Negative Swap Spreads

Textbook Definition of Swap Spreads

The classic textbook definition of swap spreads was the spread an AA-rated financing institution would pay above the US Government to borrow money.

Said another way, the swap rate suggests cost of funds for a highly rated bank. If the swap spread was 10bps, then we would expect that bank to price 10yr bonds at T10 + 10bps.

Intuitively, this makes sense. A bank’s cost of funds for long term fixed rates is a little above the US government, who should be viewed as the least risky counterparty. This also led to an easy-to-explain calculation:

Treasury Yield + Swap Spread = Swap Rate

But after the 2008 crisis, 30 year swap spreads turned negative. Is the US government really more risky than one of the AA-rated financial institutions it had to bail out?

There were a lot of explanations floating around, but since most borrowers didn’t really care about 30 year rates, this phenomenon failed to create much buzz.

10 year swap spreads turned negative briefly in early 2010, but it was short lived (and there weren’t that many 10 year financings). Then on September 23rd, 2015, 10 year swap spreads went negative again and borrowers started paying attention.

10 Year Swap Spreads

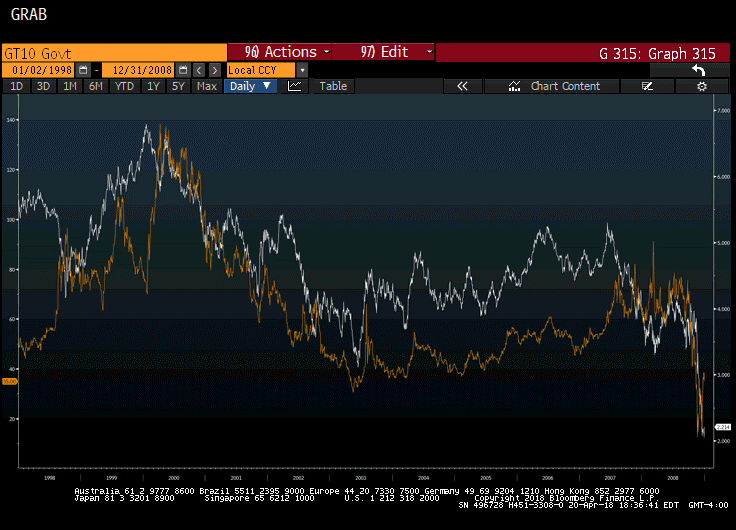

Between 1998 and 2008, 10 year swap spreads averaged 0.059%. The textbook definition of swap spreads held up right until the crisis. Once the US Government started bailing out banks and providing an implicit backstop, those borrowing spreads tightened substantially to reflect the perceived lower risk.

In other words, investors weren’t just buying bank bonds anymore. They were buying bank bonds with a US Guaranty.

Source: Bloomberg Finance, LP

Post-Crisis Definition

One trader noted, “The best way to think about swaps vs Treasurys is to almost think of them as two separate asset classes in this environment. There are much fewer dealers/risk takers looking to warehouse risk, and in the short term there are a number of factors that are negative for Treasurys specifically.”

In other words, the textbook definition was rendered irrelevant.

Common Explanations for Negative Swap Spreads

- The market views the government as a riskier counterparty than banks

- This doesn’t pass the sniff test. The government bailed out the banks, not the other way around. And if the government really is that risky, wouldn’t the banks also be in trouble? The US government is not riskless, but it is safer than the institutions it bailed out.

- Additionally, it was only the long end of the curve that was experiencing an inversion. The US government is safer than banks over the next two years but not the next ten years?

- Rapid Sell-Off in Treasurys

- This is a contributing factor, but not the sole cause. If this were true, swap spreads would have turned negative during the Taper Tantrum in 2013 when the 10 year Treasury spiked 1.20% in a few months. But they didn’t.

- And on a relative basis in late 2015, the front end jumped by more than the long end, and yet 2 year swap spreads didn’t turn negative.

