Cap Terminations - a Windfall?

If you’re a frequent reader of our newsletter or you’ve recently purchased an interest rate cap, you’re well aware that cap pricing has soared since the start of 2022. This is frustrating for many borrowers who plug an estimate into a pro forma, only to find costs up considerably over a short period of time.

But there’s a silver lining. Borrowers with caps no longer needed are finding themselves with a windfall.

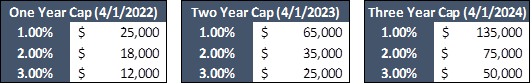

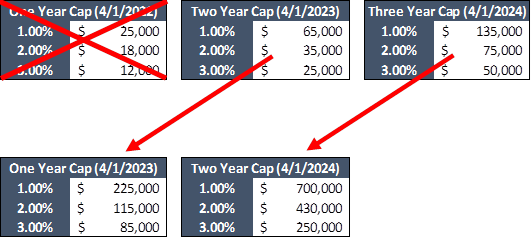

Cap costs – one year ago vs today

Here’s plain vanilla cap pricing from just a year ago. With the benefit of hindsight, we call these the good ol’ days.

Notional $25,000,000

Index SOFR

Ratings A-/A3 triggers

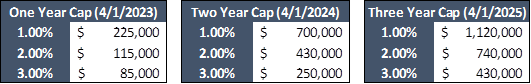

Here are the same structures today. They’re anywhere from 7-12x more expensive.

Since cap values are based on current rate expectations and volatility, most two year caps bought a year ago are worth 3-4x what was paid, even though only one year remains. Three year caps bought a year ago are worth 5-6x what was paid.

When floating rate loans are paid off, whether due to a refi or sale, borrowers may terminate the cap and recoup whatever residual value remains. Alternatively, if a borrower wishes to keep a cap and assign it to new or existing debt, that’s also possible.

There are a few steps in order to complete an interest rate cap termination:

1. Provide the cap provider evidence of the loan payoff. Note, if the cap was collaterally assigned to the lender, many banks actually require written consent from the lender prior to terminating.

2. The cap provider must refresh their KYC checks.

3. Hop on the phone to execute.

4. The bank will wire the value two business days after the trade.

Pensford helps borrowers through the interest rate cap termination process by coordinating with the cap provider, lender, and borrower. Through the use of multiple derivative valuation systems, we are also able to help achieve the highest value for your cap termination.

If you’d like assistance valuing or terminating an existing interest rate cap, please don’t hesitate to reach out.