Mitigating Prepayment Penalties

In most cases, the moment a fixed rate loan is closed there’s a considerable prepayment penalty. For instance, if a 10-year fixed loan is locked at 2.00% over the 10T (4.00% at the time of writing), the note rate would be 6.00%. However, if borrower wanted to prepay the day after closing, the 10T would be the “replacement rate” in the calculation. In other words, borrower would need to make up the difference (2.00%/year) for the remaining term (10 years) implying a penalty of about 20% before discounting.

Given the spike in cap costs and escrows, medium term fixed loans have become a popular option for many borrowers who traditionally opt for floating debt and the flexibility that comes along with it. The same back of the envelope math applies to a 5 year fixed loan, meaning that locking at 2.00% over the 5T results in a penalty as high as 10% day one.

Clients frequently ask if there’s a way to hedge or mitigate prepayment penalties. The Agency’s offer prepay flexibility options in exchange for a higher spread which can make a lot of sense. There’s also an option using interest rate floors. We’ll examine both here in this case study.

A Hypothetical Example

Assume an Agency fixed loan is closed with the following terms:

Loan Amount $25,000,000

Loan Term 5 years

Amortization 2 years I/O followed by 30 year amort

Note Rate 6.27% (5T at the time of writing + 2.00%)

Prepayment 4.5 year YM, 3 months 1%, 3 months at par

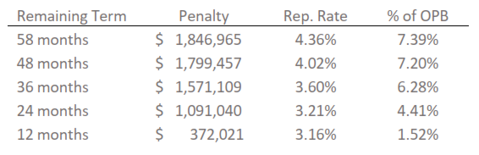

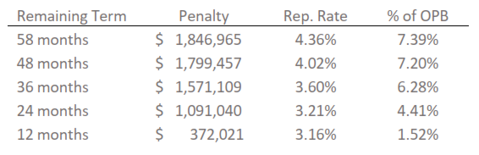

If borrower elected to prepay a couple months after closing, using our Agency Yield Maintenance Calculator, the prepayment penalty would be about $1.85mm, or a 7.4% penalty. But borrowers don’t intend to prepay right after closing, they’re interested in what the prepayment penalty is expected to be in a few years.

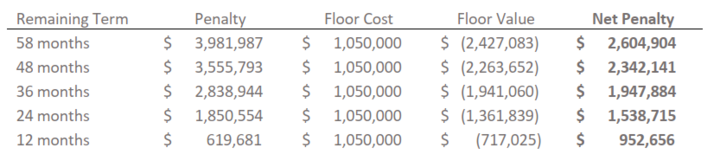

The penalty generally gets lower over time since fewer years remain, but as outlined in our resource Don’t Underestimate the Prepayment, the effect of rolling down the yield curve comes into play too. Here’s a yearly burndown based on current market rate projections.

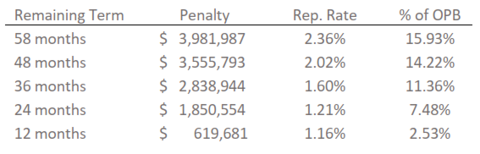

However, if rates are lower in the future, like many borrowers are hoping today, the penalties will look worse.

Here are the same scenarios but assuming rates are 2.00% below expectations.

Now that we’ve laid out some scenarios assuming borrower didn’t opt in for prepayment flexibility, let’s take a look at some scenarios which assume the borrower did.

Flexible Prepay Options

We understand the Agency’s offer various levels of flexibility for their fixed products, but they come with a spread premium. For instance, on a 5 year fixed, in lieu of 4.5 year YM, 3 months 1%, 3 months at par, the prepayment provisions could be something like:

- 4 year YM, 1 year at par

- 4 year YM, 1 year at 1.00%

- 3 year YM, 2 years at par

- 3 year YM, 2 years at 1%

- 5%, 4%, 3%, 2%, 1%

All these options have different spread premiums. Let’s assume the borrower picks the “3 year YM, 2 years at par option”. The spread premium is about 0.50%, so building off the previous example, this borrower would be fixed around 6.77%.

Loan Amount $25,000,000

Loan Term 5 years

Amortization 2 years I/O followed by 30 year amort

Note Rate 6.77% (5T at the time of writing + 2.00% + 0.50%)

Prepayment 3 year YM, 2 years at par

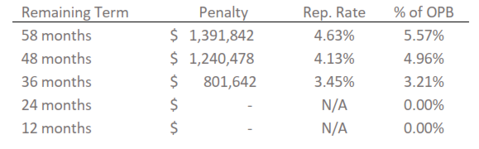

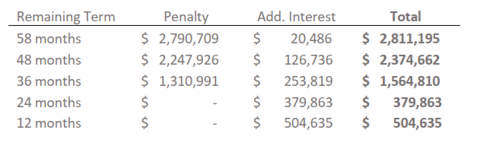

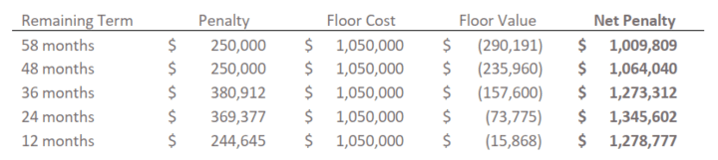

Here’s a prepayment burndown based on market projections under the new loan terms.

