Transitioning Swaps to SOFR

Overview

If you’re a borrower with floating bank debt that’s swapped, you may be wondering what happens when you transition to SOFR. This is a pretty dense piece, so for those who prefer the executive summary, below we’ve outlined the two big takeaways:

- If the replacement index on the loan matches the index on the swap, and the spread adjustment on the loan and swap are the same, then your net fixed rate will remain the same.

- If your lender is planning to transition the loan to one index while the swap falls back to ISDA SOFR, the hedge will still remain highly effective, but it will fluctuate from month to month as a result of the mismatch.

Now getting more into the weeds, the transition is typically handled one of a few ways:

- Swap and loan both go to the ISDA Fallback SOFR.

- Swap goes to the ISDA Fallback SOFR. Loan goes to Term SOFR + spread adjustment.

- Swap and loan are both modified to Term SOFR + spread adjustment.

We’ll take a closer look at how these options work and what to pay attention to, but first, let’s set the stage with a quick refresher on some key terms.

- ISDA SOFR – more precisely known as “Fallback Rate (SOFR)”, this is compounded SOFR calculated in arrears + spread adjustment.

- Compounded SOFR in arrears is derived from the overnight SOFR resets over the calculation period, meaning that the actual rate won’t be known until a couple days before the payment is due. We have some more detail about that here.

- Term SOFR – the forward-looking index based on SOFR futures which attempts to project compounded SOFR in arrears for that month.

- This index feels and behaves most similar to LIBOR since it’s driven by futures markets and moves in anticipation of hikes/cuts.

- Spread adjustment – LIBOR is an unsecured lending rate whereas SOFR is derived from overnight lending secured by Treasurys, so there should naturally be a slight difference between the two.

- 0.11448% applies to 1 month LIBOR and 0.26161% applies to 3 month. These represent the 5 year median difference between LIBOR and SOFR as of 3/5/2021 when the adjustments were “locked in”.

Methods to Transition

Scenario 1 – Swap and loan both go to ISDA SOFR

This is arguably the easiest and most efficient method for the transition to occur. The lender relies on the ISDA replacement for LIBOR on the loan and swap so that the two match perfectly.

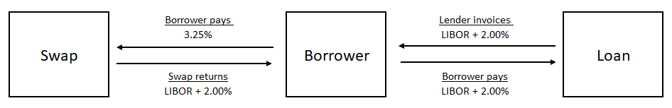

Assume you’re paying L + 2.00% on the loan and are fixed via swap at 3.25%. The cashflows initially looked like this:

Post fallback, you’re now paying SOFR + 2.11448% but are still fixed at 3.25%.

As seen above, the spread increased on the loan, but it also increased on the swap, creating a wash. You’re indifferent, the rate stays the same, and you didn’t even have to do anything!

If your swap was executed on or after 1/25/2021, the ISDA definitions by default will include language covering the automatic transition to ISDA SOFR. Once “USD LIBOR” is unavailable, the ISDA Definitions will point to “Fallback Rate (SOFR)” as the rate to be used on the swap. In other words, nothing was really modified, the bank is just following what’s set forth in the ISDA to determine the index to use.

Swaps executed before 1/25/2021 do not include this language by default and borrower will need to adhere to the 2020 IBOR Fallback Protocol or enter into a separate agreement with their swap provider for the new language to apply. We have more on this in our resource here.

With that said, if your loan didn’t have language tying the replacement loan index to whatever was used on the swap, or if your lender like many others is proactively modifying loans to Term SOFR or another index, then there are some additional considerations.

Scenario 2 – Swap goes to the ISDA Fallback SOFR. Loan goes to Term SOFR + spread adjustment.

While Term SOFR does a good job of attempting to estimate compounded SOFR in arrears, it rarely matches perfectly. Therefore, if your loan is on Term SOFR but the swap is on ISDA SOFR, there will be some noise in the rate, and it will fluctuate slightly from month to month.

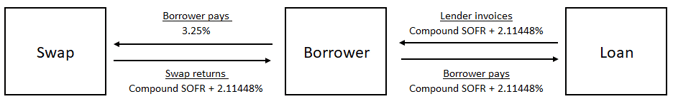

Below we’ve included a graph comparing ISDA SOFR to Term SOFR (both include the 0.11448% spread adjustment).

Here’s how to think about the graph above:

- When the blue line touches the green line, the loan and swap match up. Your fixed rate would still be 3.25% in this example.

- When the blue line is above the green line, your net fixed rate would be lower.

- In other words, ISDA SOFR would be higher than Term SOFR + spread for that period, so you would receive a higher payment from the swap than is needed to cover the loan payment, meaning a lower net rate for you.

- When the blue line is below the green line, your net fixed rate would be higher.

