Market Volatility & What To Do With a Worthless Cap

The 2020-2021 interest rate environment was characterized by not only low floating interest rates, but also the expectation that they’d remain low for years to come. During that time, many floating rate borrowers bet on those expectations holding true, buying relatively higher strike caps as Armageddon protection (3.00%-4.00% range) to minimize their costs at closing without being totally unprotected or just to satisfy a hedging requirement.

In the span of just a few months, however, the Fed has gone from adamantly saying there would be no rate hikes through 2023 to a 0.50% hike for the first time in two decades. Further, they’ve suggested more of the same may be necessary this year to rein in inflation.

The shift in rate expectations has led many of our clients that originally purchased high strike, Armageddon caps over the past couple years to start exploring buying down those strikes to better protect against their rapidly rising interest expense. Unfortunately, they’ve been shocked to find that tighter protection has now become cost prohibitive. In this resource, we’ll take a look at how layering in a corridor under your higher strike caps might be a more efficient way of adding protection while mitigating cost.

Low Strike Caps Have Gotten Expensive

If you’ve had to purchase a cap in the last few months, you’re probably all too familiar with the pain of cap costs rising more than 10x compared to where they were a year ago. The largest contributor to this change has been the huge shift in short term rate expectations, which have climbed by over 2.50% in that same time frame. This means that those 2.00%-3.00% strike caps that you were buying last year are now expected to payout to some extent over the next couple years.

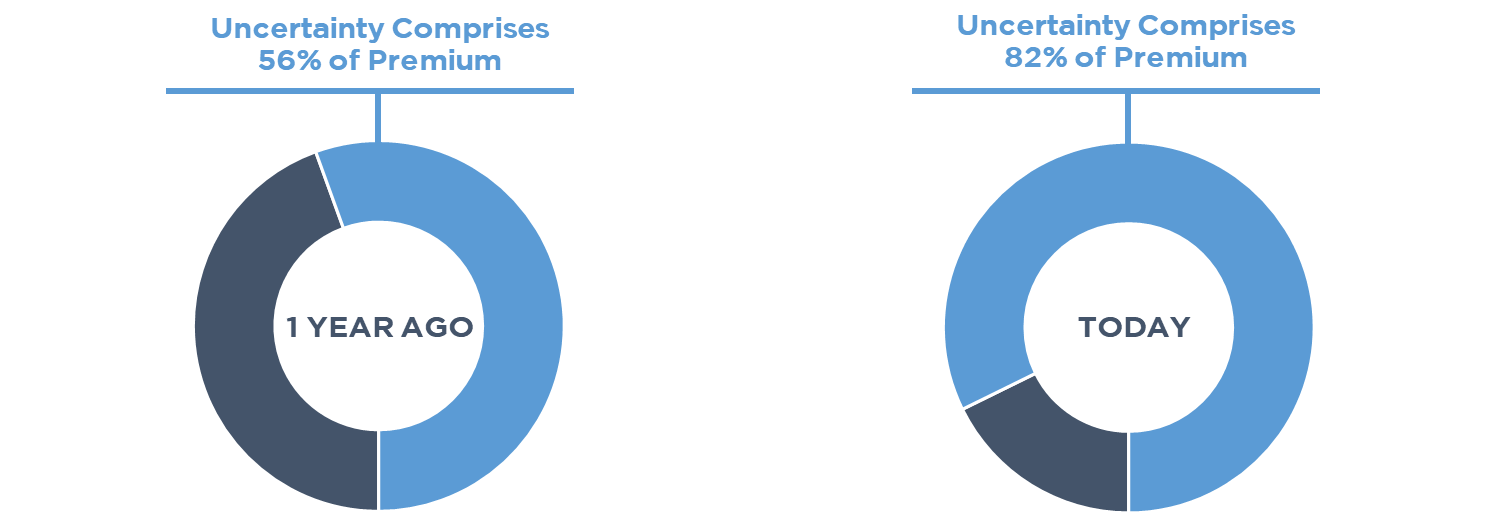

The other primary driver of increases in cap costs over the past year has been the sharp climb in market volatility. As volatility rises, so does the variance in potential rate outcomes over a given term and the market charges accordingly for that uncertainty. Check out the proportion of an out-of-the-money cap’s cost today compared to one year ago below.

