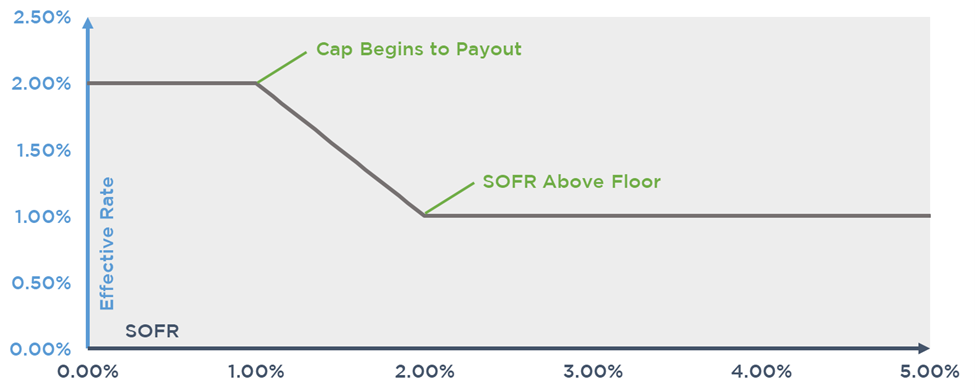

Notice how your effective rate becomes lower as SOFR rises when the cap strike is set below the floor. If rates drop back below the floor at some point, your effective rate could increase again.

Floors are frequently overlooked as rates climb and are treated as non-factor. However, in addition to minimizing your upside potential to float lower, rising floors could actually increase your effective interest rate if you’re exploring more aggressive hedging strategies.

Do you have an upcoming floating rate loan with a floor and aren’t sure how recent changes to loan terms and interest rates might impact your deal? Reach out to the experts at pensfordteam@pensford.com or (704) 887-9880 for advice on your next hedge.

If you’re comparing cap structures, check out our cap pricer for a quick estimate.