Swap Mark-To-Markets

Overview

Make whole, yield maintenance, and defeasance – many borrowers are familiar with these prepayment calculation methodologies used on fixed rate debt. But what is a swap mark-to-market (MtM) derived from? In this resource we drill down into what drives a swaps value. Before we dive in, a quick refresher on swaps.

Swap Basics

A swap is an exchange of interest payments where the borrower agrees to pay a fixed rate and in exchange receives a floating rate. The loan is still floating, the swap is just a separate contact which results in a fixed rate. Below is a diagram of the cashflows.

The borrower is invoiced for the loan’s floating rate which is offset by the floating payment received from the swap, so all they’re left with is a fixed payment. As long as the hedge and loan align, the borrower will only pay the fixed amount for the term of the swap regardless of where the underlying index resets.

The Scenario

For purposes of this analysis, we’ll examine a $25mm 7 year swap placed around 3 year ago. Borrower locked at 5.00% in exchange for L+1.85%.

On 11/1/2018 the 7 year swap mid was 2.97%, meaning that the credit charge was 0.18% and the bank made about $265k. Remember, not only should your credit charge be negotiated but your ISDA should be as well!

| Notional | $25,000,000 |

| Amortization | 25 year at 5.00% |

| Swap Term | 11/1/2018 – 11/1/2025 |

| Index | 1ML |

| Borrower Pays | 5.00% |

| Borrower Receives | L+1.85% |

Marking to Market

The value of the swap or MtM, is the just net difference between the floating and fixed legs. Said another way, the MtM is the present value sum of the difference between the fixed payments and floating payments (based on market projections at that moment) until maturity.

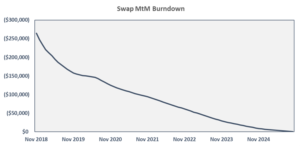

On day one of a swap, the MtM is against you by the amount of the credit charge since you’ve locked in at an above market rate. If rates follow market expectations, the MtM would decrease each month as payments are made until maturity when the swap terminates at par. Below is a MtM burndown from the day this swap was locked.

But markets are ever changing and never follow expectations, so this burndown is accurate for about a second. Especially large events like elections, pandemics, and trade wars can cause a swap MtM to go from minor to major.

On the day this swap was locked the MtM was $265k and now it’s closer to $1.8mm. This is because rates crashed, and market expectations are still well below November 2018 levels.

Swap MtMs behave a lot like any other make whole or yield maintenance calculation, with the main difference being a swap can be in favor of the borrower whereas most make whole provisions have some minimum penalty (e.g. 1.0% of the loan balance).

When calculating a MtM, a trader’s model compares the swaps fixed leg to its floating leg. Think of the floating leg as the replacement rate that would be used on a make whole calculation.

- Since a swap rate is the average of the resets over a period, and 4 years remain on our swap, the replacement rate is the 4 year swap.

- For the MtM to be $0 or in favor of the borrower, the 4 year swap would need to be at or above 2.97%.

Since the 4 year rate is closer to 1.10% today, to break the swap early a penalty amounting to 1.87%, per annum, for 4 years would be due. About $1.8mm in this example.

Conclusion

If you’re familiar with make whole or yield maintenance calculations, then you’re familiar with swap MtM calculations too. Keep in mind, the swap MtM is not necessarily the number the bank would quote if you wanted to terminate early, there’s generally some spread over mid which should be quantified.

For assistance getting a more precise number or with terminating a swap you currently have in place, please reach out to the team at pensfordteam@pensford.com or 704-887-9880.