What About Collars?

Frequently, CRE borrowers who are considering capping and swapping ask about collars. A collar is where a borrower buys a cap at a certain strike and sells back a floor to the bank helping offset the cost of the cap. This creates a floor and a ceiling on the floating rate, which resembles a collar. The value of the floor will often match the cost of the cap resulting in a “costless collar”. Here’s an example.

Notional $25,000,000

Term 5 years

Index Term SOFR

Cap Strike 3.50%

Cap Cost $650,000

In lieu of coming out of pocket $650k, the bank solves for the strike on a floor which has the same value so that the hedge is costless.

Floor Strike 2.35%

Floor Value $650,000

$650,000 - $650,000 = $0 due

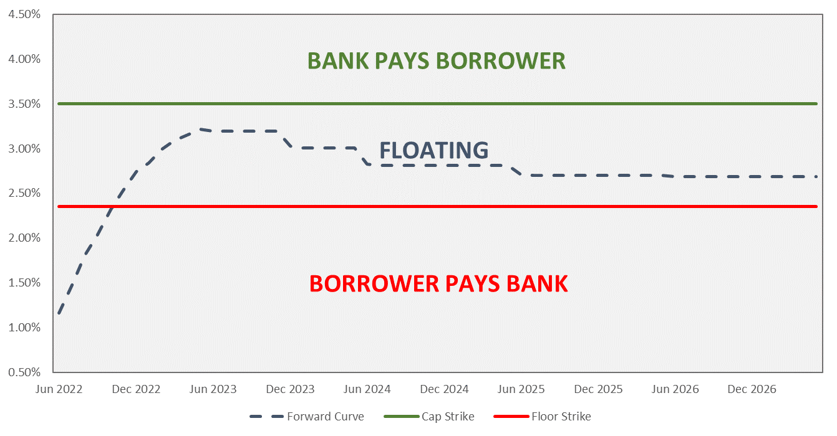

If rates remain between 2.35% and 3.50%, neither the cap nor floor come into play. For those who like a visual, the resulting hedge looks like this.

Before you jump to lock one of these bad boys in, consider the following – by selling a floor to the bank, you now have a potential future prepayment penalty AND you have to begin paying on the floor if rates go back below it.

Since collars give you a range to float in, they’re frequently viewed as less restrictive than a swap and generally have smaller prepayment penalties. However, most borrowers who dislike swaps will dislike collars for the same reasons.

If a collar is terminated early, any potential breakage is based on the market value of the cap and floor.

- If the cap value > floor liability, then borrower receives money at the termination.

- This scenario is most likely to occur if rates are near or above the cap strike with a low likelihood of dropping below the floor.

- If the cap value < floor liability, then borrower owes money at the termination.

- This scenario is most likely to occur if rates are near or below the floor strike with a low likelihood of exceeding the cap.

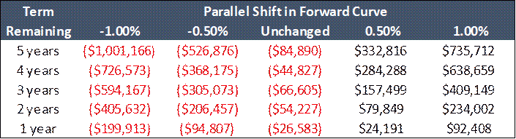

Here’s an example of a collar early breakage grid.

Notional $25,000,000

Term 5 years

Strike Buy 3.50% Cap / Sell 2.35% Floor

Index Term SOFR

Some other notes about collars:

- Since the floor creates credit exposure, collars are frequently only executed when the underlying lender has an internal swap desk (i.e. Wells or PNC).

- Similar to swaps, collars will require an executed ISDA to be in place prior to trading.

- Not all collars are costless. A borrower could sell a floor with a lower strike to help offset the cost of the cap and pay cash for the rest.

Collars are another option in the hedging toolbox that frequently make sense in rising rate environments but should be carefully weighed against alternative structures such as a cap or corridor.