Replacement Hedge Strategies - Part One

Overview

Many borrowers with upcoming hedge maturities wonder if there are alternatives to a vanilla cap that they should consider. We often say that hedges are so customizable you can cause “analysis paralysis” but the flexibility is dependent in part by who your lender is. Part one of this resource focuses on borrowers with debt such as Bridge or Agency. See part two for potential strategies with bank debt.

Hedging Bridge and Agency Debt

Due to the nature of Bridge and Agency debt, 99% of the time borrowers are limited to caps for hedging. Some of the cap strategies to consider include:

- Deeply in-the-money (ITM) strikes

- “Step down” strikes

- Longer terms than the lender minimum

Deeply ITM Strikes

The lower the cap strike, the more the cost increases due to a greater intrinsic value (projected payout). However, lower strike caps also have a smaller percentage of the cap cost attributed to time/volatility than higher strike options. Said another way, buying deeply ITM caps is arguably a more efficient use of funds, since more of your money goes to anticipated protection rather than time/volatility.

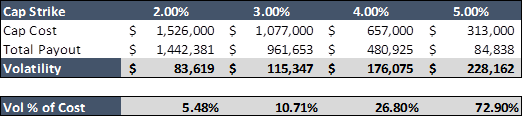

To help illustrate the concept, below we’ve outlined the breakdown of the cost vs projected payout for several different cap strikes.

Notional $25,000,000

Cap term 2 years

Index Term SOFR

Many borrowers are concerned if they buy the deeply ITM option and rates fall that they would’ve been better off with the highest strike. This is certainly a real risk, but rates can average slightly below expectation and the lower strike still come out ahead from a net cost/benefit standpoint.

Deeply ITM caps also have the added benefit of reducing interest reserves due to having a lower max rate.

“Step Down” Strikes

In a rising rate environment, a popular strategy is to purchase a lower strike for the earlier portion of cap (eg. year 1) and increase the strike in the latter half of the cap (eg. year 2). This helps balance cost and protection and is known as a “step up” strike.

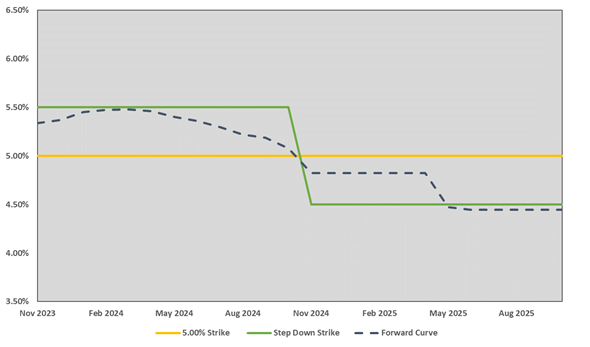

SOFR is 5.34% today, projected to be 4.82% in a year, and 4.45% in two years. Borrowers can utilize the same “stepped” strike concept in the current environment by purchasing a higher strike such as 5.50% year 1 and lowering the strike to 4.50% in year 2.

This strategy is frequently viewed as having two benefits:

- Obtain a tighter blended strike for less than the cost of the equivalent vanilla cap.

- For example, a 5.50% / 4.50% stepdown strike has a blended average rate of 5.00% over 2 years but the upfront cost is ~6% lower than a vanilla 2 year 5.00% cap.

- Raise the strike in the earlier portion of the cap when rates are projected to be highest to reduce the amount of prepaid interest. Lower the strike in the latter portion of the cap when rates are projected to be lower in case the market is underestimating the path of rates today.

To help illustrate the concept, here’s a visual of the 5.00% strike, 5.50% / 4.50% step down strike, and forward curve.

Longer Terms Than the Lender Minimum

In a typical rate environment, cap costs increase exponentially with term, which is a result of (i) increasing uncertainty, and (ii) rate expectations.

- The further out a trader hedges, the less certain they are on the path of rates, meaning the more they charge. We look closer at this in our resource The Hidden Driver of Cap Cost: Volatility.

- If the forward curve projects a cap strike to be in-the-money (ITM) in the future, that projected payout is baked into the cap cost. Costs generally increase if the forward curve is close to the cap strike too.

While cap costs still increase with term today, the inverted curve means the bulk of a cap’s cost is attributed to the first 6-12 months and longer term caps can be purchased without an exponential increase in cost.

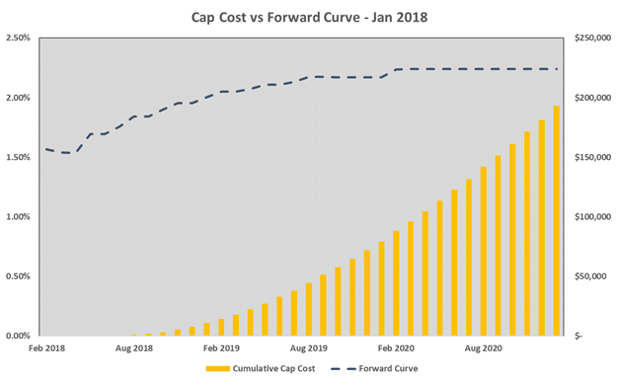

Below we’ve outlined the cumulative cost by month of a 3 year at-the-money (ATM) strike cap in a normal rate environment. At the time, the ATM strike was 2.04%.

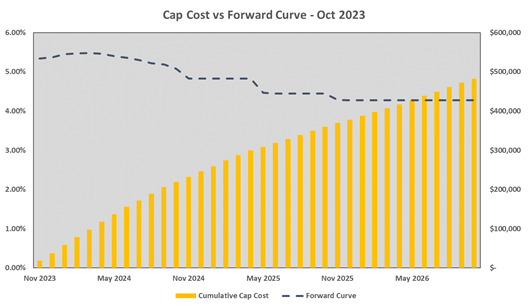

Next, we’ve outlined the cost of a 3 year ATM strike (4.80%) cap today.

Comparing the two scenarios, the bulk of the cost is built into the first year today where the first year in 2018 was practically free. Since markets are projecting rates to fall in the latter portion of a cap today, moving further away from the strike, the cost increases at a slower rate.

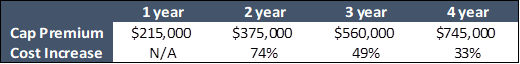

To further illustrate the concept, below we’ve included the cost of generic 4.80% caps for 1-4 years.

Notional $25,000,000

Strike 4.80%

Index Term SOFR

As outlined above, a borrower could buy a 2 year cap for 74% more than a 1 year and 3 year cap for 49% more than a 2 year, and 4 year for only 33% more than a 3 year.

If the Fed’s “higher for longer” mantra materializes, markets will readjust rate expectations, increasing the costs of the later years of the cap, and buying a longer cap could make sense today.

For Agency borrowers with substantial monthly replacement cap escrows, buying longer term protection can also potentially help improve cashflow. More on that in our resource Cut Cap Escrows in Half.

Takeaway

While these options are just variations of a vanilla cap, thinking more strategically around what protection is being purchased makes more sense now than ever.

If you're a borrower with bank debt and your bank has the ability to offer swaps and other derivatives, there are many other strategies that can be utilized. For more on that, take a look at part two of our resource here.

Pensford was formed to provide strategic advice around hedging and defeasance for commercial real estate borrowers. Let us help you overturn every stone and think through potential alternatives – we love that stuff. Reach out to pensfordteam@pensford.com or 704-887-9880.