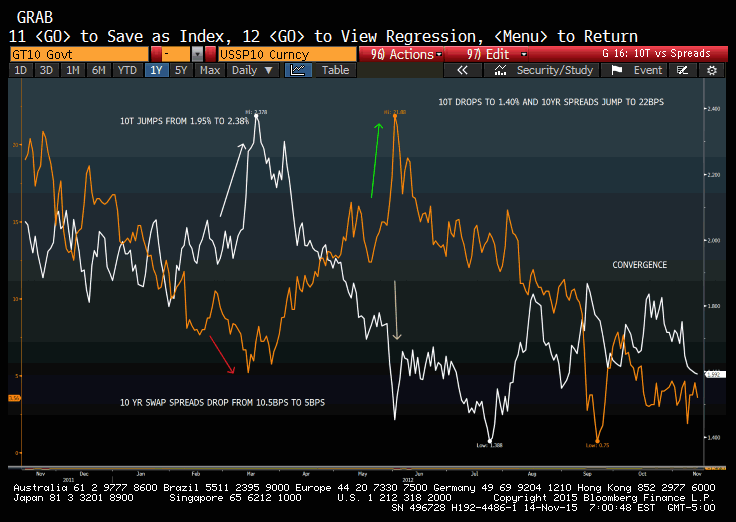

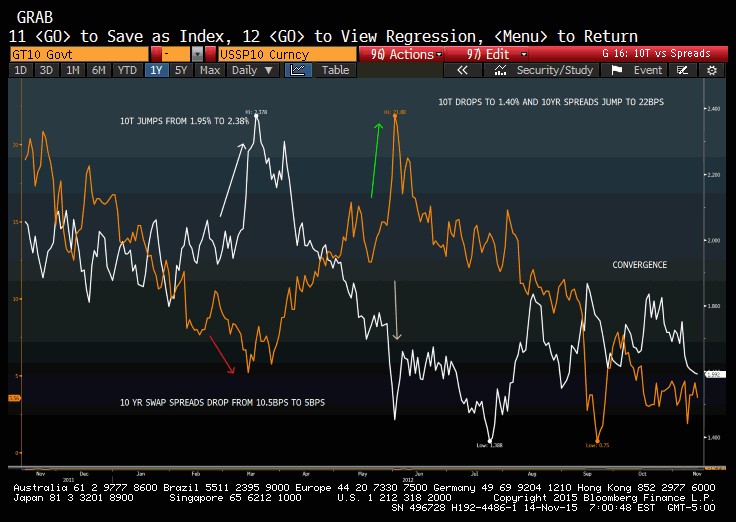

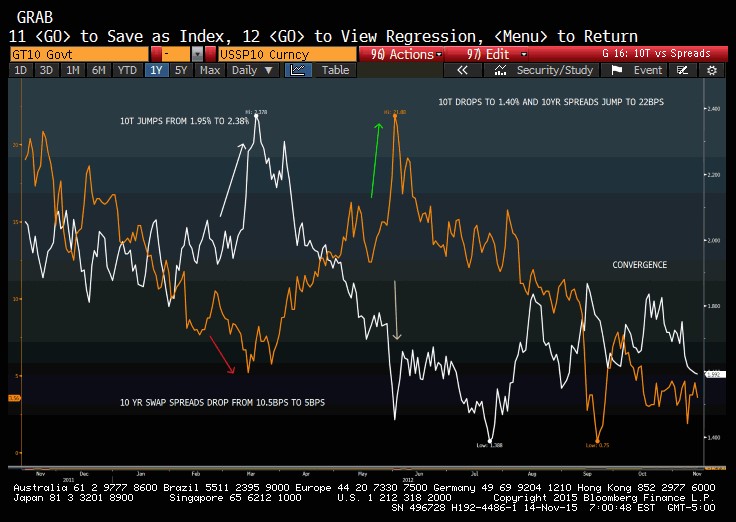

- In 2012, the inverse correlation between the T10 and spreads was apparent, at least initially. In March 2012, the T10 jumped more than 40bps and spreads tightened by 5bps. A few months later, the opposite happened while rates fell.

