Agency SOFR Caps

Agency SOFR Cap Update

Freddie and Fannie kicked off their transition from LIBOR to SOFR floating rate products in late Q3 2020. With many multifamily borrowers beginning to close on their first SOFR based loans, we wanted to address some of the frequently asked questions and provide an update with where things stood on Agency SOFR caps.

LIBOR vs. SOFR – Cap Economics

The switch to SOFR doesn’t change much as far as the economics of the underlying interest rate cap. The Agencies selected NY Fed 30D SOFR as the replacement index, and aside from a couple tweaks to the language, everything pretty much looks and feels the same.

Index – BBA USD LIBOR (1 month)

Accruals – from and including the 1st calendar day of each month to but excluding the 1st calendar day of the following month

Payments – paid on the 1st calendar day of the next Accrual period

Resets – 1st day of each Accrual period with a one (1) London banking day lookback on resets

Index – NY FED 30D SOFR

Accruals – from and including the 1st calendar day of each month to but excluding the 1st calendar day of the following month

Payments – paid on the 1st calendar day of the next Accrual period

Resets – 1st day of each Accrual period with a one (1) New York banking day lookback on resets

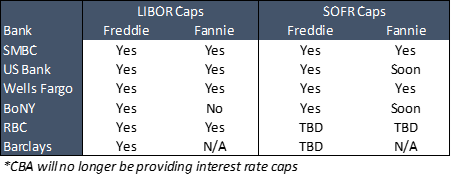

SOFR cap providers and execution

Most of the banks previously approved to sell Agency LIBOR caps are set up to trade Agency SOFR caps too. Overall, the transition has been very smooth and there are no notable changes to the onboarding and execution process.

Below we’ve included a list of Agency approved cap providers and our understanding of their timelines to get up and running.

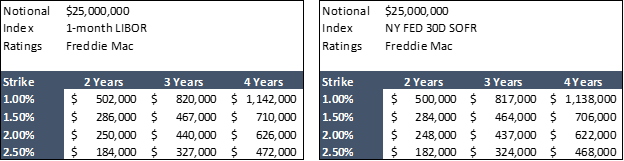

Premiums for SOFR caps

The only notable difference when comparing LIBOR and SOFR hedges is a slight premium for the former index.

This is due to a mix of less appetite for LIBOR trades as the market continues to move towards SOFR and, in the case of Agency caps, NY FED 30D SOFR being slightly lower than LIBOR since it’s set in arrears. We’ve included pricing comparing various structures below to help illustrate this.

The cost difference between the two indices is subject to fluctuate as banks adjust their models, new developments are announced, and other banks enter the space.

What to Expect Going Forward

Cap executions feel the same as they did based on LIBOR. There’s no need to worry about the cap impacting your closing - the process hasn’t changed and is as smooth as before.

Many banks have already finished, or are wrapping up, document negotiations with Freddie and Fannie to be in a position to trade SOFR caps. As more banks have entered the space, the market has become more liquid, causing the premium for SOFR caps to ease.

Please don’t hesitate to reach out should you have any questions or if we can do anything to help.

Resources

- Pensford.com/SOFR

- https://www.newyorkfed.org/arrc/sofr-transition

- https://mf.freddiemac.com/news/2020/20200817_libor_transition_update.html

- https://multifamily.fanniemae.com/news-insights/multifamily-wire/new-arm-5-5-sofr-indexed-sarm-arm-7-6-and-hybrid-arm?_ga=2.153708728.1269969991.1603812566-1273951460.1603812566

- https://mf.freddiemac.com/news/2020/20200724_sofr_based_loan_rate_cap_announcement.html

Click to Open: Agency SOFR Caps PDF