FOMC Primer – From Stabilization to Accommodation

On our son’s 18th birthday in May, he opened up a Robinhood account with $500 in savings. We were in the midst of covid lockdowns, so he bought stocks in companies he thought would do well in that environment. The first stock he bought was a vodka manufacturer…not sure why he thought they would be doing well…

In the course of two weeks, TSLA ran up from $328 to $497. He got in around $400 and rode it for a 25% gain in a week. He was rich. I was getting texts at least 5x a day showing his returns. His friends were asking if he would invest for them. “Dad, what’s a hedge fund? Is there, like, any special paperwork you have to fill out to open one?” He couldn’t believe how easy it was to make money in stocks.

Then, in one week, TSLA crashed from $497 to $333. Not only were all his gains wiped out, he had actually lost money. I didn’t get any texts from him that week. Turns out, he’s not nearly as chatty when his book is trending down.

He ended up selling and closing his account. I was surprised and told him the best traders in the world are only right 51% of the time. Learn from it, improve, move on. But he was done. He closed his account. He didn’t have the stomach for it, which I can respect. Unfortunately, I’m not sure it prepares him for the real world.

He took what remaining money he had left and is wants to buy some fancy gaming computer instead. Now that he’s down, though, he wants us to cover his losses. He wants us to subsidize him so he can afford the computer. Backstop his risk-taking. Bail him out. Chip in. How could he have known he would lose money?

Maybe TSLA’s collapse did prepare him for the real world after all.

Last Week This Morning

- 10 Year Treasury was up for much of the week, but ended down 6bps to 0.66%

- German bund closed at -0.43%

- 2 Year Treasury down a tad to 0.13%

- LIBOR at 0.15%

- SOFR is 0.09%

- CPI/PPI readings came in slightly higher than forecasted, but much lower than last month

- US budget deficit has reached $3T

- If Biden wins, will fiscal conservatives suddenly find their voices again?

- Weekly jobless claims rose again, not a good sign

- European markets were mildly disappointed by the ECB’s decision to leave rates unchanged and no new stimulus

- I can’t believe it’s been 19 years since 9/11. I have an entire group of employees that have no memory of that day.

- Wildfires are such a weird concept to this east coaster, but very few things seem scarier from afar. Watching the videos and images…just tough to wrap my brain around them. Good luck to Oregon and California.

- Football is back and KC has officially replaced Philadelphia as the fans most likely to boo anything

SOFR Caps

Our first SOFR caps are on the books. Everything is going pretty smoothly, with the documentation and bid packages largely feeling just like a LIBOR cap. The biggest change is the premium.

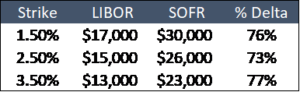

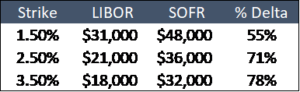

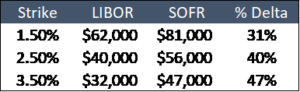

Here’s a pricing grid from one bank providing SOFR caps assuming a $25mm notional amount. This is intentionally conservative, so it is intended to provide context rather than actual pricing. While the premium is high on a percentage basis, I doubt a $15k SOFR premium is a deal killer for any of our clients.

2 Year

3 Year

4 Year

When will this premium dissipate?

- Liquidity – the more the market adopts SOFR as a viable index, providing greater liquidity and making it easier for a trader to hedge. This will be a gradual process.

- Competition – as more banks get into a position to trade SOFR, the premium will compress. That’s more likely to occur in 2021 than by year end. Caps don’t have huge profit margins so the banks aren’t rushing through a SOFR implementation process just so they can bid on an agency cap.

FOMC Primer – Stabilization to Accommodation

In July, Fed Governor Lael Brainard described the FOMC’s current mission as transitioning from “stabilization to accommodation.” In effect, the few first months of covid were about crisis management. Stabilizing markets, providing liquidity, and instilling confidence in markets.