- In other words, the payment received from the swap would be slightly below what’s needed to meet the loan payment, meaning you’re stuck covering the difference and have a higher net rate for that period.

Borrowers who elect to rely on the ISDA Fallback for the swap and Term SOFR for the loan should understand their net fixed rate will fluctuate from month to month. Historically, the mismatch has resulted in an increase to the rate in most cases. However, as seen above, the mismatch has been less than ~15 bps in either direction since the beginning of 2022, so the hedge should still remain highly effective.

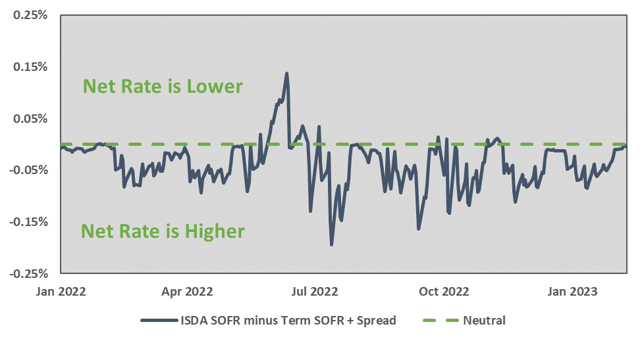

Scenario 3 – Swap and loan are both modified to Term SOFR + spread adjustment

This one can be a touch confusing. The loan and swap are both modified to Term SOFR + a spread adjustment, but the spread adjustment won’t be 0.11448%. It can range anywhere from 0.03%-0.08% depending on a variety of factors including the bank, swap terms, market conditions, etc.

When you modify the swap, the trader is actually terminating the existing LIBOR trade and entering into a new swap based on Term SOFR with the same underlying terms. Banks are able to offer end users (a smart real estate borrower like you) derivatives based on Term SOFR to hedge your Term SOFR debt. However, regulation prevents banks from hedging the other side of the swap using Term SOFR, so traders use average SOFR to offset the trade.

As illustrated in the previous graph, Term SOFR and average SOFR don’t match up 1-1, so traders are stuck with basis risk which gets passed through to the borrower. This effectively results in a bid/ask spread that might range anywhere from 0.03-0.08%. Therefore, instead of your spread adjustment being 0.11448%, it might only be 0.06% for example.

Borrowers who are modifying a swap from LIBOR to NY Fed or Daily Simple SOFR can also expect to see a lower spread adjustment.

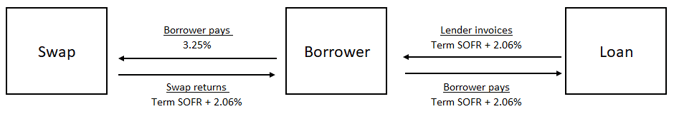

The good news is that if the spread adjustment on the swap matches the spread adjustment on the loan, you’re still indifferent and your fixed rate is the same.

This is important to note. If the swap goes from LIBOR + 2.00% to Term SOFR + 2.06%, then you want the adjustment on the loan side to also be 0.06% so that you’re paying Term SOFR + 2.06% there.

Most lenders are understanding of the market inefficiencies and wait to finalize the spread adjustment for the loan once the swap has been modified. As illustrated below, this is the best result and ensures everything matches up and borrower is indifferent.

If the spread adjustment on the loan doesn’t match the spread on the swap, then your net rate will be different. For instance, if the swap goes to Term SOFR + 2.06% but the loan is Term SOFR + 2.11448%, then your fixed rate would increase by ~0.055% or to ~3.305%.

Living with this mismatch might still be more efficient than having a mismatch between the loan and swap like under scenario 2, but it’s something for borrowers to consider. Alternatively, just ask your lender to keep them matching if they don’t offer that up initially.

Takeaways

If the replacement index on the loan matches the index on the swap, and the spread adjustment on the loan and swap are the same, then your net fixed rate will remain the same.

If your lender is planning to transition the loan to one index while the swap falls back to ISDA SOFR, the hedge will still remain highly effective, but it will fluctuate from month to month (historically this has been +/- ~15 bps) as a result of the mismatch.

If you’d like to speak with an expert or would like assistance navigating the transition, reach out to pensfordteam@pensford.com or 704-887-9880.

Some other helpful resources related to SOFR:

- SOFR RATES FOR DUMMIES - A HELPFUL OVERVIEW IN LAYMAN'S TERMS

- LIBOR TRANSITION – WHAT HAPPENS TO YOUR HEDGE BY JUNE 2023?

- TERM SOFR VS DAILY SIMPLE SOFR - WHAT’S THE DIFFERENCE?

- EXISTING LIBOR CAP OR SWAP? WHAT TO KNOW ABOUT THE 2020 IBOR FALLBACK PROTOCOL