Crash Landing Here

Good morning Giants fans! More than a few people this weekend told me the only thing more obnoxious than an Eagles fan is an Eagles fan at a Giants bar in Brooklyn celebrating a blowout while rocking an Eagles sweatshirt. I’m writing this on a flight back to Charlotte, so you’re getting an abbreviated newsletter while I contemplate what time to show up for the tailgating at the Linc next Sunday.

Take solace Giants fans. No, not in that you had your first winning season in five years, but that your head coach is a part time economist! After the game, Daboll was asked about the game but instead chose to use that time to provide his thoughts on a soft vs hard landing.

“Well, crash landing here,” Daboll said.

I respect Daboll’s commitment to being realistic, even if it came a few days too late.

Last Week This Morning

- 10 Year Treasury ran down to 3.37%, but rebounded to close the week at 3.48%

- German bund at 2.17%

- 2 Year Treasury at 4.18%

- LIBOR at 4.51%

- SOFR at 4.31%

- Term SOFR at 4.52%

- PPI came in at -0.5% vs expected -0.1%

- Empire State manufacturing index missed huge -32.9 vs expected -8.7

- Philadelphia Fed manufacturing index came in at -8.9 vs expected -11.0

- Retail sales came in at -1.1% vs expected -0.9%

- Existing home sale came in at 4.02mm expected 3.95mm

The End is Nigh

Markets don’t think the Fed will make it to 5%. Gundlach thinks the Fed won’t make it to 5%. I happen to think they will, even if they shouldn’t.

Regardless, the end of the tightening cycle is nigher than a clean Cowboys locker room.

Markets have this as a near 100% probability, and if the Fed disagreed, they would have sent signals before now. They will hike 25bps on February 1.

Over the last three months, Core PCE has annualized at 3.1%. The most recent monthly inflation print was negative, meaning disinflationary. Ron Insana weekly article in CNBC noted, “My friend and colleague, Tom Lee, of Fundstradt, points out that 59% of the CPI’s components are actually deflating, or falling, in price, suggesting more moderation on the inflation front in the months ahead.”

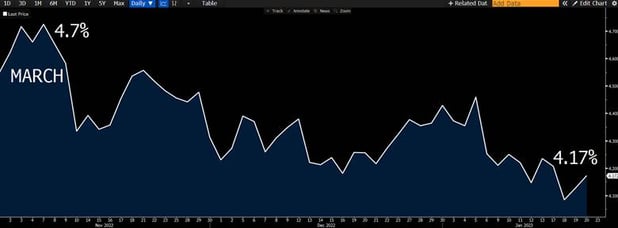

The 2yr Treasury is down 0.50% since the beginning of November. Remember, the 2T is the market’s projection of what Fed Funds will average over the next two years. The lower it goes, the more cuts the market is pricing in.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

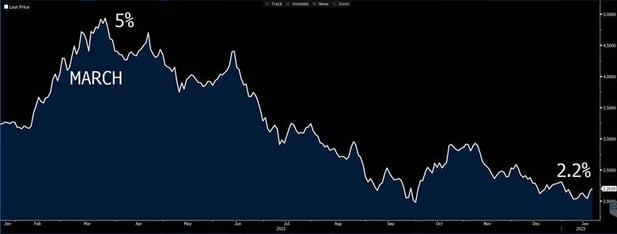

Since the first hike, 2-year inflation expectations have fallen from 5% to just over 2%.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

The following graph is the Supply Chain Pressure Index, but is instructive of what worries the Fed right now.

Supply chain pressures improved dramatically all year, but have leveled off at a level above neutral. I think this is exactly what keeps Powell up at night. What if the Fed pauses prematurely and inflation levels off at 3%?

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

I think 5% is still the most likely pausing point, but also think 5.25% is more likely than 4.75%.

You can tell the FOMC just held its mandatory annual messaging training:

Vice Chair Lael Brainard: “Inflation is high, and it will take time and resolve to get it back down to 2%. We are determined to stay the course.”

NY Fed President Williams: “monetary policy still has more work to do” than the Giants to get inflation to 2%.

Philly Fed President Harker: “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed. Also, Fly Eagles Fly!”

St Louis Fed President Bullard: “You’d probably have to get over 5% to say with a straight face that we’ve got the right level of the policy rate that will continue to push inflation down during 2023.”

Atlanta Fed President Bostic: “We are just going to have to hold our resolve. Three words: a long time. I am not a pivot guy. I think we should pause and hold there and let the policy work.”

Given the Fed’s track record of never being wrong, we should take them at their word…

10 Year Treasury

The current range on the 10T is roughly 3.40%-3.90%. While the effects of Fed tightening haven’t fully hit the system, positive news may come in suggesting resilience/strength (cough cough jobs). In the near term, that could put upward pressure on rates.

I love optimists. They’re adorable. They’re like all those Giants fans this week, “Hey, maybe we actually can actually beat the Eagles! I know we barely made the playoffs and the Eagles are 13-1 this year with Hurts as starting QB, but this time is different! Daniel Jones is the TRUTH.”

Let me introduce you to reality. There is no soft landing. Only a crash landing.

Every part of the curve is inverted. Recession signals don’t get much stronger than that.

Over the course of the year, I expect the 10T to move towards 3%.

The Bloomberg Rates team is calling for the 10yr Treasury to hit 2.50% in August.

Remember – although the best time to lock is right before the Fed starts hiking, the worst time to lock is right before the Fed starts cutting.

Week Ahead

Friday’s Core PCE is the most important data point, but Thursday’s Q4 GDP will also be critical. The Fed will be quiet because it always goes dark the week before the meeting.

But does anything else really matter than Sunday 3pm at the Linc?

See you at NMHC, I’ll be the guy wearing the Eagles shirt that says, “Nobody likes us and we don’t care.”