Negative Defeasance - Use it or Lose it

Defeasance is unique in terms of prepayment types in that the penalty can be negative, meaning the cost of the security portfolio used as substitute collateral is below the outstanding principal balance. Today’s elevated short-term yields are leading to many negative penalties, or scenarios where borrowers can essentially prepay below par.

CMBS loans subject to defeasance are typically open for par prepayment 3 or 4 months prior to maturity, the “Open Period”. Once a loan hits the Open Period the defeasance requirement ends, at which point the borrower just pays the outstanding principal balance plus any accrued interest. In other words, there’s no defeasance penalty. Waiting until the loan is in the Open Period to prepay might mean losing out on the benefit of a negative defeasance penalty.

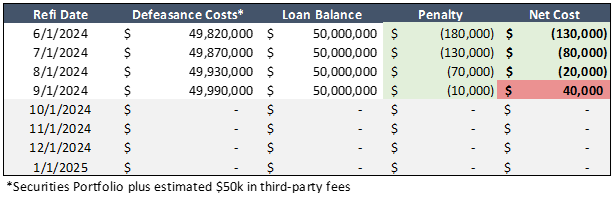

Below we’ve illustrated the “burn down” of a $50mm interest-only CMBS loan with a 3.75% rate and 1/1/25 maturity.

There are approximately 500 Agency fixed loans maturing over the next year we’d expect to have a negative penalty. A negative defeasance penalty increases to $0 as soon as the Open Period begins. Use it or lose it!

To get a detailed estimate of the costs associated with prepaying your CMBS loan, reach out to us at Defeasanceteam@pensford.com or (704) 887-9880.

Interested in looking at those 500 deals (and more)? Our sister company LoanBoss has spent years developing proprietary lead generation tools for borrowers and brokers, in addition to a vast suite of debt management tools to help CRE professionals optimize their day so they can spend time on what really matters. Learn more here.