Replacement Hedge Strategies - Part Two

Overview

Many borrowers with upcoming hedge maturities wonder if there are alternatives to a vanilla cap that they should consider. Part two of this resource focuses on borrowers with bank debt where the bank has the ability to offer swaps and other derivatives. For strategies to hedge bridge or Agency debt, see part one.

Hedging Bank Debt

Borrowers with non-bank debt (such as bridge or Agency) are often limited to purchasing caps since the hedge must come from a third party. This is because hedges such as swaps or collars create credit exposure which must be secured, unlike caps which are paid for upfront.

When the lender is a bank with an internal swap desk, the swap desk will use the real estate securing the debt to secure the hedge exposure as well. If the swap provider is a third party, they would require some sort of collateral to secure the exposure (typically cash or Treasurys), which often is a deal killer.

With the above in mind, borrowers with bank debt frequently have the option to execute swaps or collars. Some potential hedge strategies to consider include:

- Swaps with rate buydowns

- Costless collars

- “Step down” strike collars

- Collars with a floor buydown

Swaps with Rate Buydowns

An alternative to capping is entering into a swap for the same desired term and “buying down” the rate to match the lender’s max requirement. Where cap costs are driven by rate expectations and time/volatility, swaps are only driven by rate expectations.

By eliminating the volatility component, borrowers are often able to obtain the same level of protection using the swap for a lower cost than the equivalent cap. Below, we’ve outlined the vanilla swap rate (no buydown) for a 2-year swap.

Notional $25,000,000

Swap term 2 years

Index Term SOFR

Mid market 4.95%

Credit charge 0.10%

Swap rate 5.05%

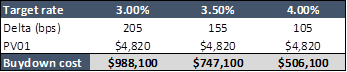

Next, we’ve outlined the cost of buying the swap down to 3.00%, 3.50%, and 4.00%.

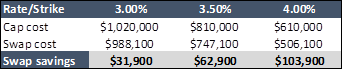

Finally, we’ve compared the cost of swapping with a rate buydown to purchasing the equivalent cap. As seen below, the swap is projected to save over capping at the equivalent strike.

Since swap breakages are driven in part by the rate locked in, the rate buydown helps mitigate any potential future prepayment penalty by lowering the rate day one. The borrower also doesn’t miss out on floating lower until SOFR is below the swap rate.

One other benefit of swapping with a rate buydown is the ability to combine a partial cap and swap to get an overall blended rate.

- For instance, if lender required a 4.00% hedge, borrower could swap 50% with a rate buydown to 3.00%, and cap 50% with a 5.00% strike.

This gives a blended rate matching the lender requirement, mitigates the prepayment penalty on the swap, retains some exposure to floating rates, and in some cases, is even cheaper than the equivalent 100% cap.

For more on the mechanics, check out our resource Buying Down the Swap Rate.

Costless Collars

A collar is when a borrower buys a cap at a higher strike and sells back a floor at a lower strike, helping offset the cost of the cap. This creates a ceiling and floor on the floating rate, resembling a collar.

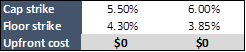

The value of the floor sold will often match the cost of the cap purchased resulting in a cash neutral or “costless” execution. Below we’ve outlined a few sample 2-year costless collar structures.

Notional $25,000,000

Term 2 years

Index Term SOFR

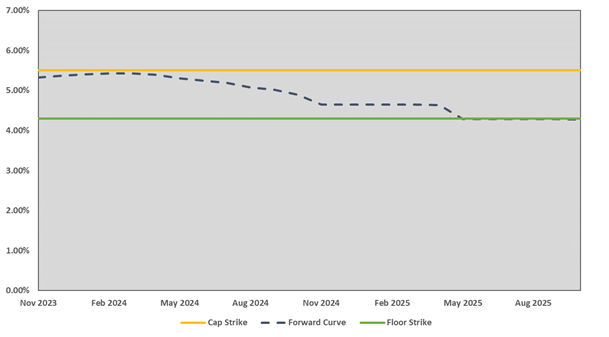

Once a collar has been executed there are three potential outcomes each period. Below we’ve outlined these using the buy 5.50% cap / sell 4.30% floor example.

