Powell Just Confirmed The Pause™

In the last few weeks, we’ve been to CA twice, Texas, Chapel Hill for a graduation, Nashville for a conference, Illinois for a 96th birthday, and then a statewide tournament (we finished tied for 3rd!). Assume I know even less about markets than usual in this week’s musings.

Last Week This Morning

- 10 Year Treasury at 3.69%

- German bund at 2.46%

- 2 Year Treasury at 4.29%

- LIBOR at 5.15%

- SOFR at 5.05%

- Term SOFR at 5.09%

- Retail Sales MoM came in at 0.4% vs 0.8% expected

- NY Empire State Manufacturing Index came in at -31.8 vs -3.75 expected

Hike/Pause/Cuts?

On Thursday, the market had a 15% chance of a hike on June 14th. Generally speaking, if the Fed disagrees with the market odds they will keep signaling until the odds exceed 60%.

That means Powell took the podium on Friday with an opportunity to push those odds up. Instead, he signaled The Pause™.

“We haven’t made any decisions about the extent to which additional policy funding will be appropriate. But given how far we’ve come, as I noted, we can afford to look at the data and the evolving outlook.”

That may not sound like much, but if he thought the market was underestimating a hike, he would have said something different.

After the speech, here are the odds the Fed hikes one more time at any point over the next three months.

June 14 17.4%

July 26 19.4%

Sept 20 12.5%

Conversely, the market has just an 8.3% chance of no cuts before year end.

And yet the 2T (which drives cap prices) finished the week higher by 0.25% and is up 0.50% in less than two weeks. What gives?

The market is starting to believe the Fed will be on hold longer before cutting. The 2T is what the market expects Fed Funds to average over the next two years, so this would keep year 1 higher and drag the average up with it. This will keep one year cap prices elevated until the market starts pricing in aggressive cuts.

This ties out with what I’ve been expecting, which is probably the strongest indicator that something different will come to pass. JPM and SMBC disagree with me, calling for cuts late summer or early fall. With Jackson Hole in August, there’s a definite chance the Fed could signal a pivot, but I still don’t think so.

Inflation has proven stubborn and the Fed will endure economic pain for longer than it would otherwise to ensure inflation moves lower. As is often repeated, a recession is a feature not a bug of a tightening cycle. The Fed expects unemployment to exceed 5% next year, which means they are already expecting pain.

That being said, it’s easy to talk tough when Americans haven’t started losing jobs yet. But with an election in 2024, how much pressure will the Fed come under to ease conditions?

Whether the Fed cuts later this year or the beginning of next year, the economy is slowing considerably and we’re just waiting for the 5% increase in rates to work itself through the system.

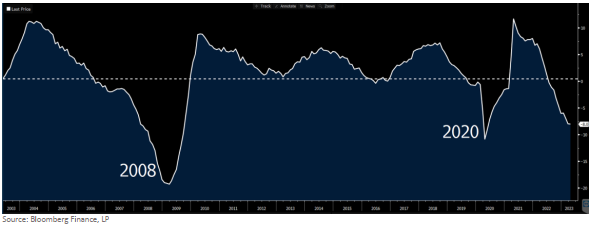

As a matter of fact, the Leading Economic Indicators index experienced its 13th consecutive monthly decline, the longest since 2008/2009. Furthermore, this month’s drop was the single biggest drop since September 2009. Not great company to keep.

Debt Ceiling

Nope.

Week Ahead

Core PCE is the headline data of the week with lots and lots of Fed speeches, so plenty of opportunities to massage market expectations.