Synthetic Fixed Rate

Fixed Rate Borrowers Considering Floating Rate Loans

The unprecedented times have led many borrowers to begin considering new and unique structures.

Some traditionally floating rate borrowers are paying the floor rate (which behaves like a fixed rate), while some traditionally fixed rate borrowers are considering floating.

Despite historically high volatility, many borrowers are using caps to obtain a synthetic fixed rate.

At-the-Money Options

A swap rate is the market expectations for LIBOR over that tenor, which is also the at-the-money (ATM) strike for an option. If the 7 year swap rate is 1.00%, a 7 year cap with an ATM strike is also 1.00%.

ATM + 0.50% would be 1.50%, while ATM + 1.00% would be 2.00%, an so on.

Using ATM strikes helps us normalize for different rate environments so we can focus on the relative value.

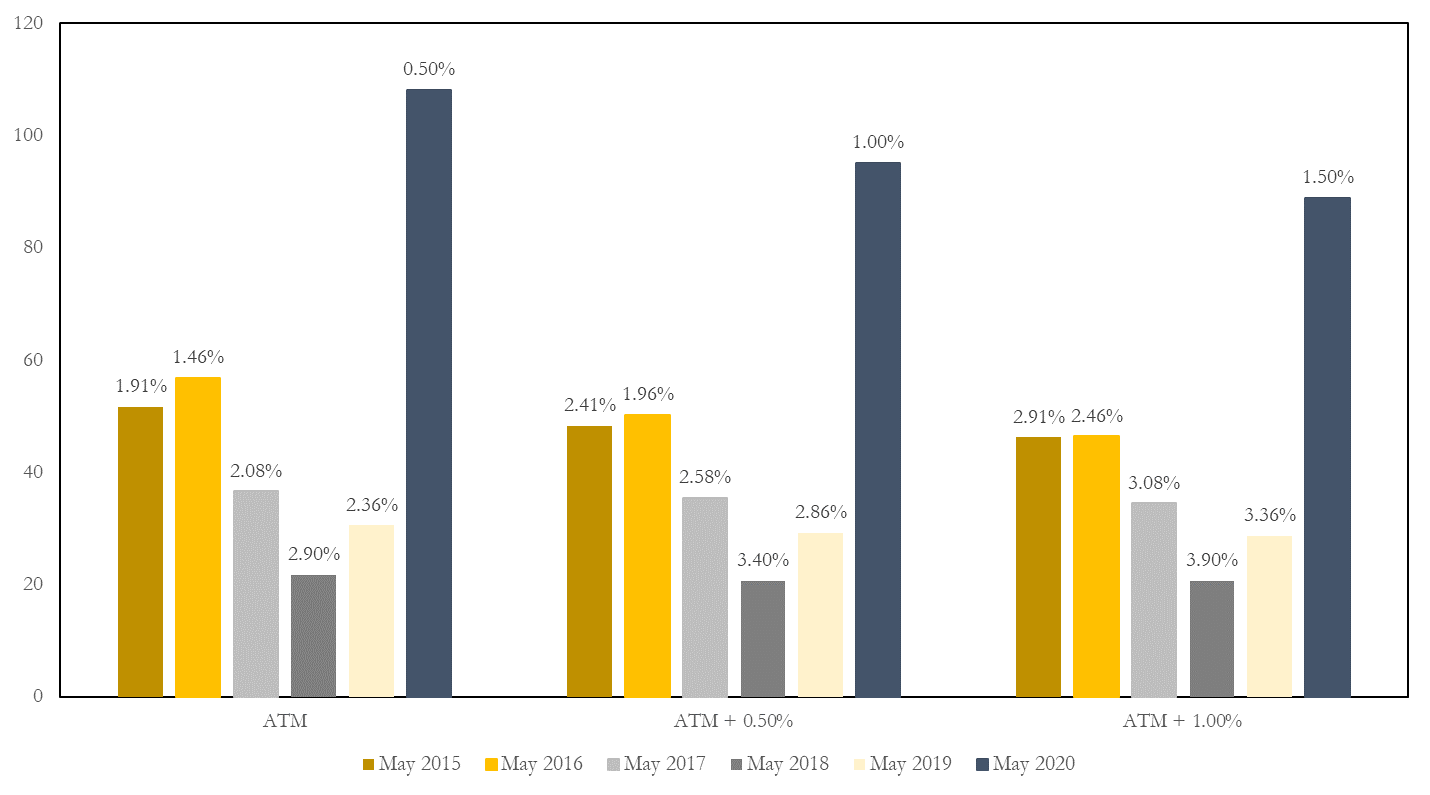

Volatility – Up Dramatically

Volatility is up dramatically relative to the last five years regardless of strike (ATM, ATM + 50bps, and ATM + 100bps). The graph below illustrates volatility in today’s market. We’ve also included the appropriate strike for each time period on top of the vertical bars.

