This is Fine

I’m writing this in the middle of the night after waking up thinking the house was on fire. No, our smoke detectors weren’t going off (which is a different bag of problems). It just smelled like the house was on fire. It was so strong it woke me up. It was pungent. It smelled so bad, I was nauseous.

Whatever middle aged out of shape springing out of bed looks like, take it down two notches and that’s what I did. I found our 15 year old in the kitchen. He had burned popcorn. Smoke was everywhere. “It’s ok, it’s fine” he reassured me through the haze.

How bad do you have to burn popcorn that it wakes you up on a different floor? Everything smelled like burnt popcorn. Nothing has helped thus far. I have fans on fans on fans. I have doors wide open. The smell is so bad I’m sitting outside typing this.

Some initial questions:

- How much smoke, exactly, was pouring out of the microwave before you intervened?

- Do your nostrils work?

- How distracted were you by the youtube video you were watching and why are you lying that you weren’t?

- Why didn’t our smoke detectors work and don’t use the excuse that I stripped them all of batteries over the years when they started beeping in the middle of the night

- How long before my clothes stop smelling like smoke?

- Wait, you’re supposed to be able to drive a car soon? (For long-time readers, this is the same son that when he was six years old, I wrote about urinating in bottles in his room because he would get so mad at getting in trouble he refused to leave even to use the bathroom. We found them months later.)

- What’s the lowest score someone can get as a parent?

- If four out of five kids turn out ok, that’s still good enough, right?

- What do you mean you know I didn’t remove the batteries from the smoke detectors and instead used a knife to cut the wiring when the beeps continued even after I took the batteries out?

- If your mom asks, the smoke detector was going off, right?

- Would you like some cookies and cream ice cream instead?

- How do you feel about state schools?

He reassured me again, “This is fine.”

Last Week This Morning

- 10 Year Treasury at 3.37%

- German bund at 2.15%

- 2 Year Treasury at 3.76%

- LIBOR at 4.83%

- SOFR at 4.80%

- Term SOFR at 4.81%

- The curve is the flattest its been since last summer

- “Calling Deutsche Bank to the dance floor”

FOMC Meeting

I won’t rehash the blast we sent out Wednesday after the FOMC meeting (see here) , but rates plunged Friday as markets backed out a hike at the May 3rd meeting. Futures now put an 88% probability that the Fed is done hiking.

St Louis Fed President James Bullard promptly announced that he was raising his FF forecast to 5.625% this year. We’re already reserving his place on the next webinar page where we highlight infamous Fed quotes about hiking right before the Fed starts cutting.

His new projection is a full 2.00% higher than the forward curve this time next year. In fact, the forward curve puts SOFR below 3% by year end 2024.

The Fed keeps beating the drum that inflation is still too high, which is why Friday’s Core PCE is so critical. The y/y print is expected to remain at 4.7%, while the m/m is forecasted to drop from 0.6% to 0.4%. I’m not sure Powell has any prayers left to ask for inflation to fall, but if he does, he’s cashing them in now.

Whether the Fed hikes in May or not, I suspect it will spend considerably more energy convincing the market it has no intention of cutting rates in 2023. “Sure, we’re done with the hikes, but that doesn’t mean we will cut any time soon…”

Except it does.

This will be fine.

A Tale of Two Tools

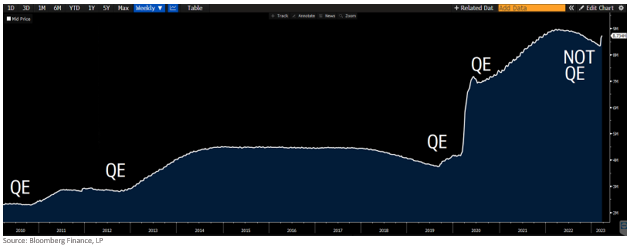

If Powell’s primary messaging goal is to convince the markets that the Fed won’t cut this year, the secondary objective is that the Fed has two distinct tools in play right now.

- Fed Funds is for fighting inflation

- QE is for financial stability

Powell told everyone on Wednesday that the recent discount window emergency borrowing is definitely not QE. A picture is worth a thousand words…

Even if I disagree with his statement, I believe that he has to toe that line. How can he claim to fight inflation with rate hikes if they risk financial instability? Instead, Tool A fights inflation and Tool B provides financial stability. “See guys! We can totally do one but not the other!”

The market’s reaction is a clear signal that it’s not buying what he’s selling. Some fun flashbacks about why the market is so skeptical…

Ben Bernanke, then-Chairman of the Federal Reserve, in 2007: "At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained."

Henry Paulson, then-U.S. Secretary of the Treasury, in May 2007: "The housing market is at or near its bottom, and the problems in the subprime market will not likely spread to other parts of the economy."

Timothy Geithner, then-President of the Federal Reserve Bank of New York, in June 2007: "We believe that the systemic risks associated with the turmoil in the subprime mortgage market have been largely contained."

Christopher Cox, then-Chairman of the U.S. Securities and Exchange Commission, in July 2007: "We have a good deal of comfort about the capital cushions at these firms at the moment."

New York Fed President Dudley, in 2007: “The market turbulence that began in earnest on February 27 is now a distant memory. Risk appetites have recovered, volatility in the fixed income and equity markets has declined, and the U.S. equity market has climbed to a new high.”

This is fine.

Tightening Credit

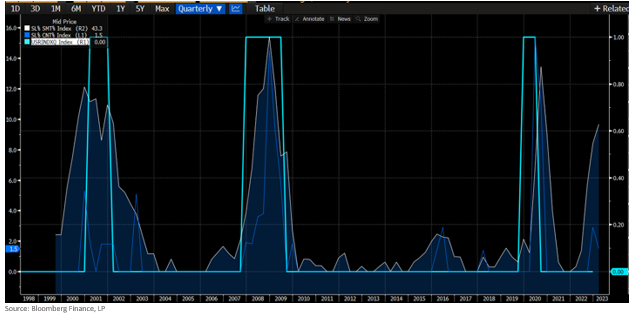

Perhaps the most unexpected development from Wednesday’s FOMC meeting is how much energy Powell dedicated to tightening credit conditions. He suggested the recent banking issues would have a material impact on lending standards and effectively replace the need for some amount of hikes. I’ve told you the story of how one of our swaps traders cautioned us all in 2007 that a credit crisis leads to the worst recessions.

Fortunately for us, the Fed conducts a survey of senior loan officers on how tight lending is becoming. In the last 25 years, there have only been three periods where the survey was higher than current levels. The dot-com bust, the financial crisis, and covid. We drew a helpful box around the recessions just in case we are being too subtle.

This is fine.

Here’s the thing - maybe all this will be fine. I have no idea how this will play out, but I know that three weeks in is too soon to give the all-clear signal.

Cap Prices

Cap prices are well off their peaks, but nowhere near as low as they should be given rate movements. It’s impossible to tell, but we suspect cap prices would be 30%-40% lower if volatility returned to March 2022 levels.

Week Ahead

Other than bank implosions, markets will primarily be focused on Friday’s PCE report and all the Fed speeches throughout the week reassuring us the banking system is sound and resilient.

Never thought I would be comparing our 15 year old burning popcorn to a Jay Money press conference, but times are strange right now.