Corridors - An Efficient Solution

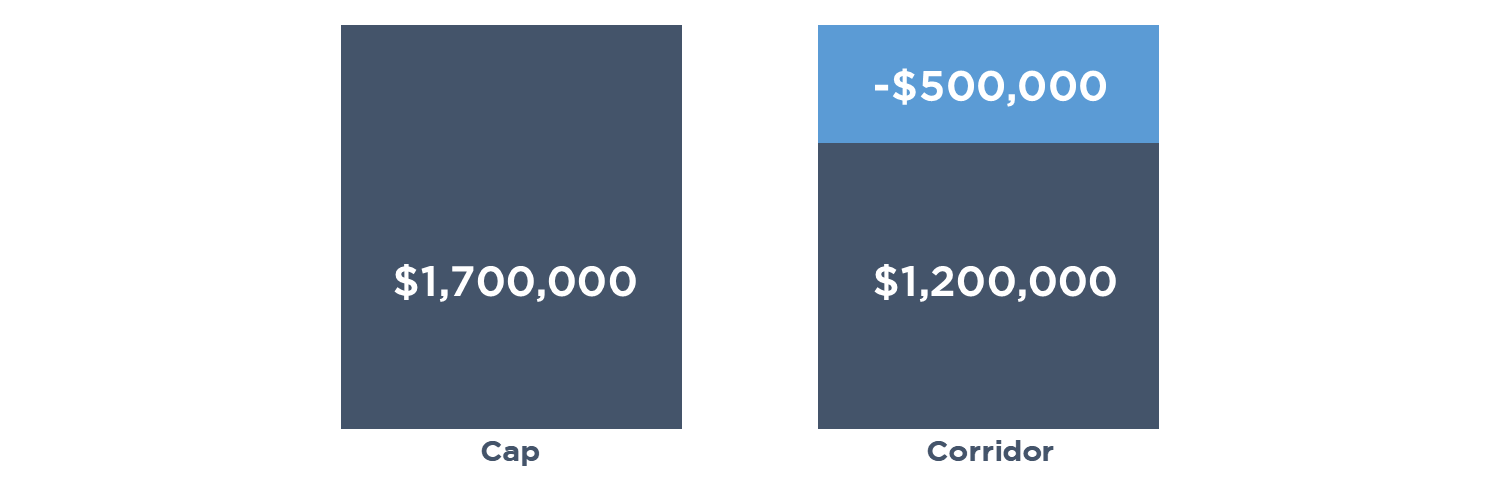

A corridor is just two caps: one bought, and one sold. The primary intent is to obtain a cap at a lower cost by selling one back at a higher strike. For example:

- You buy 1.00% - If SOFR moves above 1.00%, the bank owes you the difference between SOFR and that strike.

- You sell 3.00% - If SOFR moves above 3.00%, you owe the bank the difference between SOFR and that strike.

The 1.00% strike will always be more in the money than the 3.00% cap, so the bank will always owe you more than you owe them, and they’d just net the payments.

The higher strike’s value is comprised of not only its potential payout, but also its volatility component. Because volatility is such a significant driver of cap costs today, you’re also selling back a ton of premium even for strikes that aren’t expected to payout.