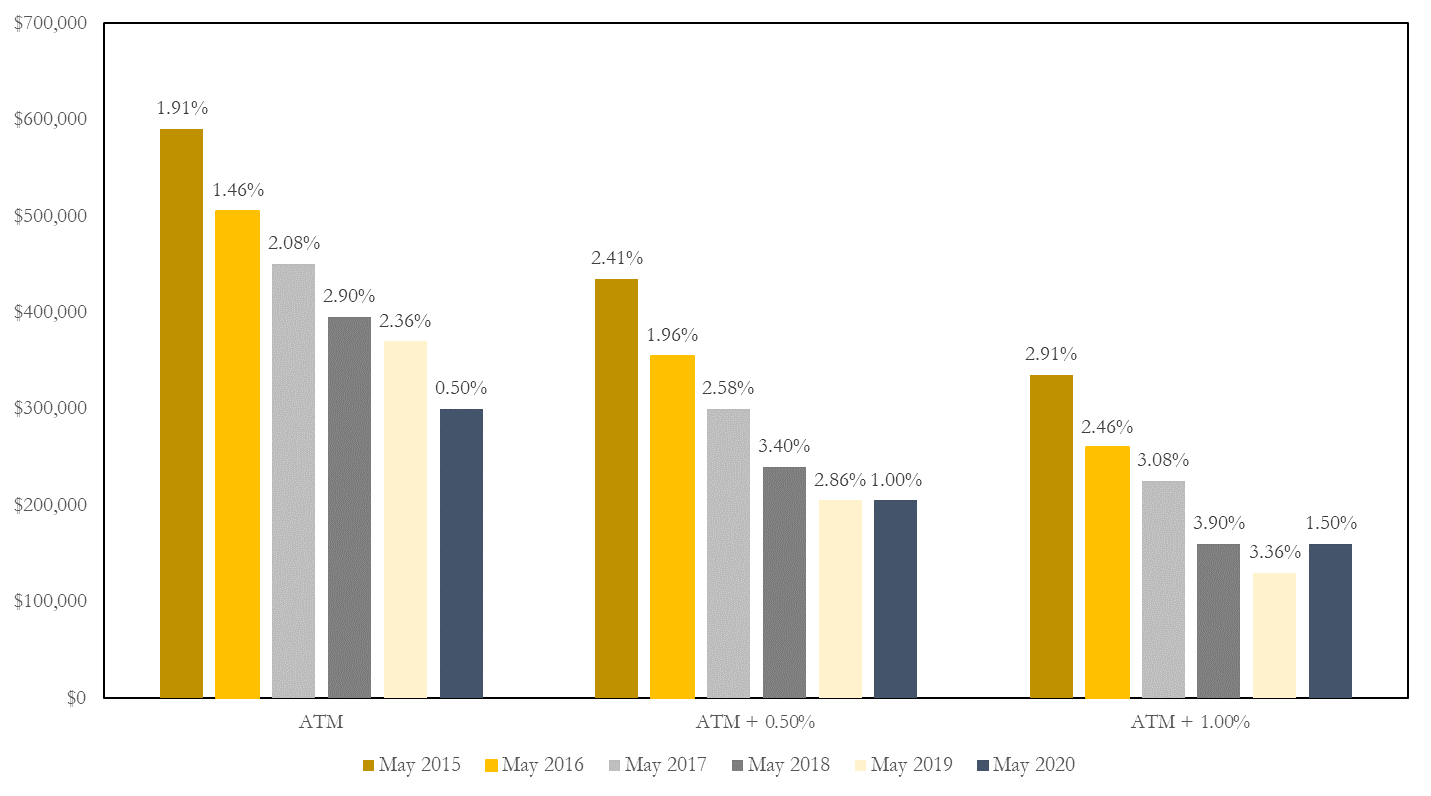

Cost – Down Dramatically

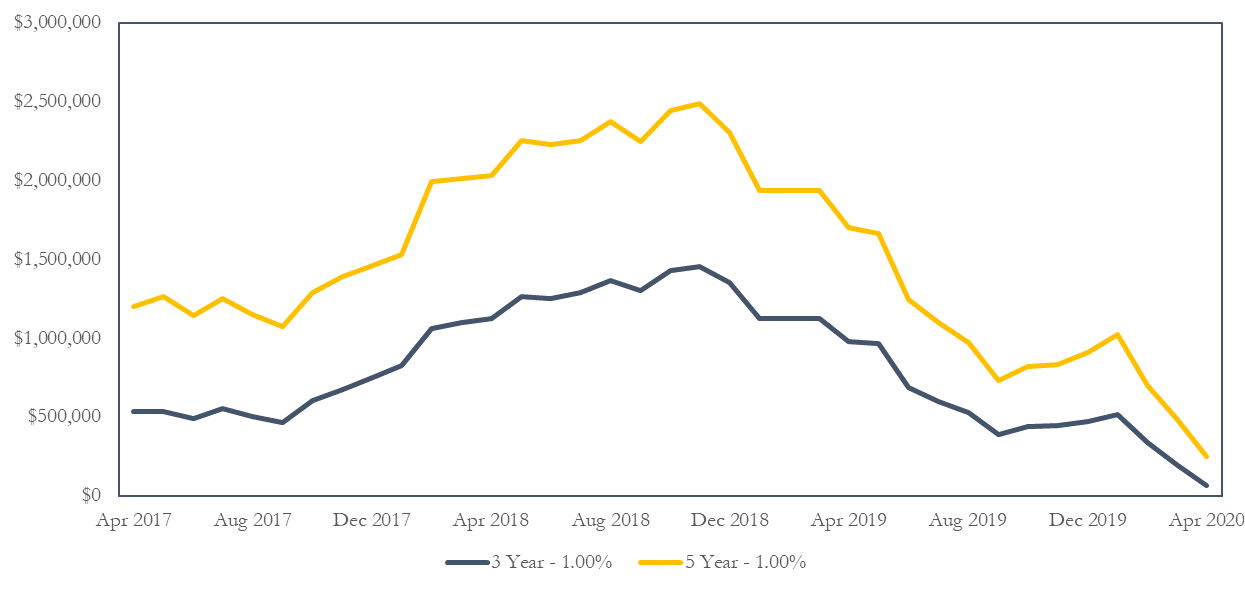

Despite volatility increasing, longer term cap costs are currently at one of their lowest points.

