Rate Lock Remorse

All the talk of falling rates on the horizon has borrowers optimistic about the cost of debt easing in 2024. However, the potential for falling rates presents a conundrum for some fixed rate borrowers with an upcoming closing:

- Rate lock now and eliminate the risk of loan spreads climbing

- Or wait to lock in hopes that Treasurys continue to fall

Well, what if we said that borrowers can do both and hedge against “rate lock remorse,” simultaneously taking loan spread risk off the table and benefiting if rates fall.

This can be accomplished with a swaption. If you’re already familiar with the way a swaption works, feel free to skip over the next section. If not, we’ll cover the high-level mechanics of a swaption below.

Swaption Mechanics

Simply put, a swaption is a call option on swap rates and can be used to hedge against rising or falling swap rates. Because swap rates are highly correlated with Treasurys of a matching tenor, they can also be used to hedge falling Treasurys.

For example, let’s say that you have a 7yr fixed loan closing in 6 months and you have the ability to lock the rate anytime between today and loan closing. You’re concerned about two things:

- By waiting until loan closing to rate lock, your loan spread could increase over the next 6 months

- By locking today, you could miss out on the 7yr-Treasury falling in those same 6 months

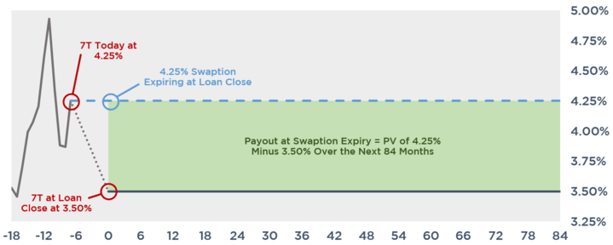

To negate both risks, you lock the rate today at 4.25% 7yr-Treasury plus the loan spread, then purchase a swaption at a 4.25% strike that expires at loan closing. If at loan closing/swaption expiry:

- The 7yr-Treasury is above 4.25%, the swaption expires worthless and you’re still locked in at 4.25% plus your loan spread

- The 7yr-Treasury is below 4.25%, the swaption is “in-the-money” and is exercised

- Your hedge provider pays you cash-upfront for 7 years’ worth of the present value difference between 4.25% and the then 7yr-Treasury yield

- You use that settlement to offset the missed future interest savings from locking the rate earlier

Say the 7yr-Treasury at closing is 3.50%. The bank would pay you the present value of 4.25% strike – 3.50% 7yr Rate = 0.75% * 84 months.

Here’s a graphical representation of that scenario.

Other Considerations

You don’t have to exercise at the swaption's expiry. If you were to see a dip in rates and wanted to “exercise” the swaption early, you could simply terminate the hedge for its then value and use the termination proceeds towards your future debt service.

This strategy also isn’t limited to scenarios where you can rate lock ahead of closing. If you’re rate locking coterminous with your loan close, but believe rates will move lower after the fact, you could still purchase the swaption to retain the ability to “re-lock” later on.

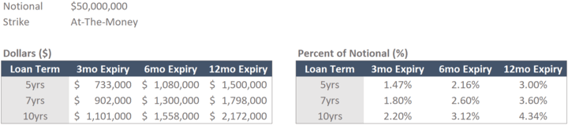

Pricing

To provide an order of magnitude on cost, below are quotes to hedge rate lock remorse on a $50mm financing at today’s rates over the next 3, 6, and 12 months. The premium would be due at the time of purchase and is a separate contract from the underlying loan.

You’ll notice that the swaption gets more expensive the further out the expiry. If the cost to hedge is prohibitive, you could shorten the expiry to help save on the upfront cost. You wouldn’t have the option to “re-lock” for as long, but you’d still benefit if rates fall between the time you purchase the swaption and the expiry you choose.

You could even further reduce the upfront cost by simultaneously buying your desired swaption and selling one back at a lower strike. This assembles what’s referred to as a swaption corridor. Selling back the lower strike limits your potential benefit to the delta between the two strikes, but offsets the upfront cost of the higher strike.

Conclusion

Borrowers who are concerned about missing out on falling fixed rates, but either have an upcoming loan closing or want to lock their spread today, can hedge against rate lock remorse with a swaption.

The swaption costs an upfront premium and pays out to the borrower in a lump sum if rates fall below the purchased strike. The borrower uses that lump sum payout to offset the missed interest savings from locking at a higher rate.

Swaptions can be structured in a variety of ways to balance protection and cost. For help determining if a swaption is right for your upcoming rate lock, or for a pricing estimate, reach out to the experts at pensfordteam@pensford.com or (704) 887-9880.