Commodities Up, Rising Rates; Possible Recession?

Contracting GDP, yield curve inversion, equities tumbling, seemingly unending inflation, and the Fed all but promising to hike into restrictive territory. All signals have markets convinced that a recession is on the horizon.

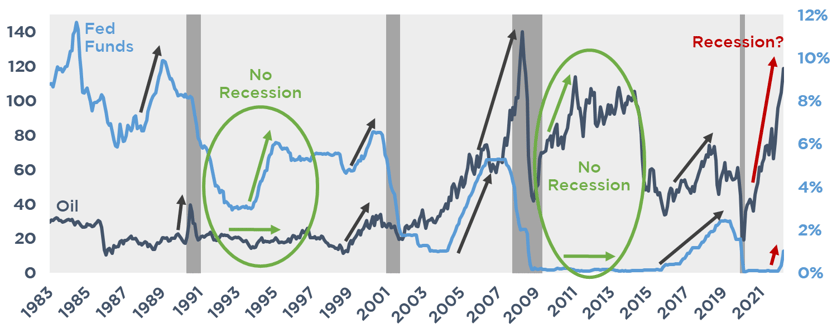

If those signs aren’t convincing enough, here’s another: the correlation between rising rates, climbing commodity prices, and recessions.

- When only rates or commodity prices rise, but not both, the US is able to avoid a recession

- When both rates and commodity prices rise, the US enters a recession

The graph below compares historical Fed Funds to oil prices over the past few decades. In the mid-1990’s, the Fed was hiking rates but oil prices remained flat, and the US avoided a recession. In the early-2010’s, oil prices were surging but the Fed held rates at zero, and the US avoided another recession.

In all periods leading into a recession, rates and oil prices both climbed.

If you’ve paid at the gas pump and have seen the name “Powell” in any news headline over the past few months, then you’re likely all too aware of where oil prices and rates are headed. With all signals pointing to a recession, is it even possible for the Fed to achieve a soft landing this tightening cycle?

For the latest on interest rates, check out our newsletter. For help on all things hedging and defeasance, reach out to the experts at pensfordteam@pensford.com or (704) 887-9880.