Subdued Inflation is Transitory, right? Right?!

Last Week This Morning

- 10 Year Treasury had a volatile week, but finished mostly unchanged, closing at 2.53%

- German bund at 0.02%

- Japan 10yr flat at -0.04%

- 2 Year Treasury closed at 2.335%, but was as low as 2.20% immediately after the Fed meeting

- LIBOR at 2.47% and SOFR at 2.50%

- Fed kept rates unchanged

- Economy added 263k jobs

- Average Hourly Earnings m/m up just 0.2%, and y/y 3.2%

- Unemployment rate at 3.6%

- AG Barr, the top person in charge of enforcing rules, directly disobeyed those rules and nothing matters any more

- Rightful Kentucky Derby winner Maximum Security was robbed by the same referee that stole the national championship from Texas Tech

Jobs

Well this has to be the Democrats worst nightmare, right? Firstly, the Mueller Report finds that Trump didn’t collude with Russia. That means Dems are forced to rely on the pesky election process to remove Trump from office – bummer. Secondly, the economy is doing really well. Unemployment is at a 50 year low. Stocks are near all-time highs. Do you think during the debates Trump will just keep interrupting with economic references?

Harris: “We need to unite…”

Trump: “Unemploymentrate3.6%sayswhat”

Harris: “Excuse me Mr. President?”

Trump: “Unemploymentrate3.6%sayswhat”

Harris: “What?”

Trump: Smirk

Bernie: “Too many have been left behind during this recovery and we need…”

Trump: (cough cough) “12 month average job gain of 240k”

Beto: “Bernie’s right, we need a recovery for everyone…”

Trump: “Oh, I thought 3.2% GDP over the last year included everyone. Does it not?”

Obama: “Wait a second, 240k is the same as my final 12 month average of 238k.”

Trump: “Umm, no! 240k is more than 238k! You would know that if you went to an Ivy League school like me. Bigly.”

Warren: “Tons of regulation is the best way of encouraging growth. I want to regulate everyone out of business. And make everything free. Everything. If you can see it, I want it to be free, right Bernie?”

Trump: “Elizabeth, please. And you’ll notice how I am not calling you Pocahontas anymore because I’ve matured. But Elizabeth, can you please tell me what 26,829 minus 1 is?”

Warren, always falling for the Trumpbait: “26,828”

Trump: “I’ll take ‘What is the highest all-time stock market close’ for $500 Alex!”

Gillibrand: “Joe, please stop massaging my shoulders.”

The economy added 263k jobs last month vs the forecasted 190k job gain. Coupled with minor upward revisions in January and February, the Q1 average gain has been 169k.

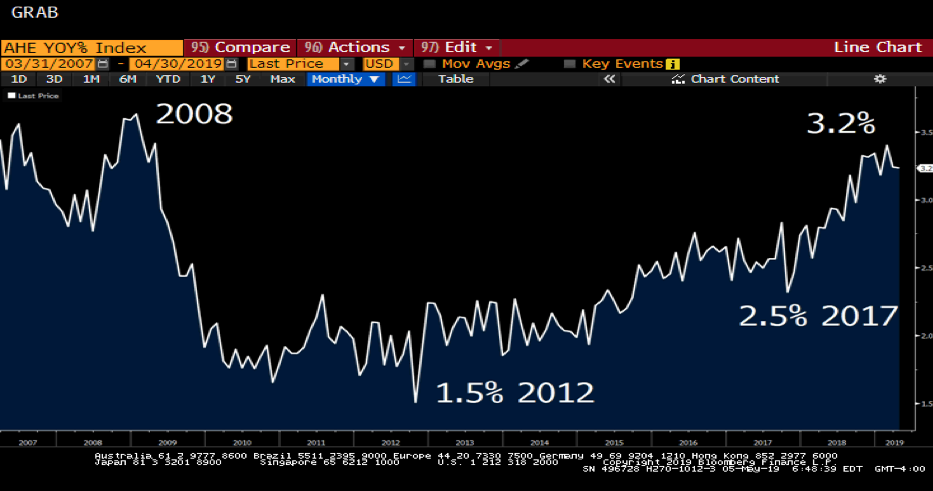

Average Hourly Earnings, considered a leading indicator of inflation, was muted. Over the last year, AHE are up 3.2%, which was slightly below forecasted 3.3% and unchanged from last month.

The Unemployment Rate came in at a 50 year low, 3.6%. But this was aided, in part, by a drop in the participation rate from 63% to 62.8% – a drop of nearly 500k people.

