Rating Requirement Impact on Caps

Rating Requirements

Once a cap is paid for, the borrower has exposure to the Cap Provider. A cap is like any insurance product – only as good as the Provider. If the Cap Provider is unable to make a payment when the floating rate exceeds the strike, the contract loses its value.

On required caps, the Lender requires a Collateral Assignment to ensure any cap payments are made directly to them. That means the Lender is the one with the exposure to the Cap Provider.

Therefore, Lenders dictate the rating requirements for any Cap Provider. These requirements tend to be nuanced and risk appetite for the requirements vary from bank to bank.

Many banks refuse to bid on caps that have rating requirements and triggers. They simply do not view the risk worth the reward. For those that do accept ratings requirements, there are several aspects that go into pricing that risk.

These requirements should be negotiated between Borrower and Lender during the term sheet stage.

Downgrade Triggers

Most Cap Providers price the possibility that they will be downgraded over time, as much as once a year, even if they don’t believe they will actually be downgraded. The higher the downgrade trigger, the higher the risk, and the more Cap Provider charges upfront to offset that risk.

Required Ratings

If a Cap Provider has to replace themselves with a higher rated Cap Provider following a downgrade, the pool of banks that they can reach out to will be limited by the Required Ratings. The higher these ratings are set, the smaller the pool of banks that the Cap Provider can replace themselves with.

Fitch Rating Requirement

Fitch ratings can dramatically increase the price of the cap because it can potentially exclude one of the most aggressive cap provider: SMBC. While a recent upgrade by Fitch to A of the parent company, SMBC Inc, has begun bidding on a few Fitch-rated caps with low requirements. It is still uncommon for SMBC to bid on these, however, particularly on securitized transactions.

Considerations for Lenders

Lenders usually seek to find a balance between the cost/benefit of lower rating requirements and the increased risk associated with that savings.

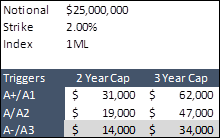

Here’s sample pricing across three common rating thresholds. Note the additional cost for A+/A1 ratings can be substantial

Conclusion

Lenders have various rating requirements that a potential Cap Provider must meet in order to bid on the cap.

The higher these rating requirements, the more expensive the cap will be.

- Odds of being downgraded below a certain level increase

- Pool of available cap providers that meet this higher threshold is smaller

Additionally, some Fitch rating requirements can dramatically increase the cost of the cap.

Rating requirements should be negotiated as a part of the term sheet.