Cut Cap Escrows in Half

Agency borrowers are no stranger to interest rate cap escrows. Once a negligible line item, cap escrows have ballooned with rising rates, leading borrowers to seek options for relief. Here’s an idea, and it doesn’t even require servicer approval.

Borrowers who extend their interest rate caps early, or purchase extensions longer than the minimum term (e.g. 2 years in lieu of 1 year), can cut their monthly escrows in half. In many cases, this can even be accomplished using the existing escrow reserves, meaning minimal or no out of pocket cost.

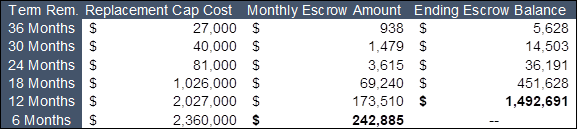

Let’s use a generic floating rate Freddie Mac financing as an example. For Freddie replacement caps, the following formula is used to calculate escrow requirements:

![]()

It’s important to note that for Freddie deals, the escrow requirement is only reassessed every 6 months.

Assuming the borrower purchased a three year $50mm interest rate cap with a 2.5% strike at the end of 2020, they currently have ~$1.49MM in reserves and an escrow requirement of ~$243k a month. Below we’ve outlined the assumptions used to get to those numbers.

The current cost to extend this borrower’s cap out a year from the current maturity is $1.22MM. The borrower has more than enough in escrow reserves today to cover the cost of a one year cap extension.

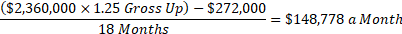

After the one year extension, the new monthly escrow would be calculated based on 18 months until maturity. In other words, the borrower’s escrow amount would drop significantly,

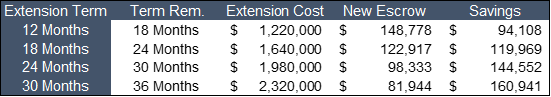

What would be the impact to the escrow if you bought a cap longer than one year? Glad you asked!

Let’s look at a few other options:

The inverted curve really helps here. Remember – caps are forward looking, so the cost today is driven by current market rate expectations (the forward curve), and time/volatility. In other words, the forward curve shows the market expecting rates to hit ~3.25% around late-2025, and that’s already reflected in the cost of your cap today. This is why the cost to buy a 30 month cap is only $1.1MM more than the cost of a 12 month extension.

If instead of only extending the cap by 12 months today the borrower extended 30 months, the new escrow would be $81,944/month, over $160k lower. This improves cashflow significantly and gets the borrower cap protection out to 2027.

One common misconception is that you have to extend the cap with the advisor who initially helped you, this isn’t true. Even if another advisor helped place the initial interest rate cap, Pensford is able to assist in evaluating and executing a replacement from the most aggressive bank in the market.

If you’d like us to run this analysis for you or one of your clients, let us know. Contact us at pensfordteam@pensford.com or (704) 887-9880, we’re happy to help.