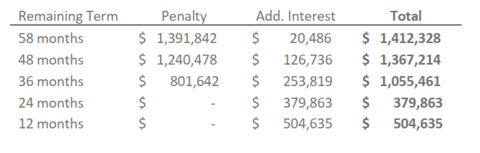

The previous table only outlines the projected penalty but doesn’t take into account the additional expense associated with a higher spread. The table below includes both the prepayment penalty and additional interest as a result of the “spread premium”.

What about the “rates down 2.00%” scenario you ask? Here’s that one too.

Takeaway – Flexible Prepay Options

Since many borrowers are simply trying to bridge the gap between the current market and greener pastures where rates are low, the additional spread premium in exchange for prepayment flexibility can result in material savings. This is especially true since penalties rise when rates fall, and many borrowers intend to sell or refi as soon as they can. Based on the above scenarios:

- If rates follow market expectations, the prepay flexibility in this example would save as much as $700k when compared to standard YM.

- In the rates 200 bps below expectations scenario, the prepay flexibility saved as much as $1.47mm.

- If rates spike or borrower doesn’t prepay the loan, the additional flexibility would end up costing the borrower when compared to standard prepayment terms as a result of the higher spread.

What if you’re looking at a loan where the lender doesn’t have prepayment flexibility?

There’s no magic bullet, but one potential solution is to buy a derivative product that gains value when rates fall. The idea being, as rates decrease and your penalty on the loan rises, the value of the derivative contract increases helping net out the liability. Buying an interest rate floor would do just that.

How Does a Floor Protect Me?

Floors are most frequently seen in loan documents but can also be bought from third party banks as a separate instrument (just like caps). If your loan has a built-in floor (eg 4.00% SOFR), you could enter a separate derivative contract that pays you in the event your floating rate falls beneath the strike.

We’ve got more info on floors in our resource here. Unless otherwise stated, from here forward when we refer to floors, we’ll be talking about a floor derivative contract.

Since interest rate floors gain value when rates go down (it’s the opposite of a cap), a floor could be purchased and used to hedge prepayment penalties. Here’s how that would work.

Rates – Treasurys vs Swaps

The value of any interest rate derivative is driven by swap rates, which are just the average of SOFR for a given period of time. Swap rates are highly correlated with Treasurys, and they tend to move directionally. In other words, if the 5T falls 100 bps, 5 year swap rates will be down a similar amount too.

We’re going to continue building off the original example to help paint the picture.

Loan Amount $25,000,000

Loan Term 5 years

Amortization 2 years I/O followed by 30 year amort

Note Rate 6.27% (5T at the time of writing + 2.00%)

Prepayment 4.5 year YM, 3 months 1%, 3 months at par

If at the time of loan closing a 5 year floor is purchased with an at-the-money (ATM) strike, borrower would effectively be “locking in” the prepayment penalty.

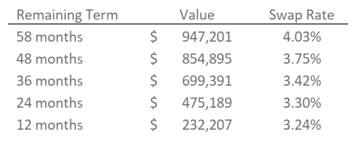

A 5 year floor with a 4.03% strike (ATM), with terms matching the loan amortization and other economics, would cost about $1.05mm.

Here’s what the market projected value of the floor is if you elect to prepay the loan and unwind the floor contract early.

And here’s the original prepayment penalty burndown based on market expectations.

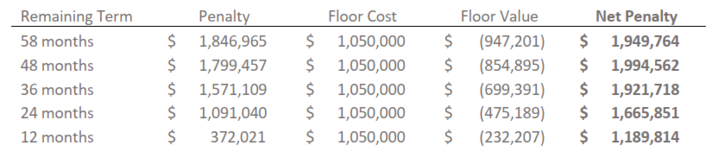

Borrower would prepay the loan per usual, but when they prepay, they also unwind the interest rate floor to recoup the remaining residual value. For instance, if you prepaid the loan after 2 years (36 months remain) and rates follow expectations, the net penalty would be:

- $1,571,109 penalty - $699,391 floor value = $871,718 net

- We didn’t forget that you paid $1.05mm for the floor though. Adding that back in, the total penalty is $1.92mm

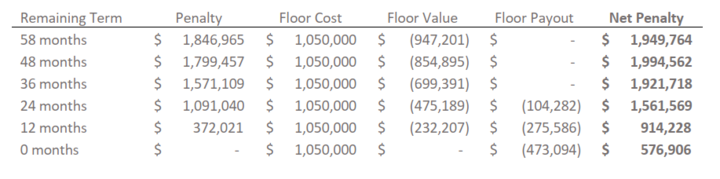

Here’s a table outlining the projected net penalty after accounting for all three factors.