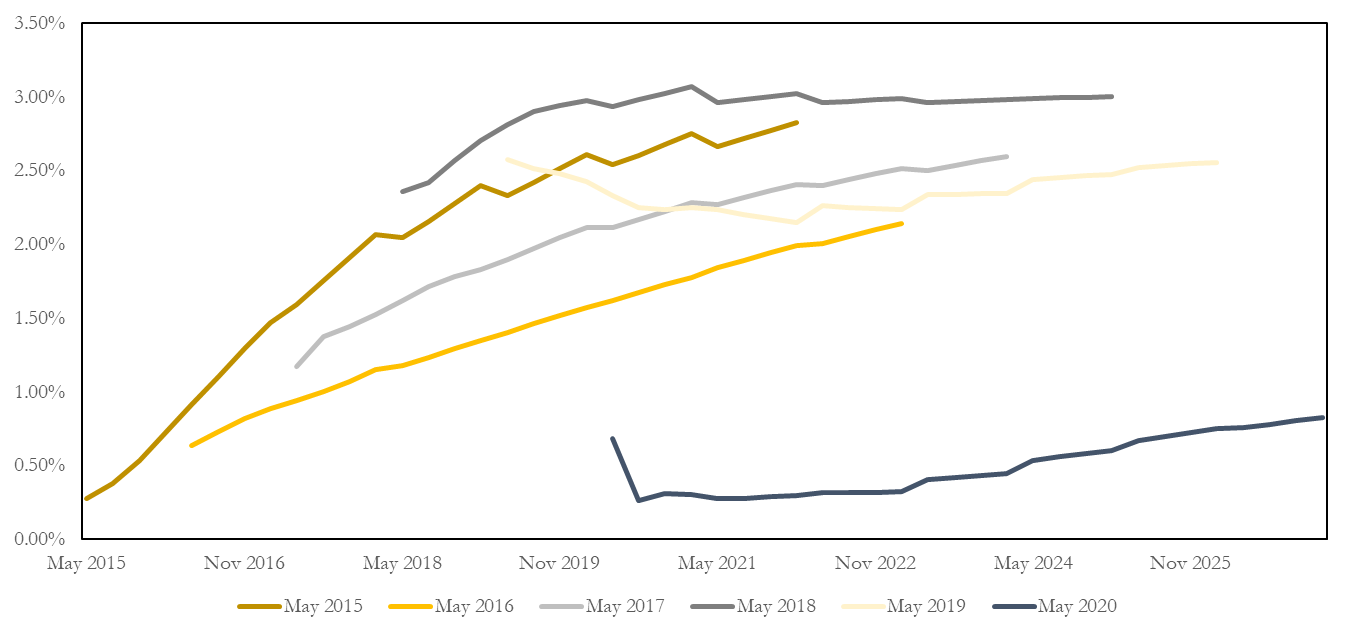

Historical Forward Curves

Cap pricing has decreased largely due to the shape of the forward curve relative to previous rate environments. Higher pricing coincided with steeper forward curves. Should the forward curve steepen again, cap prices are likely to rise with it.

Synthetic Fixed Rate – Loans with Floors

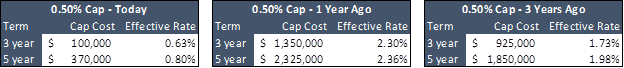

The synthetic fixed rate is pretty simple if you have a floor. Purchase a cap with the same strike as the floor, effectively resulting in a fixed rate. Interest rate caps are so inexpensive today this is more attractive than any other time in recent years. Below we’ve outlined a couple examples based on the following:

Notional $25mm

Index 1ML

1.00% Floor and Cap

If LIBOR is below the floor, you pay 1.00%. If LIBOR is above the floor, the cap pays out the difference between LIBOR and 1.00%. In other words, you’re synthetically fixed at 1.00% plus your loan spread.

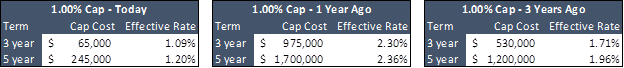

We calculate the effective rate by translating the cap premium into a bp/year cost and adding it to the strike.

E.g. ($245,000 / $25,000,000) / 5 = 0.20%

0.20% + 1.00% strike = 1.20%

By adding the effective rate to your loan spread, you get your “all-in” synthetically fixed interest rate.

Here’s a graph illustrating the changes in pricing on the 1.00% cap over the past three years.

