Time Value Impact on Cap Pricing

Interest Rate Cap Pricing

Cap pricing is driven by multiple factors, most notably:

– Term

– Strike

– Notional

– Market Volatility

– Rating requirements

The cost of a cap in today’s environment is driven more by time than by the strike. A four year cap costs substantially more than a three year cap, while a three year cap costs substantially more than a two year cap.

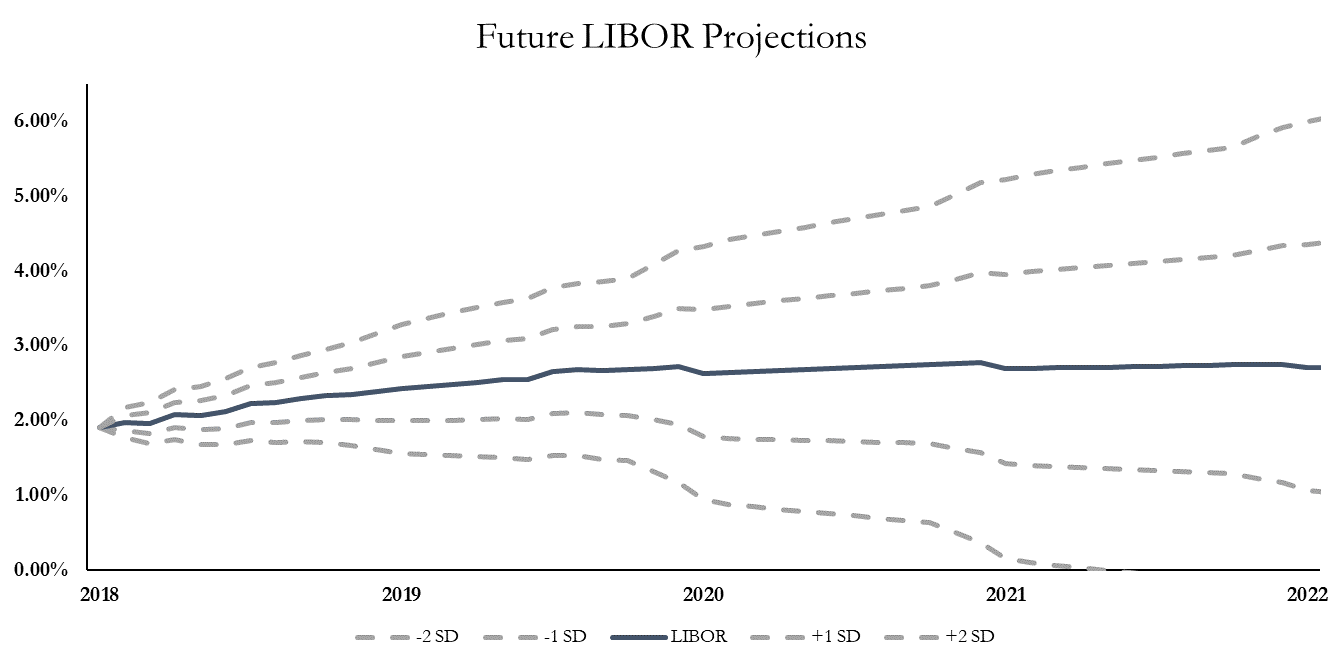

This is true even if the strike is above the peak LIBOR reset over the full term. In other words, even if the market never projects LIBOR exceeding the strike, it will charge substantially more for a longer term cap.

Simplistically, this is because of variance. The longer the term, the greater the variance of potential outcomes for LIBOR. Even if the market doesn’t expect LIBOR to exceed a certain level, it feels less confident in that projection in month 48 than in month 12.

