Was Friday’s Nosedive an Overreaction?

Last Week This Morning

- 10 Year Treasury jumped to 1.67% on Tuesday before plunging Friday to 1.47%

- German bund down 2bps -0.34%

- 2 Year Treasury spiked to 0.64%, then fell back to 0.50%

- LIBOR at 0.09%

- SOFR at 0.05%

- Headline PCE at 5.0%, the highest YoY increase since 1990

- The Fed’s preferred measure of inflation, Core PCE, came in at 4.1%

- WTI plunged 13% on Friday

- Durable Goods Orders fell unexpectedly by -0.5%

- Jobless claims much better than expected at 199k

- Household spending surged with Personal Spending rising 1.3%

- Existing home sales rise 0.8% to a nine-month high

- Biden announced Powell will be returning as Fed Chair for a second term with Brainard taking the Vice Chair position. Markets reacted to the continuity with a swift rise in rate expectations.

- The White House indicated a new Vice Chair for Supervision will be named “in the coming weeks”

- FOMC Minutes for November released with members judging inflation pressures will “take longer to subside than they had previously assessed”. The Fed continues to see inflation abating in 2022 but is less certain on its path.

- Biden is tapping domestic oil reserves to ease pressures, but OPEC is set to meet this week to consider additional restrictions that would offset that supply

- I wonder if Cam yelled, “I’m back! I’m back!” as he took his place on the bench?

Rates Whipsaw

Rates spiked on Tuesday and Wednesday following higher inflation expectation readings. Core PCE, the Fed’s preferred measure of inflation, came in at a 30 year high.

Source: Bloomberg Finance, LP

The T10 breached the key 1.62% level, reaching as high as 1.67%. Next stop 1.75%…

Source: Bloomberg Finance, LP

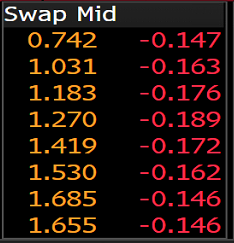

Then the bottom fell out on Friday with news of a new Covid variant, Omicron. The T10 fell back below 1.50% while rates plunged across the curve. Check out how dramatic the move was in swaps.

This feels like an overreaction to me, exacerbated by the lack of liquidity on a Friday where most trading desks looked like a ghost town. I suspect this kind of dramatic swing is more attributable to short covering more so than the typical flight to safety.

In other words, it’s not as if the market necessarily believes the Omicron variant will destroy the economy again. Instead, short positions just wanted out until we know more. I wouldn’t be surprised if this was just the pressing of a reset button again and rates rebound as long as Omicron doesn’t accelerate.

Oh, and just for fun, tapering begins this week…

Current resistance and support levels:

High end: 1.62%, then 1.75%

Low end: 1.45%, then 1.38%, then 1.25%

Interest Rate Caps

Although most of the focus will be on the T10, proportionately the T2 move was even more dramatic. A 14bps drop on the front end of the curve is the equivalent of the T10 plunging to 1.29%. It was a giant movement.

Unfortunately, cap prices haven’t initially felt a corresponding drop because volatility spiked, offsetting the benefit from the drop in rates.

If rates stay low and volatility subsides, cap prices could settle down a bit.

Week Ahead

Jobs jobs jobs. Consensus forecast is for about 530k jobs, similar to last month’s gain.

Also, news on the new Covid variant will dominate as well.