Here’s the same example, but with a 0.50% floor:

0.50% Floor and Cap

0% Floor and Cap

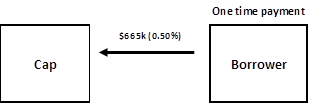

If you’re one of the lucky ones with no floor on your loan, or a 0% floor, you can still synthetically fix your rate. This would be accomplished by purchasing a cap with a 0.00% strike.

This strategy works especially well for borrowers who traditionally opt for fixed rate debt but elected to go with floating due to the current lending environment.

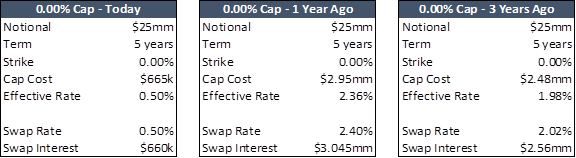

0% Cap

Notional $25mm

Term 5 years

Strike 0.00%

Cap Cost $665k

Swap Rate 0.50%

If you could enter into a swap for five years, the fixed rate would be about 0.50%. Over the next five years, the total interest paid would be $660k.

Instead, the you could buy an interest rate cap with a strike of 0.00%, for which you pay an upfront premium of $665k. This is simply prepaying interest.

Think of the upfront cap premium as the fixed rate. In this scenario, you make a one time payment of $665k and synthetically fix LIBOR at 0.50% for five years.

($665,000 / $25,000,000) / 5 = 0.50%

The most obvious challenge to the 0.00% cap is the upfront cost. However, given current conditions, this option is much more plausible.

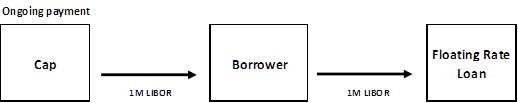

Cashflows

What happens with the payments made by the Cap Provider each month? It’s simple – they offset the floating rate payment owed to the lender. The cashflows would look like this:

The cap exactly matches the floating index on the loan creating a wash. Whether LIBOR goes to 10% or 0%, the cap payment offsets the index portion of the loan payment.

The borrower is therefore left with the fixed rate plus the loan spread and has synthetically locked in their rate.

Below we’ve outlined a couple historical scenarios when rates were much higher:

If this borrower entered into a five year swap a year ago, the fixed rate would’ve been 2.40% assuming 0.20% of profit to the bank. Over the next five years, the total interest paid would be $3.045mm.

If the borrower bought a cap with a 0.00% strike, they would’ve paid around $2.95mm. In other words, they would’ve synthetically fixed the rate at 2.36%.

Buy a Cap Below the Floor

If you are one of the floating rate borrowers with a higher floor from several years ago, you could buy a cap below the floor. Here’s an example which assumes you buy a 1.00% cap but have a 1.50% floor in the loan.

Scenario 1 – LIBOR below the floor

LIBOR is at 0.20%

Cap pays out 0.00%

1.50% – 0.00% = Still paying 1.50%

Scenario 2 – LIBOR is above the cap but below the floor

LIBOR goes to 1.25%

Cap pays out 0.25%

1.50% – 0.25% = Now paying 1.25%

Scenario 3 – LIBOR is above the floor

LIBOR goes to 4.00%

Cap pays out 3.00%

4.00% – 3.00% = Now paying 1.00%

Prepayment

Unlike a swap or fixed rate loan, caps will never have a prepayment penalty. If the loan is prepaid, or the borrower wishes to terminate, simply unwind the cap and the residual value will be returned by the Cap Provider. In other words, the prepaid interest is returned if paid off early.

Considerations

No matter the rate environment the concepts remain the same, but since rates are currently at all-time lows, the cost to execute the strategy is much lower.

Just a year ago, the exact same cap structures we laid out above were substantially more expensive. While the 0.50% and 1.00% caps are currently projected to provide little value, a minor shift in rate expectations could quickly change the outlook and make the synthetic fixed rates much more attractive.

The most obvious challenge to the 0.00% cap is the upfront cost. However, given current conditions, this option is much more plausible.