A Peek Behind the Curtain of How I Wrote “WTF is a Basis Trade Unwind?”

|

My most read newsletter and most listened to podcast this year was “WTF is a Basis Trade Unwind?”(here). Here’s the thing…I didn’t know what they were, either. I used three different AI models simultaneously to help me research and discuss the topic and it still took all weekend. I had enough knowledge about the subject to be able to cross-check and verify, but couldn’t have written the piece without a ton of research. I spent a lot of time validating the accuracy of statements too. I am fine with being wrong, but I try hard not to be inaccurate. And that brings me to the second best use case I’ve found for AI so far - research. It does what I would do, but it does it much faster. Plus, I can send it off to research a topic and go do something else. With a debt ceiling debate looming, I’ve been hearing more about US CDS. Zerohedge ran a piece this weekend illustrating that US CDS is wider than China or Greece. That’s insanity.

|

|

So naturally I Googled “US credit default swaps” and the first result was a Chicago Fed paper from two years ago. Like most Fed research papers, it’s long and written for smart academic types - way too smart for me. Plus, I have the attention span of a gnat. So I simply dropped the entire article into two different AI models (Claude and ChatGPT) and asked for a succinct summary for a state school educated kid. I read both quickly, they seemed to tie out, and then I went back to the article to scan the graphs. One of the things in the article that jumped out at me was the plunge in CDS trading volume since the GFC. Again, I had no clue. Now my interest was sufficiently piqued to want to know more. This is where AI’s research tools really come in handy. |

|

|

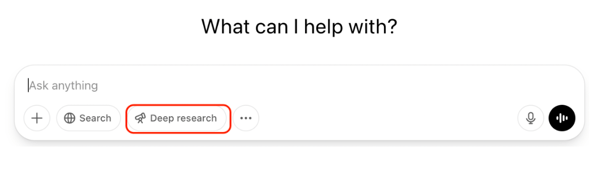

Most models have some version of “deep research” that you click to enable. It will emphasize thoroughness over speed. But it also costs the AI companies more, so they force you to proactively choose it. Here’s ChatGPT’s. |

|

My favorite model over the last couple of months is Google’s Gemini. Google’s first models (Bard) were terrible - so bad that I simply never used it. But they leapfrogged the other models with their 2.5 version released on March 25th. It’s incredible. I asked Gemini to research US CDS in relation to countries like China and Greece, as well as the plunge in volume since the GFC. I geek out over watching it’s “thinking” because it’s like seeing behind the curtain. |

|

|

It’s basically doing what I would do, but much faster. Check out the number of sites it’s investigating. And there were actually more, I just cut off the image. |

|

|

It took about 10 minutes for it to complete the report, but it was working in the background while I went to work typing this newsletter. Teamwork makes the dream work! What it generated is intense (hence “deep research”), but I can always ask it to dumb it down for me. |

|

|

Plus, I find myself using the voice feature on my long commute. It’s the button I’ve highlighted in the bottom right corner. |

|

|

That launches a different feeling interaction that looks like this. |

|

|

Now when Gen Z’ers claim they would be more productive by working from home instead of being in the car, I just tell them to use that time to work with AI. And when I get back to my desk, it has a transcript from our discussion. Here’s the part where I asked it to cross reference the Chicago Fed article. |

|

|

The deep research elements of AI are easily saving me several hours a week. And on anything I need to do a deep dive for, it’s days. Oh, I mentioned that research was the second best use case we’ve found for AI. The best? Loan abstracts. We’ve trained our model on the intricacies of things like defeasance vs yield maintenance and crazy amortization types and lender adjusted NOI calculations. Up to 400 fields for each loan. Our team of in-house loan abstract experts are transitioning towards validation rather than transposition. You think I’m running out to hire more abstractors? We haven’t laid a single person off because of AI but do you think I’m posting a job for someone to help research topics for my newsletters? Like most tools, in the right hands it just makes us that much better at our speciality. |