The Fed is now moving into the next phase, accommodation. This transition likely kicked off with the Fed’s change to Flexible Average Inflation Targeting, continued with Jackson Hole, and will now be memorialized at Wednesday’s formal FOMC meeting.

Congressional stalemate. Election uncertainty coupled with a likely protracted legal battle. Covid. The greatest demand shock our country has ever experienced. The FOMC can ill afford to send mixed signals right now. I think we get a clearly defined roadmap for the next three years that basically says, “we are all-in and rates aren’t going anywhere for a while.” Anything less, and the markets might puke.

The only ambiguity I envision the FOMC holding onto will be some language around how the Fed needs to retain flexibility and that any of the potential conditions for hiking may not alone be sufficient to hike. That was one of the most poorly worded sentences I’ve ever written, and I’ve written a lot of those, but no matter how hard I tried, I couldn’t come up with a better way to word it.

In other words, just because inflation looks like it will be averaging 2.0% doesn’t alone mean they will hike. If unemployment is too high or financial conditions are too tight, maybe they hold off. These are guideposts, primarily meant to reassure markets that the Fed will not be hiking too early in the recovery.

Lead Pipe Lock Predictions for Wednesday’s Meeting

- On hold through 2023 – I think there’s a very good chance the Fed’s updated forecast for Fed Funds will indicate it will be on hold through year end 2023 instead of 2022. I am not in the consensus here, so take that with a grain of salt. Last month we highlighted how the Fed revised its timeline four times post-financial crisis, each time pushing the first possible hike out further. Let’s press fast forward on that inevitable process and get it over with. They don’t call him Jay “Easy Money” Powell for nothing. And for the record, “they” don’t call him that, only I do.

- Average Inflation Target – the statement (and subsequent Q&A) will likely remove references to the symmetrical objective of 2%, replacing it with language that reinforces the FAIT objective of averaging 2.0% inflation.

- Hi Phillips Curve, Bye Phillips Curve – Full employment, while still a statutory mandate, will be less influential in projecting inflation and monetary policy. We had 3.5% unemployment and little inflation, it’s time to stop thinking that full employment guarantees inflation.|

- Fiscal policy – Jay Powell has been more willing than his predecessors to call out Congress for failing to act. Monetary policy alone a healthy recovery does not make (Exhibit A – the last decade).

- Asset purchases – you know these as QE, but technically the Fed has not been calling its asset purchases since March, “QE.” It’s been calling them, “market functioning” purchases. Again, this highlights the move from stabilization to accommodation.

- Forecasts – Q4 forecasts will likely be revised up. The unemployment rate projections will be lowered, inflation and GDP raised. I would be surprised if they change any forecasts for 2021 or beyond. What’s the upside to raising those right now? Sit tight and see how the next six months play out.

- Evans Rule Redux – in 2012, the Fed instituted a policy generally referred to as the Evans Rule, named after Chicago Fed President Charles Evans. He had advocated for forward guidance to provide specific targets that the market could use to interpret FOMC rate timing. Effectively, the Fed wouldn’t hike until unemployment was below 6.5% or inflation was above 2.5%. I could imagine a similar takeaway, but this time both requirements must be met. For example, an unemployment rate target of 4.5% and inflation average of 2.0%. But in all scenarios, the Fed will reinforce that these are necessary but not alone sufficient to warrant a hike. Just because these conditions are met doesn’t mean the Fed will hike, but it will not hike without them.

Even if I’m wrong and the Fed doesn’t make these sort of changes on Wednesday, they are coming nonetheless. It just means they wait until after the election. Give the conspiracy theorists one more thing to count on post-November 3rd…

Financial Conditions, which hit an all-time low (accommodative) on September 1. Conditions tightened a little with the stock market sell-off, but we are still in exceptionally accommodative territory.

The Fed has done and is doing what it can. It is time for fiscal policy to take the baton.

Week Ahead

No life changing data releases ahead, and they wouldn’t matter any way with a Fed meeting.