Why Cap Pricing Has Spiked

oday I learned the LA port is not a 24/7 operation. It just had its busiest month on record and there are 96 ships parked off the coast awaiting processing. A month ago, there were a record 62 ships parked off the coast. LA and Newport account for 40% of the total shipping containers entering the US and apparently, it’s run by…millennials?

Last Week This Morning

- 10 Year Treasury up 10bps to 1.67%

- The 10T is up 35bps in the last month

- German bund ran up to -7bps before closing out at -0.09%

- 2 Year Treasury at 0.45%

- LIBOR at 0.09%

- SOFR at 0.03%

- Budget deficit now exceeds $2.8T, which is somehow an improvement over last year’s $3.1T

- Building permit applications and new housing starts were both down significantly

- Manufacturing survey came in at a 7 month low

- Fed instituted new trading rules for its own officials because it turns out maybe there’s an itty bitty conflict of interest

- Is credit card debt spiking yet? I can’t find any “live” data, but I wonder if the banks are seeing an increase in debt as unemployment insurance runs out.

- Even moderate Dems are apparently opposed to corp tax hikes

- Trump calling his new social media site “Truth” is like Penn State calling its offense “Run & Gun”. Seriously, how inept is a team that scores 18 points in 9OT’s, following a bye week, at a home game, and against an opponent with a losing record that hadn’t scored a single point in 3 weeks?

Don’t Overreact to the Upcoming Q3 GDP

You’re probably going to read headlines later this week about a disappointing Q3 GDP. The consensus forecast is for 2.7%, but I think there’s a chance it’s below 2.0%. Regardless, it will be the first sub-6% GDP print this year. As a reminder, here’s GDP thus far in 2021:

Q1 6.3%

Q2 6.7%

The good news is that we don’t have a demand problem. The bad news is the logistical issues aren’t going to resolve themselves overnight.

As we discussed last week, a weaker than expected GDP likely means stronger than expected GDP in the upcoming quarters. In other words, don’t overreact to Thursday’s headline. Lack of GDP last quarter will be made up for at some future quarter.

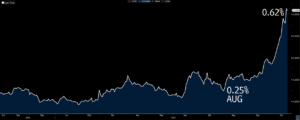

Interest Rate Cap Pricing Got Crushed

If you’ve been one of the unfortunate souls trying to buy a cap over the last two weeks, you are well aware that pricing has spiked 3x.

Check out the dramatic spike in 2-year swap rates, which are one of the key drivers of cap prices.

Source: Bloomberg Finance, LP

The last time I can recall such a dramatic shift in cap pricing was the 2016 election. It’s been brutal. Volatility has spiked and rate expectations have jumped.

What drove those rate expectations higher? The growing belief the Fed will need to start hiking much sooner than expected, perhaps as early as when tapering is done.

Rate Hike Expectations

In the last month, 2-year rates have doubled. Can you imagine the headlines if the 10T moved from 1.50% to 3.0% in just four weeks? You would be reading about it everywhere.

Prior to this move, the market was pricing in about 1.5 hikes over the next two years. It is now pricing in 5 hikes over that same time frame. That’s a shocking shift in such a short amount of time considering the Fed is in complete control of this outcome.

The market is pricing in a 70% probability of a rate hike at the June 2022 meeting (which coincides with the conclusion of tapering). Here are the cumulative market implied # of hikes at various FOMC meetings next year:

June 0.7 hikes

Sept 1.4 hikes

Dec 2.2 hikes

Why the sudden change?

Firstly, the market is effectively disagreeing with the Fed’s transitory message (as many of you are).

Secondly, Powell is addressing inflation differently than he has before now, which the market is interpreting as a shift in his position. Last week, Powell said pricing pressures are “likely to last longer than previously expected, likely well into next year.” The market puked.

I don’t interpret this as Powell throwing in the towel on his thesis. Instead, I think Powell is trying to achieve two highly interrelated objectives: managing inflation expectations and protecting Fed credibility.

Managing Inflation Expectations

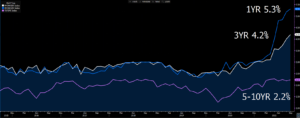

We’ve been beating this drum awhile, but there are growing concerns that inflation won’t subside next year as expected. Check out the graph below to see how forward expectations have changed in the last six months.

Source: Bloomberg Finance, LP

Powell still has cover fire if you stretch out the timeline far enough, but note how dramatically near term expectations have jumped in just six months.

Powell needs to rein those in. Tapering should help, but so does forward guidance. When Powell tells the market the FOMC is ready to hike if needed, he’s sending a signal that they won’t let expectations run rampant.

“The risk is that ongoing high inflation will begin to lead price and wage setters to expect unduly high rates of inflation in the future,” Mr. Powell said.

He’s trying to pull those expectations back down. Or, at a minimum, at least prevent them from running away.

Fed Credibility

The Fed has to acknowledge inflation has run higher than expected for longer than expected, otherwise it loses credibility around its own decisions and forecasts.

But that credibility also impacts inflation expectations, which as we addressed above is Powell’s primary objective right now. Credibility goes hand in hand with managing expectations. The Fed chair talking about rate hikes largely mimics the effects of actual rate hikes. The Fed can influence markets just by talking about something, but not if credibility is strained.

Powell is in that stage of the cycle when he has to acknowledge current conditions without abandoning his thesis that inflation will dissipate. Tricky, yes. But that’s why I think the market is overreacting to his comments.

I continue to believe he will remind markets that a Fed rate hike won’t resolve supply chain issues. Monetary policy is the wrong lever to pull right now and that inflation will fade in the coming quarters.

The LA port issue is a perfect example. People will take action to resolve the issues and the number of ships stuck off the coast will gradually decline. Rate hikes won’t help with that.

Week Ahead

Q3 GDP is the big news for rates. Nearly half of the S&P report earnings this week, including 5 tech giants that make up about 22% of the W&P weighting.