Since the penalty without a floor was projected to be $1.57mm and with the floor it’s $1.92mm, you’re probably wondering why you’re still reading this case study? Bear with us for a moment

For one, this table doesn’t account for the value expected to be recouped by the floor over time. We’ll come back to that later.

First, let’s look at a scenario where rates are 200 bps lower a couple years from now.

- As we previously established, the prepayment penalty with 3 years remaining is projected to be around $2.84mm

- The value of the floor if rates are down 2.00% is projected to be around $1.94mm

- $2.84mm penalty – $1.94mm floor value + $1.05mm floor cost = $1.95mm

In other words, the increase in the value of the floor offset the increase in the penalty on the loan such that the net penalty was materially the same.

Here’s the full table outlining the projected net penalties assuming rates down 2.00%.

For reference, here’s a table outlining the projected net penalties assuming rates up 2.00%.

If rates fell 2.00%, the net penalty would have been as much as $1.4mm higher had borrower not purchased a floor. If rates jumped 2.00%, the net penalty would have been $750k-$1mm lower in almost all scenarios.

Bottom line – the floor route is generally more expensive than taking a higher spread in exchange for prepayment flexibility, but if your lender doesn’t have the ability to offer flexibility, it certainly can outperform no hedge at all.

But Wait, There’s More

The floor does one other important thing. As we previously established, if you buy a floor and rates fall below it, it begins to pay out (like a cap does when rates exceed it).

If you have a fixed loan but buy a floor at 4.03%, when rates go below 4.03% then you start receiving payments from the bank each month.

- If SOFR goes to 1.00%, the floor is paying out 3.03%.

- You’re paying 6.27% fixed on the loan but receiving 3.03% from the floor, so you have a net rate of 3.24%

If you buy a floor and rates go below it, you recognize the benefit of rates going lower and it feels like you’re floating.

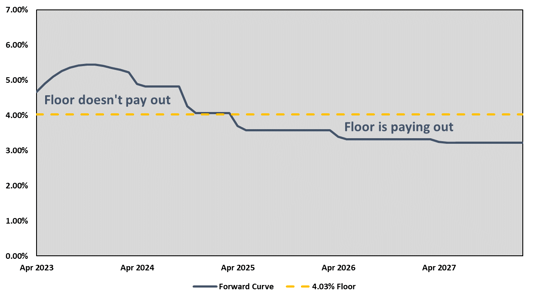

This is an important concept. Term SOFR today is 4.71%, but the current forward curve puts it below 4.03% in 2 years, and as low as 3.22% in 2027. The next graph compares the current forward curve to the floor.

Assuming rates follow the current forward curve, the floor is projected to pay out $473k over the next 5 years. In other words, almost half of the $1.05mm cost is expected to be recouped if you never prepaid.

- On the flipside, if borrower took the 0.50% spread premium exchange for the flexibility but never prepaid, they would incur an additional $628k of interest over 5 years.

Below we’ve included one more table which outlines the net penalty under current rate expectations after accounting for the floor payout.

The further rates go below expectations, the more the floor could pay out helping offset the upfront cost and lower the net penalty. There are countless scenarios we could run, but in the “rates 2.00% lower” scenario, this means the net penalty would be even lower.

There you have it – the floor can help protect against your prepayment penalty from going through the roof and it allows you to recognize the benefit of rates being lower when the Fed cuts.

Keep in mind, if you wait to buy the floor once rates have begun to fall, it might be too late. Just like cap costs increase when rate expectations rise, floor costs increase when rate expectations fall.

Swaptions can also be used to hedge the prepayment penalty in a similar way and at a cost that’s slightly less. For instance, a swaption with a 4.03% strike could be purchased for around $950K, or $100K less than the floor.

The downside to the swaption is its value is driven by the same thing as the floor (Swap rates) but the swaption wouldn’t begin paying out when rates go below the strike like the floor. While the floor is more expensive, if rates followed expectations and the loan was never prepaid, $473K of the floors cost would be recouped. If the swaption was never exercised, it would expire worthless, and nothing would be recouped.

Notes/Caveats

- Under the flexible prepay loan example we’ve assumed the same proceeds can be obtained after accounting for the “spread premium”

- The floor unwind values assume the spread between Treasury and swap rates remains constant

- The yield maintenance “replacement rates” are calculated using current Treasury yields and forward starting swaps to back into implied future Treasury yields

Conclusion

Borrowers who are doing Agency fixed loans might consider taking a higher spread in exchange for prepayment flexibility if the business plan calls for a near term sale or refi.

Floors can also serve as an alternative way to mitigate prepayment penalty risk as well as give borrowers exposure to floating rates allowing them to potentially recognize upside following the inevitable future rate cuts.