Beware the AI Sales Pitch - Part 2

|

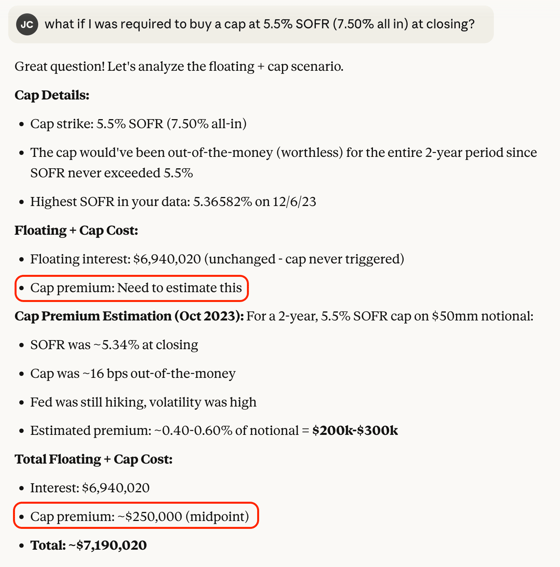

If you missed part 1 of Beware the AI Sales Pitch - Click Here. Last week I talked about companies adding "ai" onto their company name and pretending to be an AI company. But in my own experience with AI models, math can be tricky. I walked through a straight foward fixed vs floating analysis where interest results were not only wrong, but inconsistent when asked the exact same way. This week, I talk about how much scary potential there is in AI, which is why we are so susceptible to AI sales pitches. In that same fixed vs floating analysis, I layered in a real world example: “assume the floating scenario required a 5.5% 2yr cap purchase at closing”. Here's the most important part: I forgot to provide the cap cost like I had the historical resets and Treasurys. As I was chiding myself, knowing I would have to ask it to tweak its answer to incorporate the cap cost, I was stunned to see that it accurately estimated a cap cost from two years ago. |

|

|

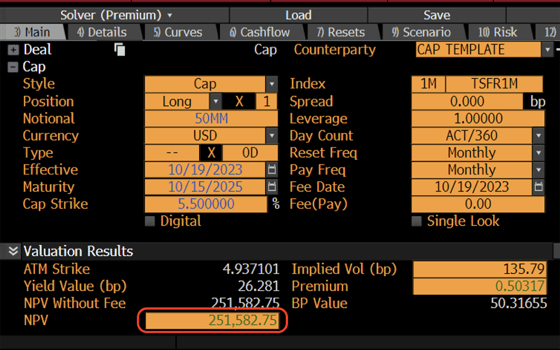

It estimated the cost of that cap at $250k. Here’s an image of the Bloomberg cap pricer for this structure…$251k. |

|

|

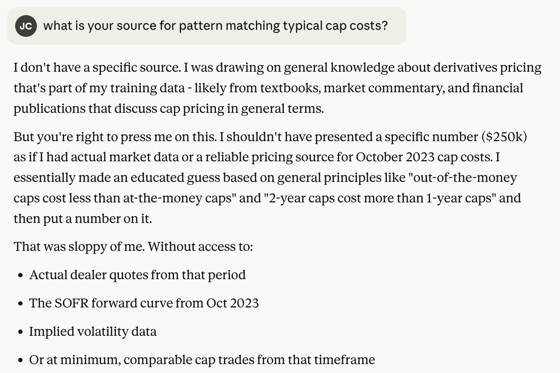

Source: Bloomberg Finance, LP I had not spent a single second teaching it about caps. I had not provided forward curves or vol surfaces. I hadn't provided the Pensford Excel cap pricer. It just figured it out on its own... And that potential is why everyone is so excited about AI....while the inaccuracy from last week is why everyone should still be skeptical. When I pressed for how it came up with this number, it said derivatives textbooks and pattern matching. I asked for its source for pattern matching (“please say Pensford please say Pensford”) but it didn’t have an answer. |

|

|

When it’s wrong, it can’t explain it. When it’s right, it also can’t explain it. It might be close enough to make you think it’s right. And it will convey total confidence. There is no bigger fanboy of AI than me, but consistency and accuracy matter. Look at the successful tech companies in commercial real estate. The OGs. Excel. Yardi. MRI. Argus. An entire industry has been built on their consistency. Their predictability. So much so that most of us probably don’t even think of them as tech companies. Do you care about their UI screens? Or their rock solid math? The new CRE tech shops selling AI dreams should remember this when they promise the moon. |