Source: Bloomberg Finance, LP

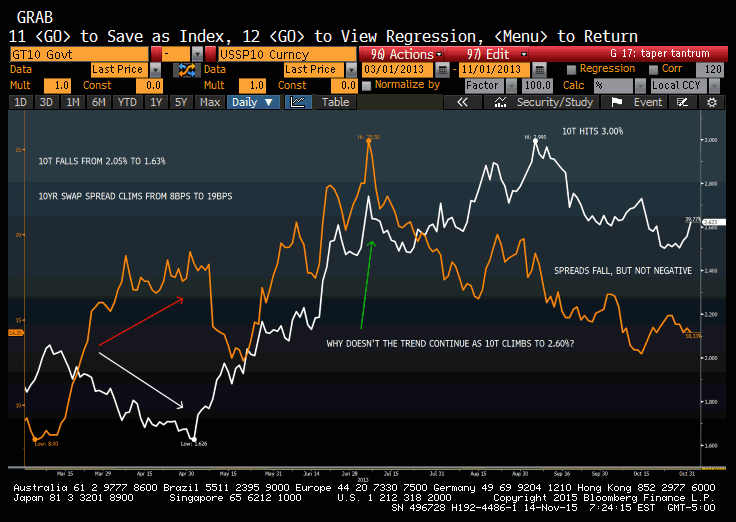

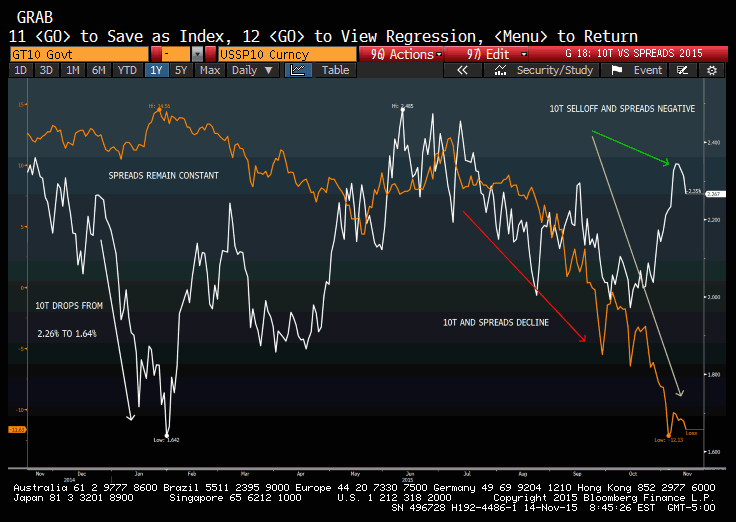

Now, let’s examine the same relationship during the Taper Tantrum in 2013.

The correlation appears to hold prior to the Taper Tantrum; however, as the T10 spiked more than 100bps in a month, swap spreads did not tighten. In fact, swap spreads actually widened much of the run up in rates.

Once the T10 broke through 2.60%, spreads began to fall again but never got close to turning negative. In fact, they never dropped below 14bps.

If the jump in 10 year Treasury yields of 30bps in September 2015 was to blame for negative swap spreads, why didn’t those same spreads turn negative when the T10 jumped more than 100bps in a month in 2013?

Source: Bloomberg Finance, LP

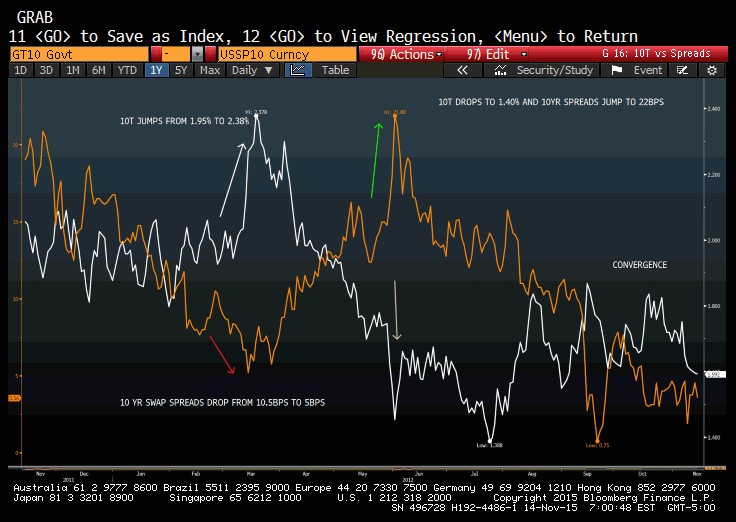

Now let’s examine the relationship in 2015. The inverse correlation appears at times, there is no discernable pattern. For example, in early 2015 the T10 fell to 1.64% but spreads remained constant instead of climbing.

Source: Bloomberg Finance, LP

Bottom line – there is a correlation at times, but not at all times. This leads us to believe rate movements, particularly dramatic ones, are a contributing factor to swap spread movements, but not the sole factor.

Explanations for Negative Swap Spreads

Perhaps the manifestation of negative swap spreads in late 2015 was a confluence of events rather than the result of a singular issue. The following explanations should be viewed as those collective forces, not taken individually.

