SOFR – The Day the LIBOR Transition Died

I spent the weekend in Athens, GA watching the Bulldogs host Notre Dame. My brother is a professor in the real estate department at UGA and has season tickets. The first five people he invited couldn’t make it, so I got to go. I’m not fan of either team, but the atmosphere was insane. If I was a five-star recruit, which I probably am, I would have a hard time saying no to a team if I was watching from the sideline. Also, the game ended about 4 hours past my bedtime, so this intro is basically as long as the actual newsletter.

Last Week This Morning

- 10 Year Treasury fell 0.18% to 1.72% because maybe everything isn’t fine after all

- German bund fell 7bps to -0.52%

- German 30yr flipped negative again

- Japan 10yr at -0.21%

- 2 Year Treasury retraced to 1.72%

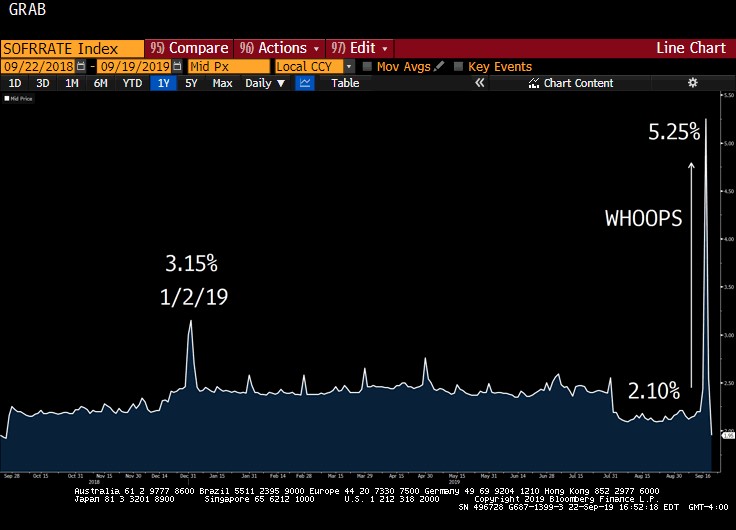

- LIBOR at 2.04% and SOFR at 1.95% after spiking to 5.25%

- Fed cut rates 25bps as expected

- Repo liquidity crisis hit the market early in the week (see our article here)

- Terrorist attack on Saudi Arabian oil refineries (is it just me, or does that feel like way more than a week ago?)

- A delegation from China cut its US visit short, dampening hopes of a near term resolution

FOMC – Rate Cut

The Fed cut rates 25bps as expected, but the 7-3 vote highlights quite a bit of disagreement behind closed doors. Two members wanted no cut, while one member wanted a 50bps cut.

Just as importantly, the blue dot forecasts suggest even greater divergence of opinions for monetary policy through year end. Seven members forecast one additional cut, five expect no more cuts, and five expect a hike by year end. And the Fed wonders why it has a credibility issue in the market…

Unlike the Eagles secondary, we’ll tackle why there’s no way the Fed plans on hiking before year end. It’s really technical and you may not be able to follow, but I’ll do my best to translate. Here we go…

Reasons Why the Fed Won’t Hike Before Year End

Reason #1 – because it just cut rates

Reason #2 – there are no other reasons, see Reason #1

You mean to tell me the Fed cut rates in September and will hike again within the next three months? If there was any chance the economy/markets could absorb a hike before year end, the Fed wouldn’t have cut last week. Guess how many times the Fed has ever hiked rates within three months of a cut…yeah, zero. Those five members are like the sports writers that used to vote for the AP Top 25 on Sunday morning by opening up their newspapers, reading the scores with no context, and casting their votes. C’mon.

The market has odds of at least another 25bps cut at the 10/30 FOMC meeting at 100%. While that may be a touch high, I would agree that the odds of another cut before year end are close to 100%. I also think it’s better for the Fed to cut sooner rather than later and moving again in October will be better received by the market.

SOFR – The Day the LIBOR Transition Died

OK, maybe that’s a bit hyperbolic, but it very well may prove to be true. Traders were already very wary of SOFR and its futures contracts, which is how you build a forward curve. Then last week it spiked to 5.25% unexpectedly. You think any traders, already hesitant, are more likely to jump in right now?

Again, the irony here is that the very reason regulators want to find a suitable replacement for LIBOR is to avoid manipulation. But any market-driven index will be subject to volatility. You are darned if you do and darned if you don’t.

Random thought of the day – why are banks so reluctant to lend out excess cash to fellow banks that the NY Fed had to intervene with an emergency repo facility?

Random thought of the day part deux – why are banks so short on cash they are trying to borrow it from fellow banks?

Random lesson learned from 2008 – in periods of crisis, cash is king.

And the 10 Year Treasury is a close second.

This Week

The Fed will continue to massage the message from last week’s meeting. There’s some manufacturing data, which takes on increased significance since the last report suggested a recession in the manufacturing sector. We’ll also get another GDP revision, durable goods, and consumer confidence.