Time Value on Cap Pricing

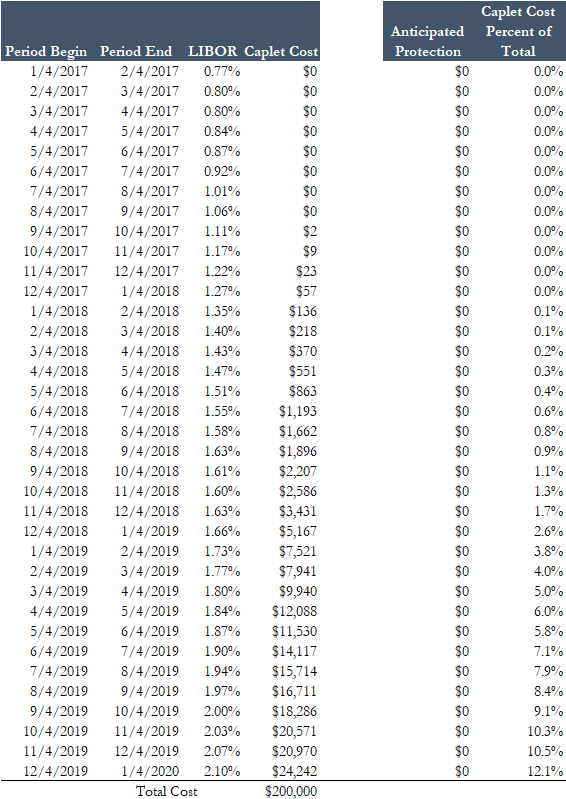

Here is a month by month breakdown of a $100mm 3 year cap at 3.50%. Note how the last 6 months comprise 58.2% of the cap cost..

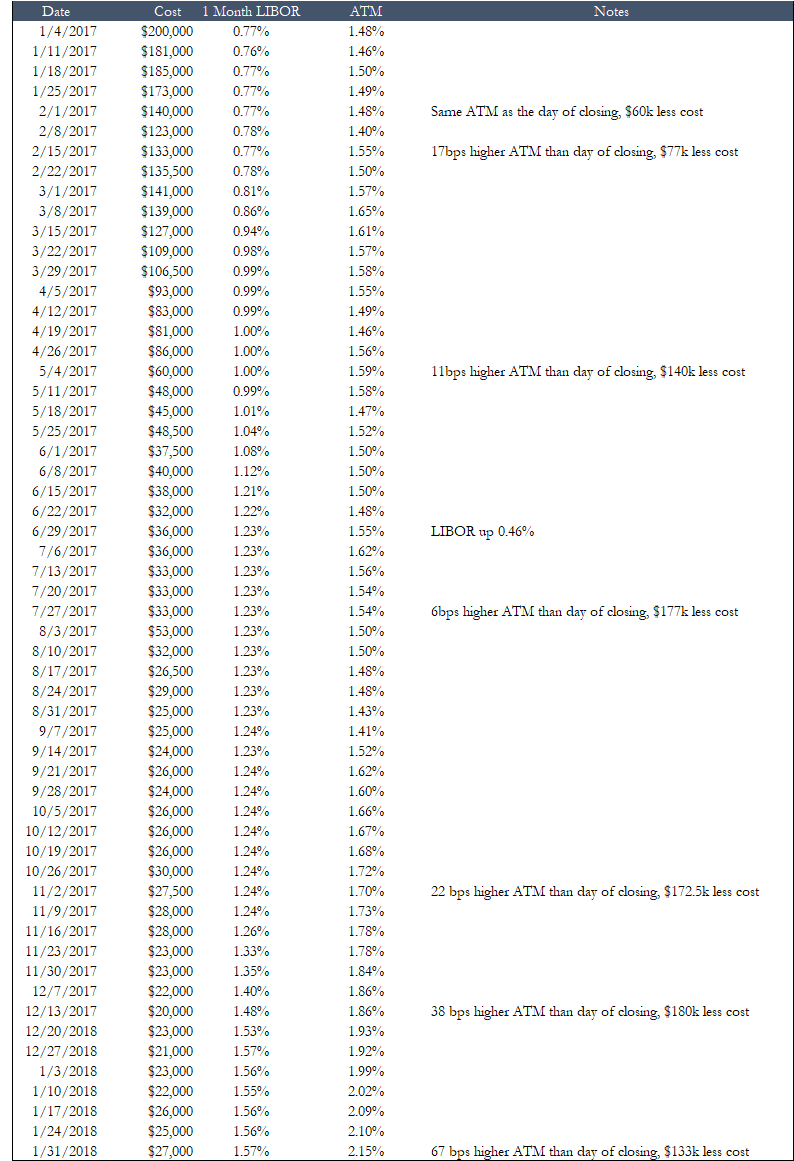

Case Study

This client was trying to decide whether or not to buy a cap at closing. Even though LIBOR and the At the Money (ATM) strike climbed substantially over the year since closing, the cost dropped by $133,000.

In other words, the savings from the time value eroding exceeded the increased cost from higher rates.

Conclusion

A large percentage of the cap cost is attributable to the tail months, even when the market doesn’t expect the cap to provide any protection.

Even as rates climb, the time value savings usually exceeds the higher rates. Generally, rates must climb much faster than expected in order to offset these savings.

Some borrowers elect to buy a shorter-term cap initially, then monitor the future cap cost monthly/quarterly.

- A cap buyer may buy a 24 month cap on a 36 month loan

- In six months, the borrower purchases a cap on the final 12 months

- Even if rates climb as expected, the borrower could buy the third year at a savings of $175,000