1. Regulation

Basel III and Dodd-Frank have changed all the rules.

Basel III – the capital requirements are much more stringent. This reduces credit risk, which exerts downward pressure on swap spreads. Banks are less risky than they were a few years ago, so pricing reflects that.

Also, Treasurys and swaps heavily rely on the repo market to fund positions, but capital restraints have limited the use of repo, which in turn has impacted swap trading volume and pricing. Hedge funds and prop desks would typically come into the market to reverse an inversion by using the repo market to buy Treasurys and enter into a pay fixed swap. Without the repo market, that trade has faded.

Just as importantly, Basel III capital requirements are measured at quarter end. That forces banks to sell bonds to free up capital at the end of each quarter. We’re coming back to this one in a bit, so don’t forget about it.

Dodd-Frank – borrowers probably know DF as that cumbersome registration process prior to executing a trade, but that is just a small portion of the regulation. The meat and potatoes was to make swaps traded through an exchange. If you are reading this you probably haven’t done an exchange traded swap because you’ve qualified for an End User Exemption, but the Too Big to Fail Banks trade through an exchange. The exchange handles the collateral posting by all parties. If the other counterparty in your trade defaults, the exchange steps in and becomes your counterparty. This limits the contagion risk.

Since swaps are now exchange cleared, there is no longer a credit spread attached to swaps; prior to 2009, spreads were used as a proxy for credit weakness. That would exert widening.

2. Quarter End Selling

Basel III tests the capital reserves of financial institutions at the end of each quarter. This creates an interesting song and dance every three months.

Banks have bonds held as investments, but those tie up precious capital. So they sell these bonds (and other similar assets) to free up the cash before they get audited.

Here’s where things get interesting. You, Mr. Treasurer, were clipping a coupon at some rate, let’s say 4%. Now all of a sudden you are earning 0% to appease the regulators. What do you do?

You enter into a receive fixed swap, that’s what you do. Now you are receiving a fixed rate that replicates the coupon you were receiving right before you sold the bond. And since the payer side of the swap has the majority of the credit risk, your counterparty is the one that has to post the collateral, again keeping your capital free.

Sounds like a good plan, right? Here’s the rub – everyone wants to be on the same side of that trade.

That means the fixed payer (your counterparty) is the prettiest girl at the bar when a bunch of Army recruits get their first leave. She is in total control. And that means she gets to pay less, if anything.

A pay fixed swap provider gets to dictate the rate since everyone is a receiver at quarter end. That means they can pay less than the US government’s cost of funds, right? Spreads collapse. And maybe even go negative if enough other factors show up in the market.

3. Treasury Sell-Off

In this case, think of the spread as the two curves rather than a simple spread. Picture the Treasury curve and then picture the Swap curve a few bps above it.

In late 2015, central banks began selling US Treasurys, trying to get in front of the upcoming tightening cycle (the first hike came December 2015). China, in particular, began selling massive volume of Treasurys since it devalued its currency in August 2015. Higher rates are bad for bond prices, causing a loss. But unlike the banks mentioned above, central banks are owners, not hedgers.

When central banks sell, it puts upward pressure on the Treasury yield curve. If there is no corresponding movement on the swap curve, then the spread between the two has narrowed and the swap spread has tightened.

The other thing a sell-off does is suddenly make new bond issuance more attractive because of the higher rates. Maybe investor demand wasn’t there when you were pricing off a 2% T10, but all of a sudden there is more demand when you’ll be pricing off a 2.30% 10T. That leads us to the next point.

4. Corporate Issuance

Corporate bond issuance had smashed all records by late October in 2015. Treasurers, like China, were trying to get in front of the Fed.

When corporations issue fixed rate bonds, they frequently swap them back to floating. There aren’t any exact numbers, but traders generally estimate about 35%-50% of all issuance is swapped back to floating.

If you are paying fixed on a bond and want to swap to floating, you need to receive fixed. Just like you did in #2.

The more receivers there are in the market, the more downward pressure on swap spreads. In a year of record issuance, there were a lot of receivers in the market. That pushed spreads down.

Negative Swap Spreads Conclusion

The return to double digit positive spreads will likely be initiated by the reduction in banking regulations. If Dodd-Frank is materially repealed, this could create the type of environment that would result in the market pricing in greater risk into financial institutions.

Absent this, the other technical factors like corporate issuance will help keep a lid on swap spreads and prevent a dramatic run up to the levels seen pre-crisis.