The Effect

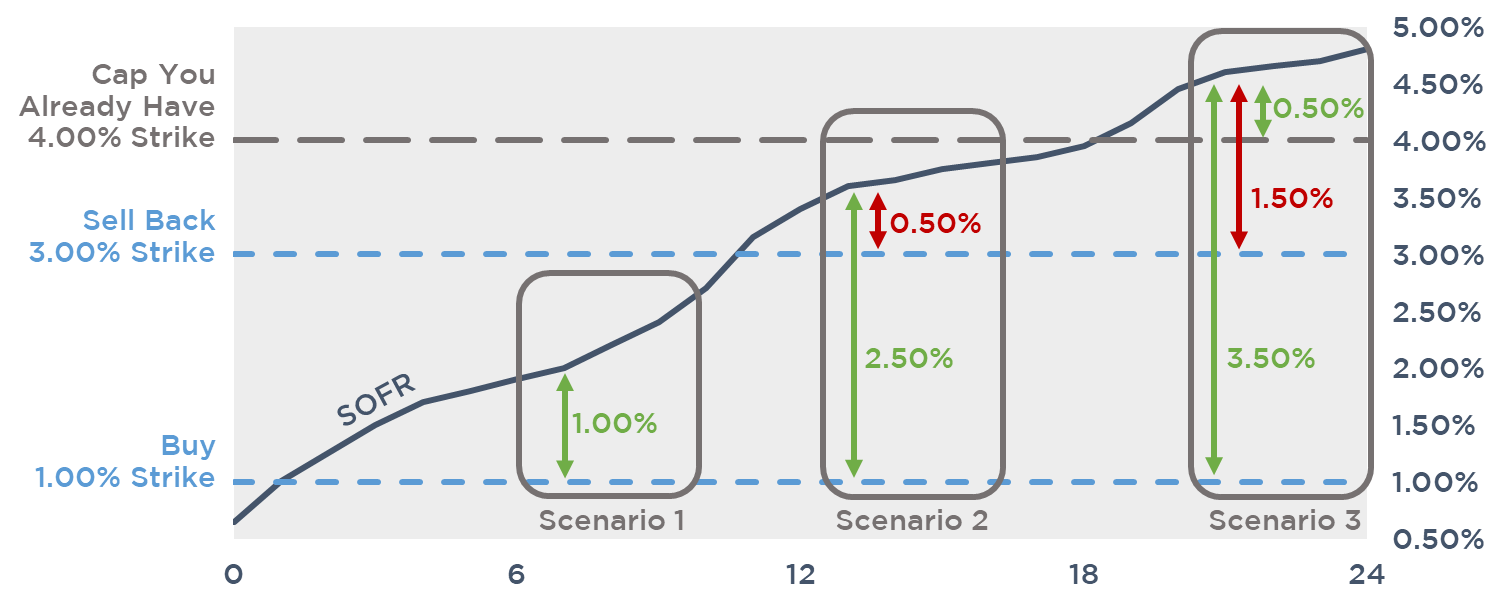

Continuing with the example corridor structure above, let’s assume you already have a 4.00% strike cap in place. Buy 1.00%, sell 3.00%, you already have 4.00%

This creates a “capped corridor.” Here’s how it works:

- When SOFR is below 3.00%, you feel like you have a 1.00% cap

- When SOFR climbs above 3.00%, your rate is pulled above 1.00% basis point for basis point

- When SOFR hits 4.00%, your rate stops increasing

For corridors, here’s the quick formula to calculate your rate when SOFR is above the strike you sold:

SOFR – (Sold Strike – Bought Strike) = Effective Rate

For capped corridors, here’s the formula to solve for your max effective rate:

Highest Strike – (Middle Strike – Lowest Strike) = Max Effective Rate

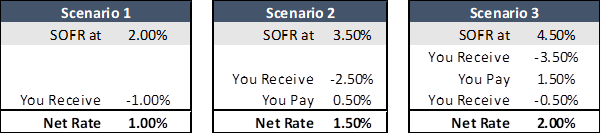

Here’s a few scenarios breaking down how our example capped corridor would behave when SOFR’s at 2.00%, 3.50%, and 4.50%.

Now, here’s those same three scenarios illustrated graphically.

Benefit – If SOFR never exceeds the strike you sell back, you’ll have effectively capped your rate at a discount. Compared to just buying a vanilla 1.00% strike cap, selling back a 3.00% cap could reduce your upfront premium by over 33%.

Risk – If SOFR spikes even more dramatically than expected, you may wind up paying more than you would have to just cap your rate at the max effective rate. For example, your max effective rate with the above capped corridor structure is 2.00%. Just buying a vanilla 2.00% cap would be about 15% cheaper.

Conclusion

If you’re looking for alternative methods to increase your protection on floating debt you’ve currently got Armageddon caps on, layering in a corridor could be a more cost efficient solution than just buying down the strike. For help identifying whether a corridor would make sense for your deal, or if you have any questions, please don’t hesitate to reach out to Pensford at pensfordteam@pensford.com or (704) 887-9880.