Fixed Below Floating – No Brainer?

With the 10 Year Treasury at 2.37% and fixed rates across the curve below floating rates, we wanted to revisit whether we should be locking in right now.

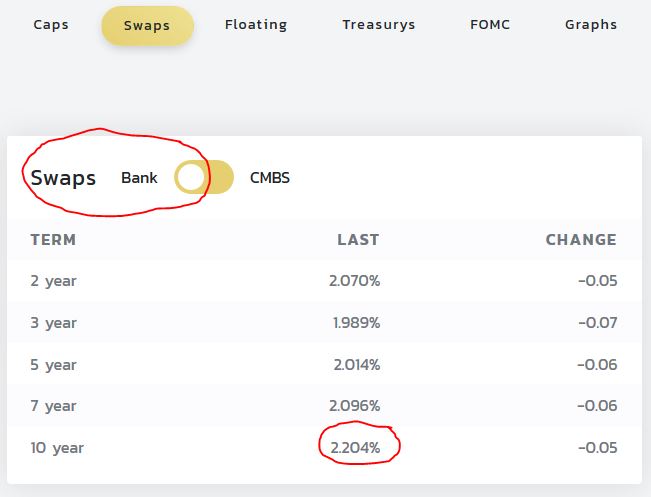

Interest Rate Swap vs Floating

1 Month LIBOR 2.43%

10 year bank swap 2.20%

No brainer to fix, right? Immediately lower your interest expense and lock in 10 years of protection.

Not so fast. Here’s our January newsletter on this very topic - If I Can Lock in Fixed Below My Floating Rate - Should I?

1. If you don’t have the time this morning to read it in full, here are the quick takeaways over the last 20+ years with the benefit of hindsight.

- Generally, the worst time to fix is when fixed rates are below floating rates because the Fed will end up cutting rates and you miss out on lower rates

- When you float and are wrong, you are wrong small

- When you fix and are wrong, you are wrong huge

This is not a recommendation against swapping/fixing right now. Unlike previous cycles, fixed rates are already very low. Locking in at 2.20% and missing out on LIBOR going to 0% won’t hurt as much as it did in 2007 when fixed rates were above 5%. Also, floors are more common, so there’s potentially less benefit from floating down with potential rate cuts. Most importantly, most projects work at today’s fixed rates and absolutely understand why some would lock in today.

Just don’t call it a “no brainer”.

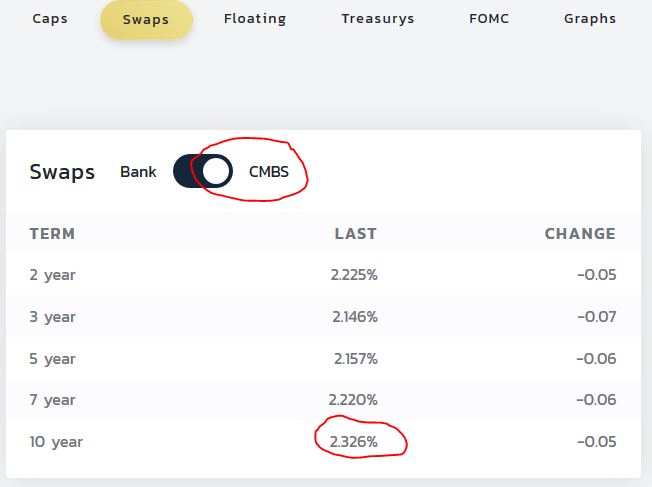

PS – if you think the 10 year swap rate is 2.32% right now and not 2.20% like I quoted above, it’s because you are probably looking at CMBS swap rates and not bank swap rates. Here’s our white paper on that topic https://www.pensford.com/resources/bank-swaps-vs-cmbs-swaps/

Just as importantly, our home page on pensford.com has a bank swap and a CMBS swap calculator.

Interest Rate Cap Pricing – Down Sharply

If you are concerned about locking in a fixed rate but still want to hedge given the rate drop, check out how far cap pricing has dropped recently. The following assumes a $50mm 3yr cap at 3%.

Today $ 51k

1 Week Ago $ 68k

6 Months Ago $406k

Click here to check current cap pricing for your specific structure https://www.pensford.com/resources/cap-pricer/

FOMC – Year End Probabilities

Odds of a 0.25% rate cut 78%

Odds of a 0.50% rate cut 39%

Other Things to Consider

- Negotiate those floors!

- Buying a cap now if you have a required cap in the future (extensions, agency, etc)

- Portfolio level cap that can be assigned to future cap purchases

- Hedging the third year of a loan if you only bought a two year cap initially

- Hedging a remaining portion of a loan you only hedged partially at close

Conclusion

If you think the market’s reaction is overdone (transitory, as it were) or that Trump may come to the rescue to avoid watching stocks swoon further, current levels could look attractive in the near future.

Please email or call with specific pricing or structuring questions.