Spend More Faster

Last Week This Morning

- 10 Year Treasury tested the lower boundary of 1.62% before closing at 1.67%

- Biggest quarterly spike since the 2016 election

- German bund up to -0.35%

- 2 Year Treasury unchanged at 0.14%

- LIBOR at 0.10%

- SOFR at 0.01%

- Biden is turning his attention to his $3T infrastructure bill

- Powell conceded the economy is recovering faster than expected but reiterated the Fed will only begin to slowly remove accommodation once we have “all but fully recovered”

- This comment is about QE tapering, not hiking rates, which creates more risk to further increases in the 10T

- The 7 Year Treasury auction went poorly, with foreign demand slipping 43% from last month’s same auction

- This created some market concern over this week’s 10T and 30T auctions

- GDP came in at 4.3% vs forecasted 4.1%

- Core PCE (Fed’s preferred measure of inflation) was weaker than expected at 1.3%, vs forecasted 1.4%

- University of Michigan Sentiment came in better than expected

- Both existing and new homes sales down dramatically

- Durable Goods down 1.1%

- Consumer spending fell 1.1%

- Personal income dropped 7.1%, the biggest decline on record

- This came after January’s 10% increase

- A sideways boat is disrupting global supply chains

- Congrats to the Big Ten for winning “Most Overrated League” in basketball to add to their already impressive football collection

- A Michigan fan asked if I would be rooting for them against FSU today. I am not one of those “I root for my conference” people. If I hate the team, I always hate them. I will never, ever, root for Michigan, Ohio State, Duke, etc. I can’t flip a light switch and suddenly root for them. I hope Michigan loses in spectacularly embarrassing fashion because I am petty and jealous.

Spend More Faster

On Wednesday, President Biden will unveil the details of his Build Back Better (gag) program, a little $3T infrastructure bill. Details are likely to leak ahead of the actual announcement.

In the March 1st newsletter, we mentioned how little attention this massive spending bill was receiving. Because Republicans did not pass a budget last year, Democrats actually get to use reconciliation twice this year. In other words, they can cram pass this second bill without a single Republican vote.

The plan is expected to have two primary pillars: social and infrastructure.

The “social” pillar is expected to account for about a third of the price tag and includes things like free community college, universal pre-K, and national childcare. Listen, I want to pawn my kids off onto other people as much as the next parent, but I’m not sure why we need to spend $1T to do so.

The “infrastructure” pillar will tackle things like transportation, roads/bridges/tunnels, cellular networks and electric car stations.

The market is struggling with how to account for this bill.

If you’ve been reading for the last six months, we’ve been beating a dead horse about how Treasury supply, not economic growth, causes spikes in Treasury yields. Well, if Treasury issuance to fund a $1.9T stimulus package caused a one-point spike in 10T yields, how much could $3T do?

But this one isn’t quite as cut and dry.

Firstly, Democrats may have a tougher time avoiding a single defection. Key Dem voters, like Joe Manchin, are going to be asking for everything under the sun. If this bill gets passed, don’t be surprised if the 2028 Olympics get moved from LA to West Virginia. For this reason, the market is pricing in some probability the Dems can’t pass this bill (for now).

Secondly, Biden plans on raising taxes to help foot the bill. Some expected highlights (lowlights?):

- Raising the corporate tax rate from 21% to 28%

- Raising the personal tax rate for individuals earning more than $400k

- Higher capital gains tax rate for individuals earning more than $1mm

- Tax employers at the same time you are trying to encourage hiring (ok, I might be reading between the lines on this one)

The independent Tax Policy Center analyzed Biden’s tax plan and concluded it would raise about $2T over 10 years.1 In a vacuum, that would really help offset the $3T price tag, meaning the US wouldn’t need to issue as much in Treasury to pay for it (and therefore less reason for yields to spike).

For Democrats that couldn’t understand how traditional Republicans could have voted for Trump, this is Exhibit A. Higher spending, higher taxes.

I was fine with Dems using reconciliation for COVID relief because of the urgency (and shame on the Republicans that touted the benefits to their constituents after voting against it). But this feels like a more traditional agenda that should rely on bipartisan support rather than reconciliation. If it takes longer to pass, so be it. If it requires concessions, so be it. I think Dems run some risk of backlash in the mid-terms if they jam this through.

Expect rate oscillations as the market tries to figure out how much and how fast might get passed. If it starts to look like we will need to issue a lot of Treasury to pay for the plan, rates could take off.

Friday’s Job Report – Prepare for the “Record” Headlines

Last month, we asked, “The most important thing to know about the incredibly strong job report is this – how crazy strong will next month be? Excluding the crazy rebound last summer, March could experience the strongest job gain on record.”

Time to find out.

The consensus forecast is for a gain of 643k jobs. Excluding last summer’s snapback from shutdowns, the single largest job gain on record is 540k in May 2010. Prepare for a lot of headlines about how this is the strongest job report ever.

The unemployment rate is expected to fall to 6.0% this month, but don’t forget even the Fed expects it to decline to 4.5% by year end.

Just Because…

The Bloomberg Rates team is among my favorite, and they think the 10 Year Treasury could get to 2.50% this year, and potentially as early as the summer. It isn’t their base case (which is 2.0%), but a real risk.

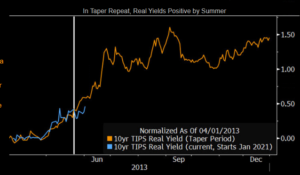

This graph shows the 2013 Taper Tantrum overlaid on top of today’s yields. While this focuses on “real yields”, meaning adjusted for inflation, the takeaway is the same – about 0.90% of upward room on 10 Year Treasury yields.

Week Ahead

Obviously, Biden’s details (whether on Wednesday or through earlier leaks) will likely dominate headlines until Friday’s job report.

Sources