- If SOFR is above 5.50%, the cap is in-the-money and borrower receives a reimbursement from the hedge provider just like with a vanilla cap

- If SOFR is above 4.30% but below 5.50%, neither the cap nor floor are in-the-money and borrower just pays floating

- If SOFR is below 4.30%, the floor is in-the-money and borrower owes the hedge provider for the difference between SOFR and 4.30%

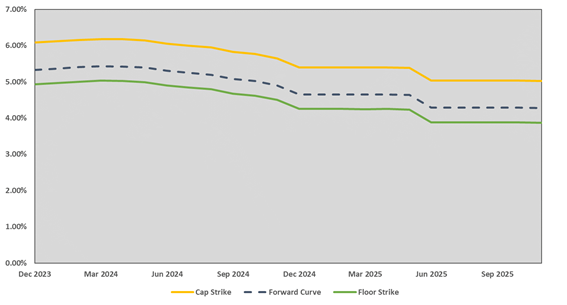

Here’s the above collar structure graphed against the forward curve.

In the above example, the cap strike is set above the peak of expectations and SOFR is projected to be below 4.30% for 6 months, meaning you’re trading a cap projected to pay nothing for a floor projected to have some level of liability.

Generally when structuring a collar the cap strike is set above the swap rate and the floor strike below. With the 2-year swap rate currently at 5.05%, structuring a costless collar with a 5.00% cap is unachievable. Borrowers needing a cap strike at or below 5.00% may want to look elsewhere for a cashless hedge. That said, a borrower can still do a collar and sell back a floor at a lower strike to offset some of the cap premium, however they would still need come out of pocket to cover the remainder of the cap premium.

If this isn’t attractive, there are a couple other variations of the collar to consider too.

Step-down Strike Collars

Remember, hedges are so customizable you can cause yourself analysis paralysis. This is one of those structures, but we’ll keep it high level. Raising the cap/floor strikes when the curve is highest allows borrower to obtain lower cap/floor strikes when the curve is lower. This is what we refer to as a “step-down” strike collar.

Below we’ve included a sample variation of this structure. The cap strikes were set 0.75% above the curve and the floor was set 0.45% below the curve. Like the previous structure, this one is costless too.

This structure can be attractive since the cap and floor strikes go lower over the course of the hedge. This provides a benefit under the cap if rates are “higher for longer” but rates can also fall 0.45% more than expected before the floor kicks in. It actually looks like a collar too!

Collar with a Floor Buydown

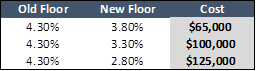

If neither vanilla nor stepdown costless collars seem attractive, one more option is to consider a collar with a floor buydown. Just like it sounds, this is when you enter into a collar, but rather than it being costless, you pay cash to lower the floor.

Viewed another way, this is where you buy a cap and sell back a floor, which offsets some (but not all) of the cap premium. Below we’ve outlined a few examples building off the vanilla, buy 5.50% / sell 4.30% scenario.

This could even be combined with the step-down collar example. For instance, in lieu of the floor strikes being 0.45% below the curve, they could be lowered to 1.45% below the curve for $85k.

Takeaway

These are just a few of many variations of swaps and collars that could potentially make sense in the current environment. While there’s a benefit to keeping things simple, thinking more strategically around what protection is being purchased makes more sense now than ever.

If you’re a borrower with bridge or Agency debt, 99% of the time a cap will be the only hedge that can be utilized. For more on potential cap strategies, take a look at part one of our resource here.

Pensford was formed to provide strategic advice around hedging and defeasance for commercial real estate borrowers. Let us help you overturn every stone and think through potential alternatives – we love that stuff. Reach out to pensfordteam@pensford.com or 704-887-9880.