This was also the fourth month in a row that the participation rate dropped and the first time in a decade. This may dampen the data somewhat, but doesn’t suggest the labor market is struggling.

If the story is the same this time next year, the Dems are going to have their hands full.

Take a Bow

tran·si·to·ry

/ˈtransəˌtôrē,ˈtranzəˌtôrē/

Adjective

- not permanent

The Fed kept rates unchanged and largely suggested it is on hold for at least the rest of the year. “We do think that our policy stance is appropriate right now,” he said. “We don’t see a strong case for moving in either direction.”

“We suspect that some transitory factors may be at work,” Mr. Powell said of core inflation. Thankfully, he was not eating a bucket of chicken during the press conference.

In other words, lack of inflation is temporary, so the Fed will not be cutting rates any time soon.

And while data has been coming in strong, don’t forget the Fed’s preferred measure of inflation, Core PCE, came in most recently at 1.55%. With a 2% stated target, the Fed is not hiking any time soon, either.

Markets were caught somewhat offsides by Powell’s statement, having aggressively priced in two rates cuts by the end of 2020. The curve shifted upward mildly after the conference.

“It appears that risks have moderated somewhat,” he said. “Our outlook, and my outlook, is a positive one, is a healthy one, for the U.S. economy for the rest of this year.”

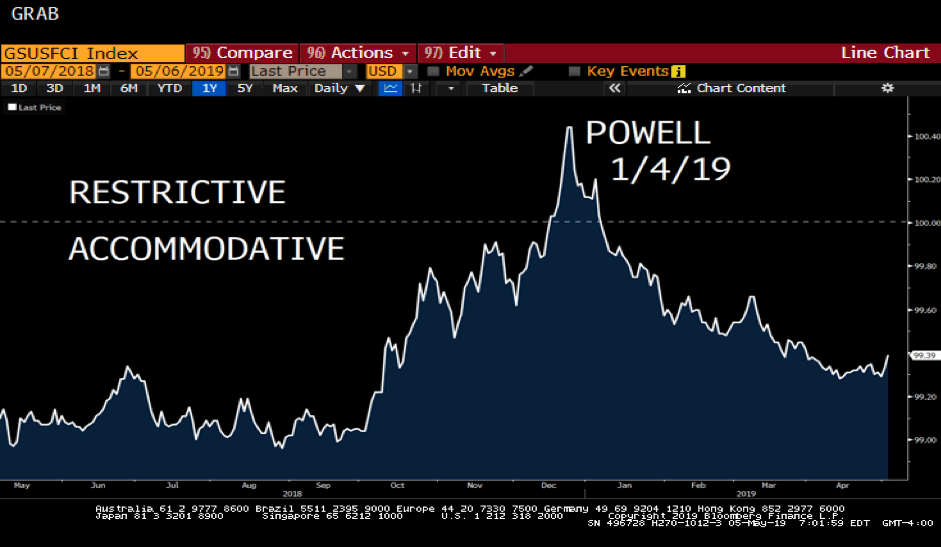

This is where Mr. Powell should take a bow. His position change earlier this year fundamentally altered the trajectory of market conditions. Before his change, financial conditions were tightening dramatically and markets were spiraling out of control.

Since then…markets have taken the risk of a Fed-induced recession off the table.

Rates

A few weeks ago, I suggested the flattening yield curve was the result of inflation expectations, not recession fears.

If this is true, inflation data should have an outsized impact on rates. With CPI and PPI due out this week, we might be testing my hypothesis pretty quickly.

With the Fed’s transition to accommodative policy once again, it does suggest a risk-on mentality for markets, which generally applies upward pressure on yields.

But with tepid inflation, it’s challenging for the 10 Year Treasury to detach materially and drive higher. Here’s a graph of Core PCE vs 10 Year Treasury yield. If inflation doesn’t move higher, it’s tough to envision a scenario where the 10T moves up dramatically. This is especially true when factoring in low global yields.

Here’s the same graph, but simply the spread between the T10 and Core PCE.

As you can see, the peak delta over the last five years has been 1.40%.

If we hold inflation constant, that implies a T10 ceiling of 2.94%.

Obviously, a key risk would then be that inflation moves up. Count me among those firmly in the camp of benign inflation for the foreseeable future…BUT… if Average Hourly Earnings continues its upward trend, that could be the sort of catalyst for inflation to finally start showing up in the data.

This Week

Relatively quiet week. Inflation data (but not Core PCE) and progress on trade deal with China are probably the headline generators.

There will be some Fed speeches, likely to massage the market’s interpretation of the FOMC statement last week.